Quick Take

- Since the Global Financial Crisis (GFC) in 2008, a zero-interest rate policy along with quantitative easing has been the norm for the past 15 years.

- This policy has contributed to asset inflation, which is anticipated to reverse. The extent of this reversal, however, remains uncertain.

- Both the equities and real estate sectors flourish in an environment of inexpensive credit. Yet, with treasury yields at the start of the yield curve now surpassing 5%, the incentives have shifted.

- Dylan LeClair, an analyst at Bitcoin Magazine, has circulated a chart demonstrating that the current yield of the U.S. three-month treasury rate is roughly equal to that of the S&P index yield and U.S. corporate bonds (below).

- As treasury yields are globally recognized as the “risk-free” rate, the appeal of holding other assets is diminishing, especially when they all return approximately 5%.

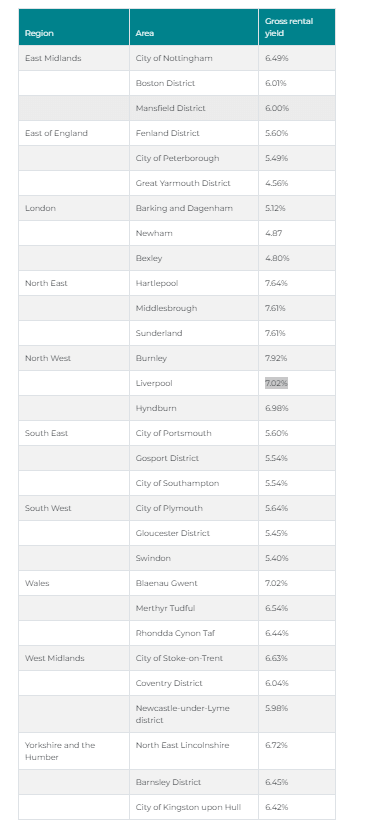

Moreover, the average rental yield in the U.K. for real estate ranges from 5-7%. This not only falls below the Consumer Price Index (CPI) inflation rate, but it’s also less appealing as gilt yields begin to climb above 5%, rendering them a potentially more attractive investment option.

The post Major repricing event underway in TradFi markets appeared first on CryptoSlate.