According to statistics, 4,498 blocks have been mined in the last 30 days, creating 28,112 new bitcoins over the past month. Bitcoin’s network hashrate has been around 341 exahash per second (EH/s) during the last 2,016 blocks or the last two weeks. This month, the mining pools Foundry USA and Antpool dominated the pack, accounting for 52.87% of the global hashrate in March.

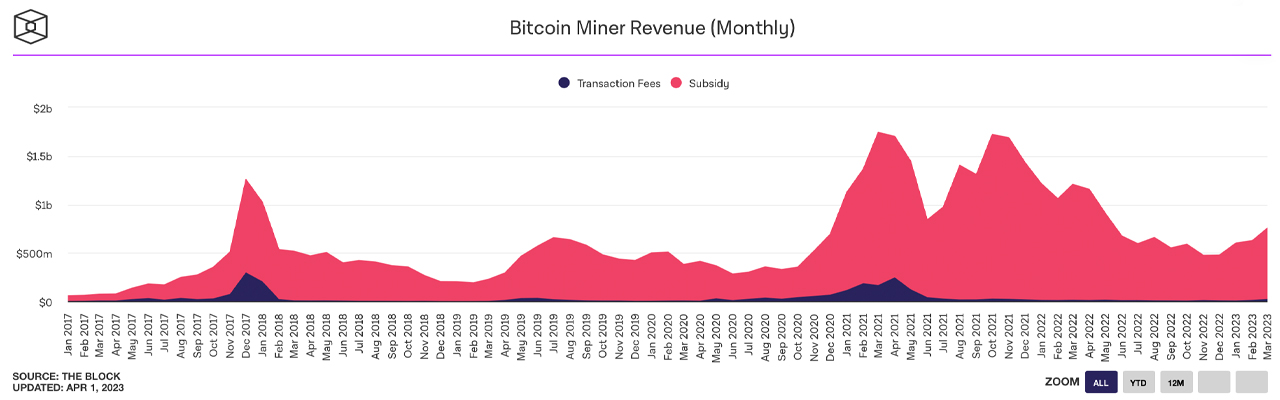

Bitcoin Mining Revenue Has Increased Month Over Month Since December

Bitcoin miners had a decent month in March with revenues not seen since before June 2022. During the last 30 days, 4,498 blocks were discovered, and bitcoin miners obtained $734.78 million in revenue.

Of that value, 28,112 freshly minted bitcoins were issued, accounting for $712.12 million. March statistics further show that bitcoin miners made approximately $22.66 million from transaction fees.

March’s total bitcoin mining revenue of $734 million also outpaced February’s $627 million, January’s $601 million, and December’s $477 million. Out of the 4,498 blocks, the largest mining pool by network hashrate, Foundry USA, discovered 1,468 blocks or 9,175 new bitcoins.

Foundry’s percentage of the hashrate in March was around 32.64%, and at press time, the pool has 105 EH/s of hashpower. Antpool found 910 blocks in March, which produced 5,687.50 BTC.

Foundry and Antpool are followed by F2Pool, Binance Pool, Viabtc, BTC.com, Luxor, and Braiins Pool. Last week, Bitcoin’s hashrate reached the 400 EH/s range, and on March 25, 2023, it hit an all-time high of 414.34 EH/s.

With the hashrate so high and block intervals below the ten-minute average, the next difficulty change is expected to occur on April 6, 2023. At present, the difficulty change estimates are roughly between 1.20% to 1.38% higher than the current difficulty of 46.84 trillion.

Three years ago, Bitcoin’s hashrate surpassed the 100 EH/s range, and today it is 240% higher than that period. At that time in April 2020, the total revenue obtained by Bitcoin miners was $412.42 million, with transaction fees accounting for $6.07 million of the aggregate.

What do you think the future holds for Bitcoin mining, given the current trend in revenue and hashrate? Share your thoughts about this subject in the comments section below.