Despite Bitcoin’s price staying below the critical $30,000 mark, recent spikes in a key market metric, the Spent Output Profit Ratio (SOPR), suggest the market is in a profit-taking regime.

BTC has been flatlining around $29,200, unable to regain the $30,000 level it lost on July 23. While the market anticipates further sideways movements before breaking through the $30,000 resistance, a key on-chain metric suggests some market participants have already begun raking in profits.

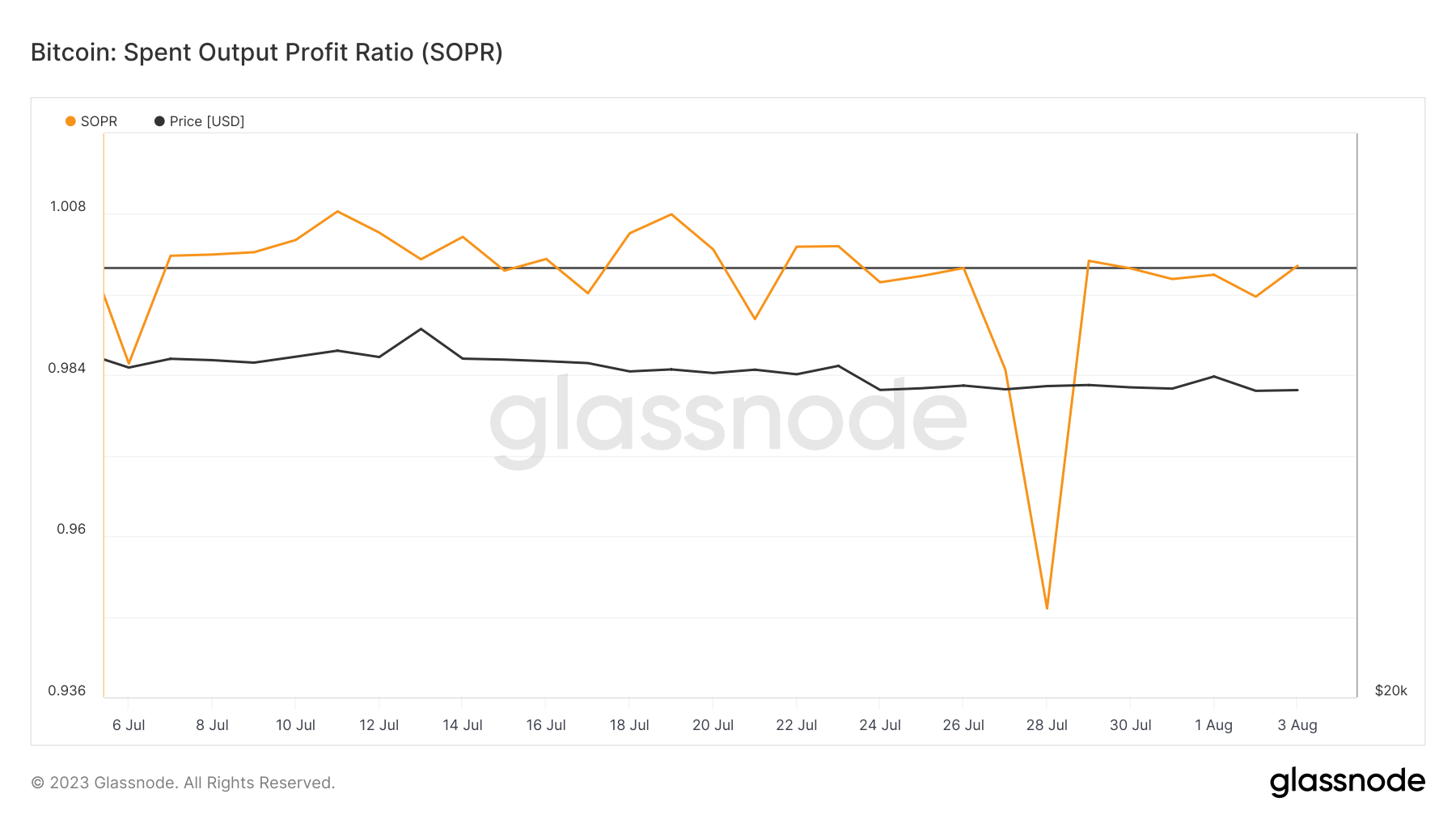

The Spent Output Profit Ratio (SOPR), a key metric in market analysis, calculates the profit ratio of coins moved on-chain, measured by the price sold divided by the price paid. This metric has shown a significant increase in August. A SOPR score of 1 indicates break-even, above 1 signifies profit, and below 1 denotes a loss.

