On-chain data suggests Litecoin whales have participated in buying recently despite the fact that the asset’s price has been finding struggle.

Litecoin Whales Accumulated 100,000 LTC Recently

As pointed out by an X user using data from the on-chain analytics firm Santiment, the LTC whales have recently bought while the cryptocurrency’s price has declined.

The indicator of relevance here is the “Supply Distribution,” which tells us about the total amount of Litecoin that the different wallet groups in the market are holding right now.

Addresses or investors are divided into these cohorts based on the number of coins they are carrying in their balance currently. The 1-10 coins group, for instance, includes holders owning at least 1 and at most 10 LTC.

In the context of the current topic, the whale cohort is of interest. These entities may be defined as the addresses holding between 10,000 and 100,000 LTC. At the current exchange rate, the lower bound of the range converts to about $820,000, while the upper one to around $8.2 million.

Clearly, these holdings are quite sizeable, due to which the whales are considered influential beings on the network. As such, their behavior may be something to watch for, since it could end up reflecting on the market in some form.

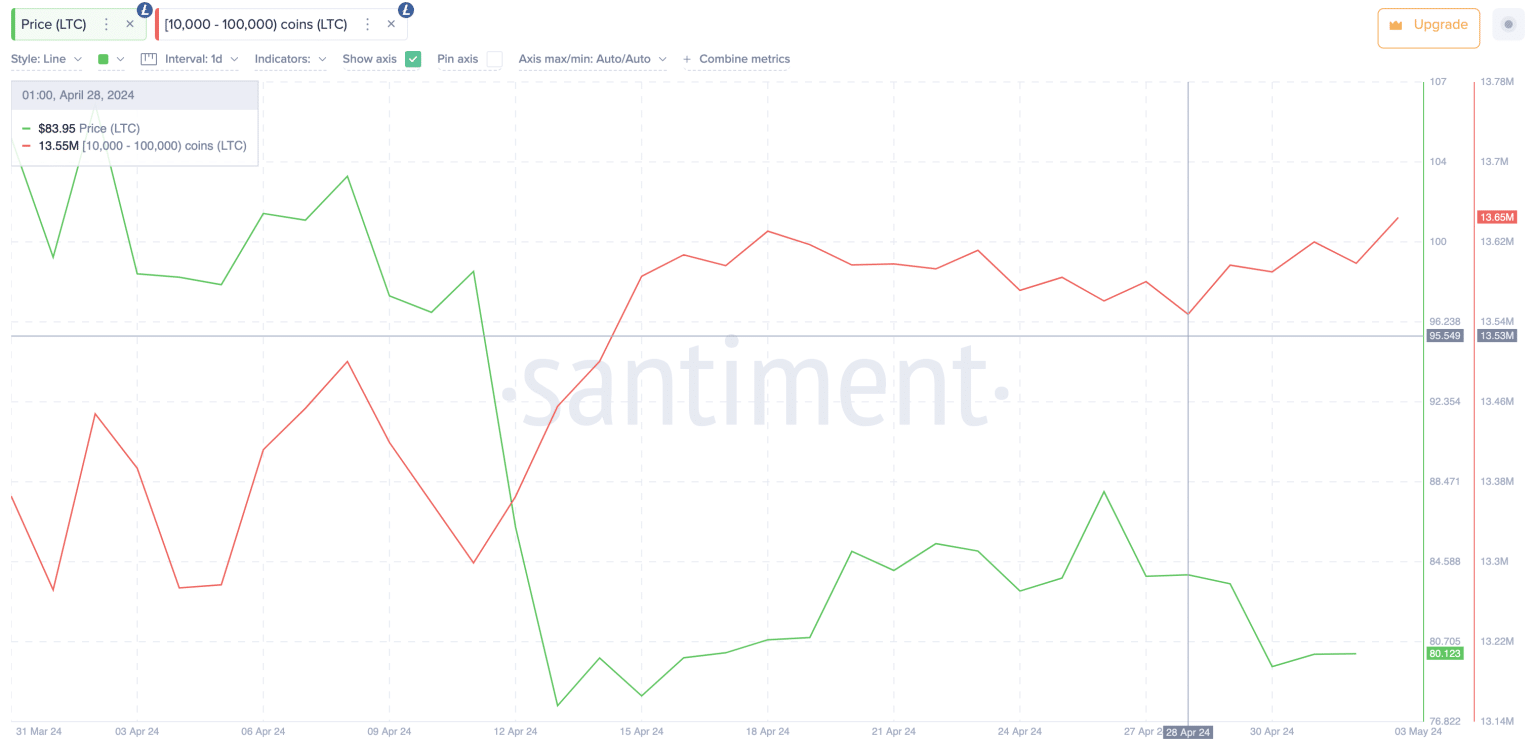

Now, here is a chart that shows the trend in the Supply Distribution of the Litecoin whales over the past month or so:

As is visible in the graph, the Litecoin Supply Distribution for the investors holding between 10,000 and 100,000 LTC has observed an increase recently. More specifically, the metric went up by around 100,000 LTC ($8.2 million) between April 28 and May 4.

This net accumulation spree from the whales seems to have come alongside a decline in the price of the cryptocurrency. A similar trend also occurred last month, where these large investors had participated in significant buying alongside the crash.

Back then, these holders had also first done some selling, potentially paving the way for the price decline in the first place. This time around, though, there wasn’t any notable net distribution from the whales prior to the drawdown.

Interestingly, the whale buying reaction had come at similar sub-$80 prices following both of these drawdowns, so it would appear that these investors believe the cryptocurrency to be a worthy buy at these prices, at least in the long-term.

Naturally, so long as the bullish sentiment among these influential entities remains, Litecoin could be able to see a recovery push. This indicator could be to keep an eye on in the near future, though, as if these investors take to selling instead, then more drawdown could rather follow for the asset.

LTC Price

Litecoin had started a recovery rally in the past day that had taken the coin back above $84, but it would appear that the run has fizzled out as LTC is now back under $82.