The post Litecoin Price Breakout: Will the Bulls Reclaim $110? appeared first on Coinpedia Fintech News

Litecoin price today made headlines with a stunning 16% surge that lifted it back above $102. This rally didn’t happen in isolation. Privacy-focused coins like Zcash saw an equally impressive run, reflecting a broader spike in demand for anonymity across the crypto markets.

Traders need to note that the action wasn’t just speculative, spot ETF inflows hit $640k for Litecoin. On top of that, the coin made a comeback with key technical averages and snapped out of a months-long bearish channel. The perfect storm of fresh whale accumulation, historic on-chain activity, and wider interest in privacy protocols set the stage for this week’s breakout.

Whales and Volume Surge

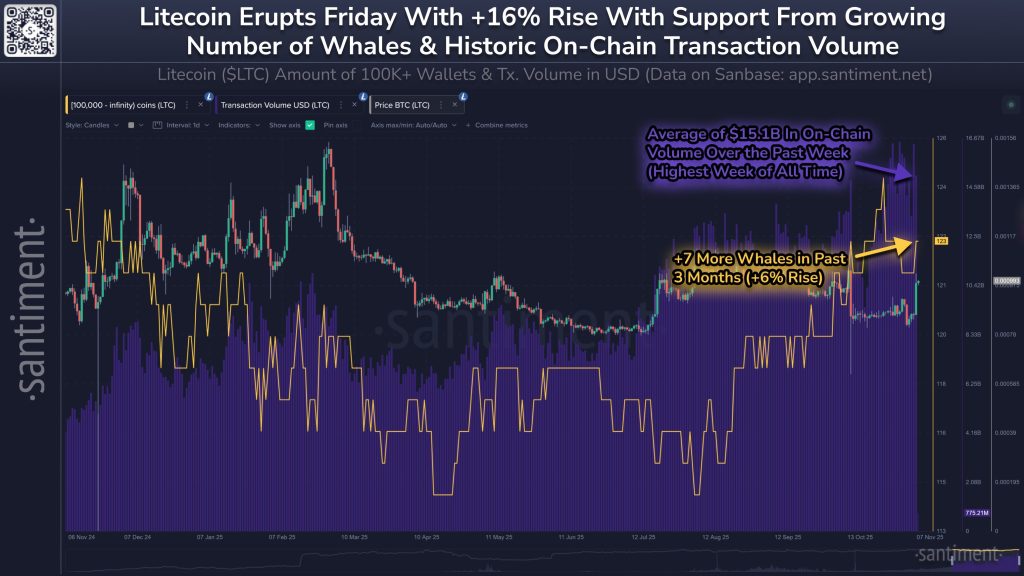

The most compelling evidence supporting Litecoin’s rally comes from whale wallets and on-chain volume. Over the past 3 months, the count of 100k+ LTC holders grew 6%, with 7 new whales joining the ranks. This is a significant jump and often signals coordinated accumulation. Santiment highlights that on-chain transaction volume went through the roof, averaging $15.1B for the week, the highest in Litecoin’s history.

These factors place Litecoin in a class of its own among altcoins for now. With whales appearing to back the upward move and transactional activity at record levels, the technical rally draws solid on-chain support. This trend helps keep the bulls in control and sets up the next round of price discovery.

LTC Price Analysis

Litecoin price is retailing across exchanges, at $101.06, up 12.61% in one day and 5.2% over the week. The market cap zoomed past $7.73 billion, while 24-hour volume nearly tripled to $1.68 billion. LTC crypto price decisively broke above its 30-day SMA at $95.86. This is a level that had previously acted as a ceiling for price action.

Consequently, the RSI is presently neutral, sitting at 66.46, suggesting that the price is not yet oversold nor overbought. The breakout above $100.91, which lines up with the Fibonacci 50% retracement, highlights short-term bullish sentiment. Buyers seem to be in control, with the MACD histogram at +0.39 flagging growing momentum.

That being said, if LTC price closes above $109.09, the next logical target is $119.21, which matches the Fibonacci 23.6% level. Optimistically, that target could be hit within the next week. This is if the bulls defend the $100 mark and the volume keeps rising at the current pace.

However, it’s important not to chase blindly, as failure to hold above $100 could drag LTC back down to $92.74 support. Should volume dry up and whales stop accumulating, the price would likely fade toward $86 before stabilizing. Current conditions favor the bullish case with a risk of sharp profit-taking. But unless price dips under $93.36, the bearish scenario remains relatively modest.

FAQs

Litecoin’s breakout was fueled by higher whale activity, historic on-chain volume, and rising demand for privacy coins, combined with a technical breakout above key averages.

If LTC stays above $100, $109.09 becomes the next target, with $119.21 possible soon. The key downside risk is support at $92.74.

Momentum remains solid, backed by volume and whales. Bulls control the trend above $100, but below $93.36, bearish pressure could quickly grow.