On August 3, the SOPR surged above 1, signaling that the market had started realizing profits. This surge followed a near-vertical drop to 0.94 on July 28, after a volatile month. This is the first time in August that the SOPR has crossed the 1 mark, indicating a shift in market sentiment.

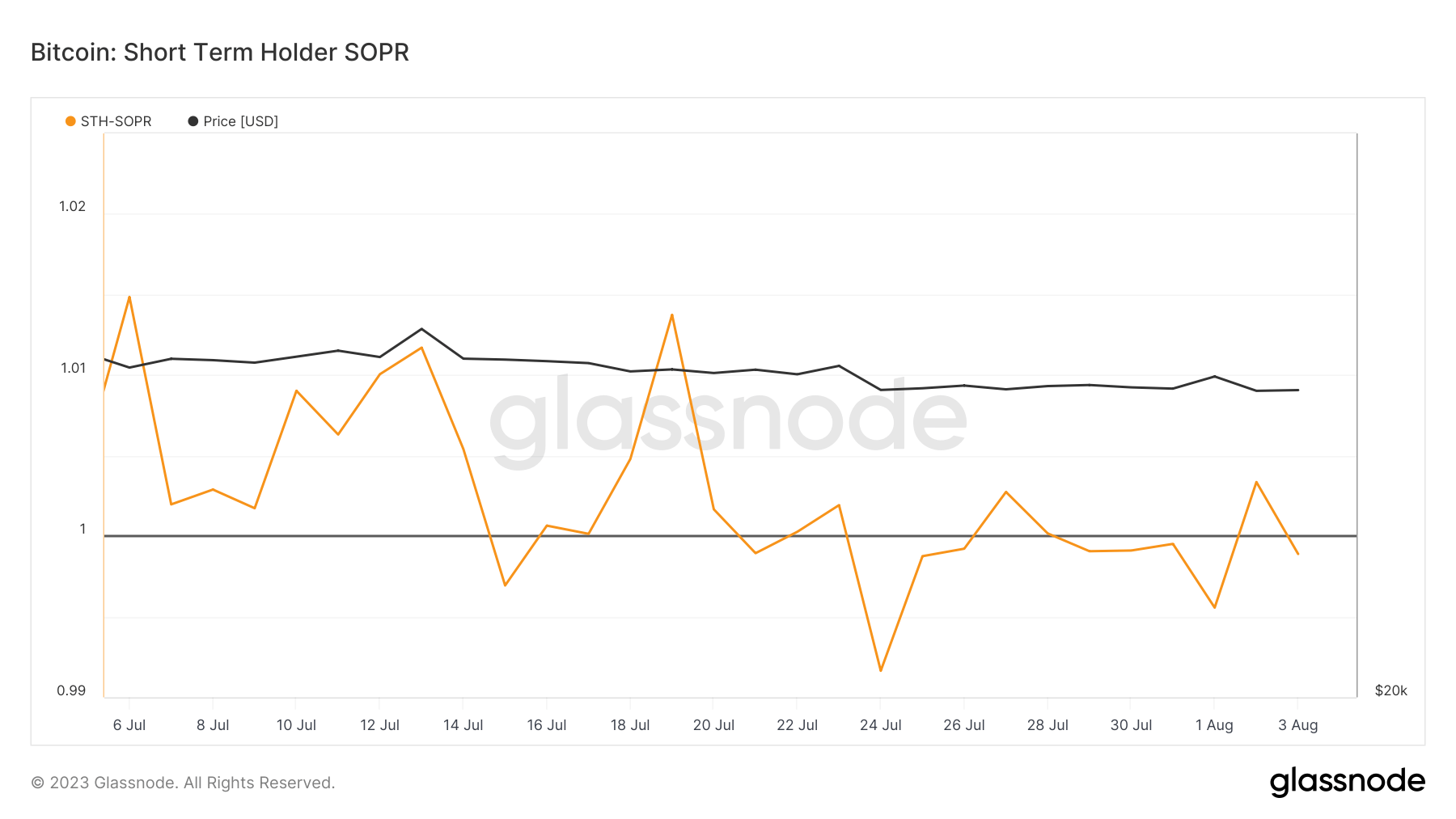

A closer examination of different market cohorts reveals who drives this profit realization. The SOPR for short-term holders (STHs) dropped below 1 on August 4, following a brief spike at the beginning of the month. This suggests that short-term holders are selling at a loss.

