On-chain data shows the Litecoin whales have gone on a $230 million buying spree recently, which could bring bullish winds for the coin.

Litecoin Whales Have Been Making Net Inflows To Their Wallets Recently

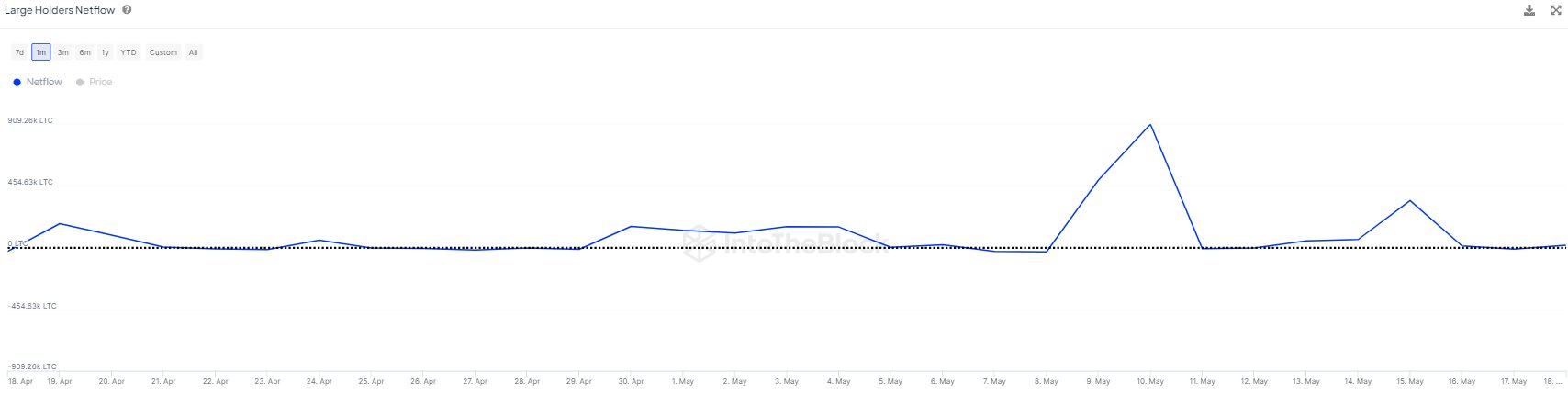

According to data from the market intelligence platform IntoTheBlock, the Litecoin whales have received large net inflows in their addresses over the past month or so.

The on-chain indicator relevant here is the “Large Holders Netflow,” which tracks the net amount of Bitcoin entering into or moving out of the combined wallets of investors owning at least 1% of the cryptocurrency’s circulating supply.

IntoTheBlock defines such “large holders” as the whale entities of the asset. Whales are generally considered to be influential beings on the network, owing to their ability to move large amounts on the network in a short span of time.

When the Large Holders Netflow has a positive value, it means that these humongous investors are receiving a net amount of coins into their balance right now. Naturally, such buying can be bullish for the coin’s price.

On the other hand, the negative indicator implies the whales are potentially participating in selling currently, which could have bearish consequences for the asset.

Now, here is a chart that shows the trend in the Litecoin Large Holders Netflow over the past month:

As displayed in the above graph, the Litecoin Large Holders Netflow has mostly observed positive values inside this window, suggesting that the whales’ wallets have been receiving net deposits.

According to the analytics firm, these large holders have accumulated 2,751,633 LTC in the last 30 days. At the current exchange rate of the asset, this stack is worth a whopping $230 million.

As the chart also shows, the indicator spiked particularly strongly on the 10th of this month. During these net inflows alone, the whales bought 900,000 LTC, the highest daily amount since February, representing around one-third of the total accumulation in the past month.

This buying spree from the large holders has come as the asset’s price has been consolidating around its lows following the mid-April crash. Thus, it would imply the whales believe the recent prices of Litecoin to have been worthy entry points into the coin.

This could certainly be a bullish sign for the cryptocurrency, so it remains to be seen how the asset’s price will develop in the near future. The indicator may be worth monitoring, though, as its value turning negative could instead spell a bearish outcome for the coin.

LTC Price

Litecoin has continued to consolidate inside its range recently as its price is currently trading around $84.