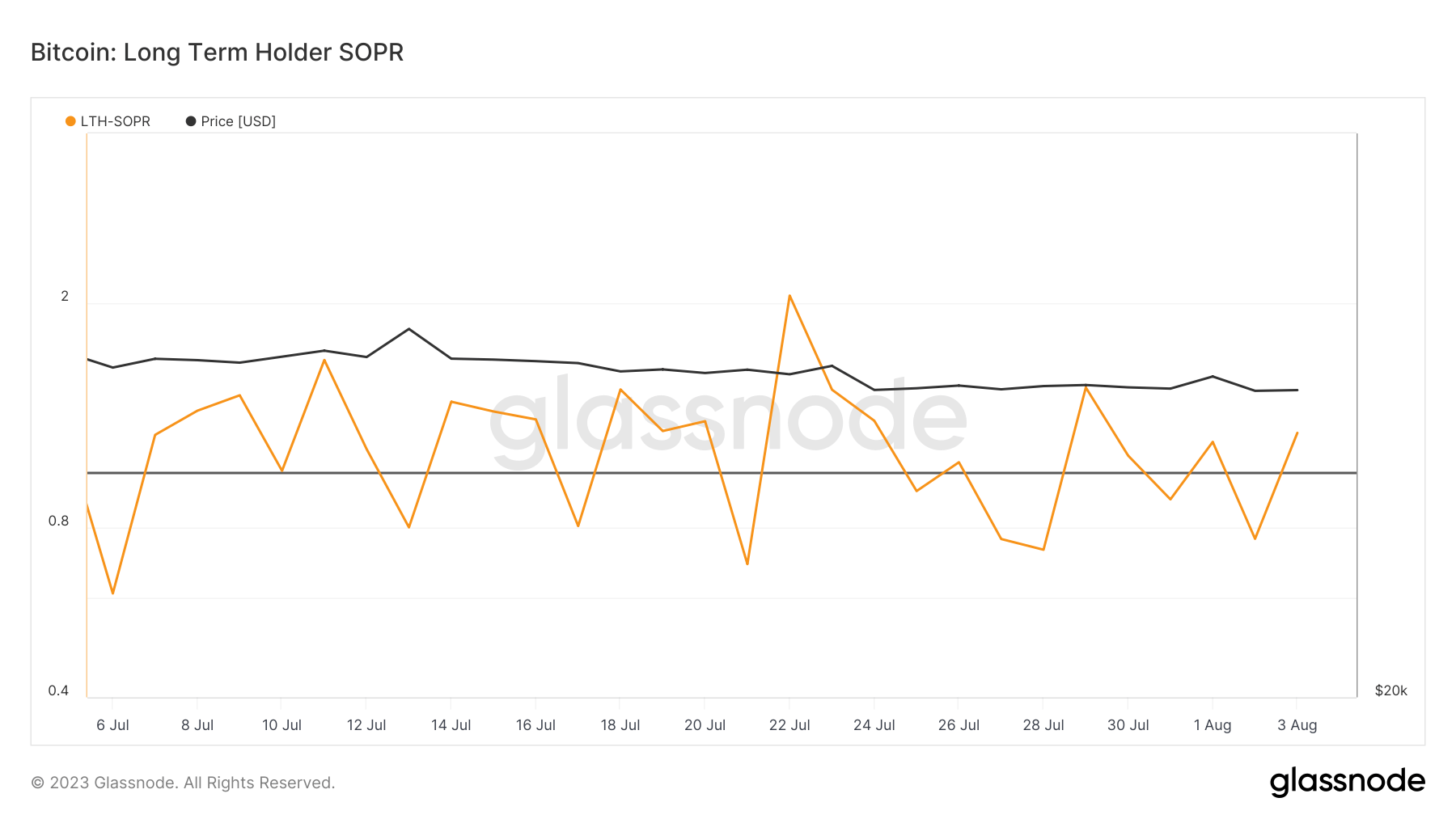

In contrast, long-term holders (LTH) saw their SOPR jump to 1.17. Over the past 30 days, the LTH SOPR has spent 20 days above 1, indicating that this cohort is selling at a profit.

These contrasting behaviors between short-term (who are selling at a loss) and long-term holders (who are capitalizing on their profits) suggest a market in the throes of redistribution. While short-term holders capitulate, long-term holders capitalize on their profits. This dynamic could potentially lead to a consolidation of Bitcoin holdings among long-term investors, setting the stage for the next price rally.

As Bitcoin continues to trade below $30,000, these key on-chain metrics, particularly the SOPR’s movements, will likely be the market’s focus. The SOPR movements will provide valuable insights into the market’s profit-taking behavior and its potential impact on Bitcoin’s price trajectory.

The post Market back in profit-taking mode despite flat Bitcoin shows key metric appeared first on CryptoSlate.