Onchain Highlights

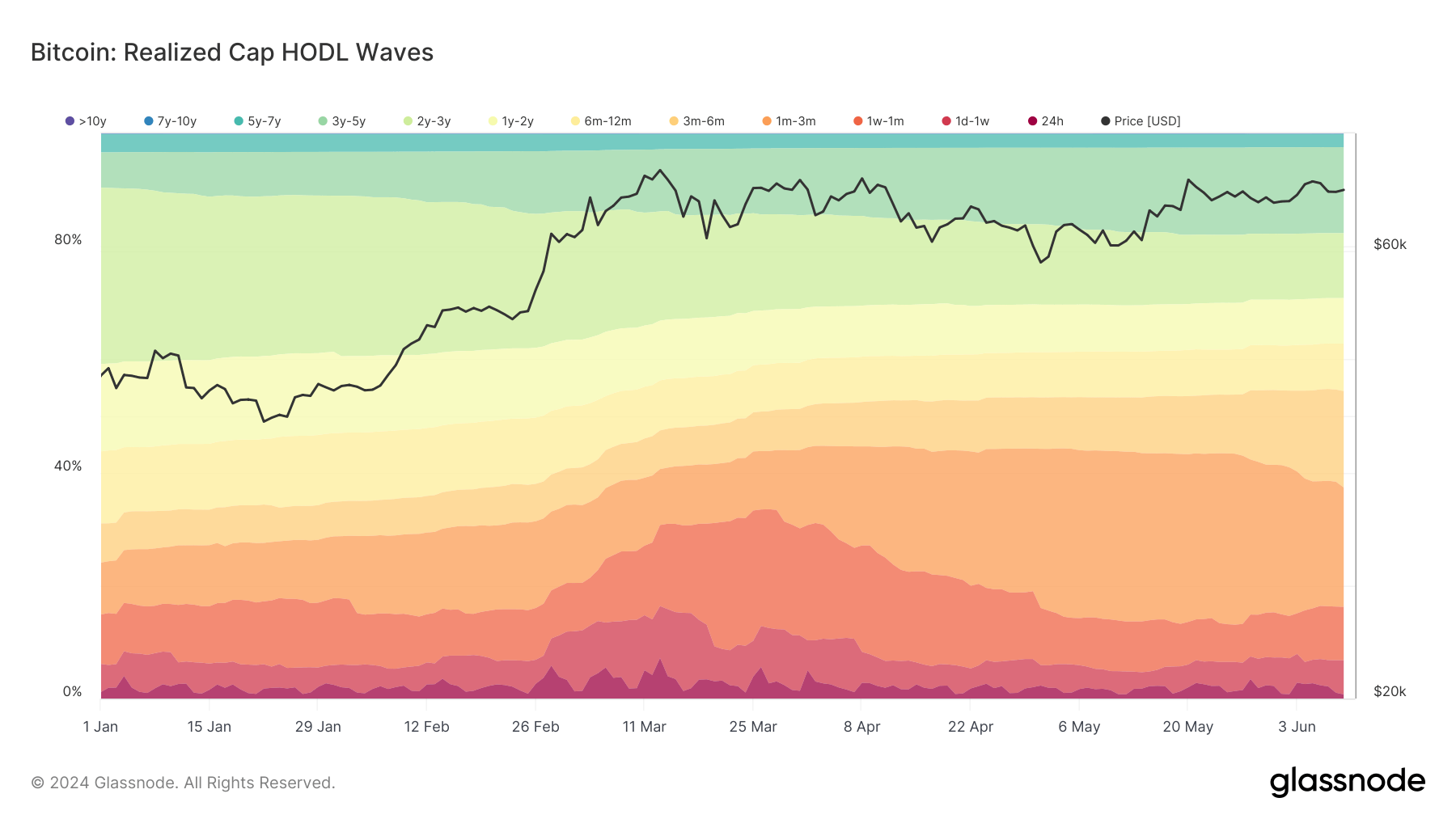

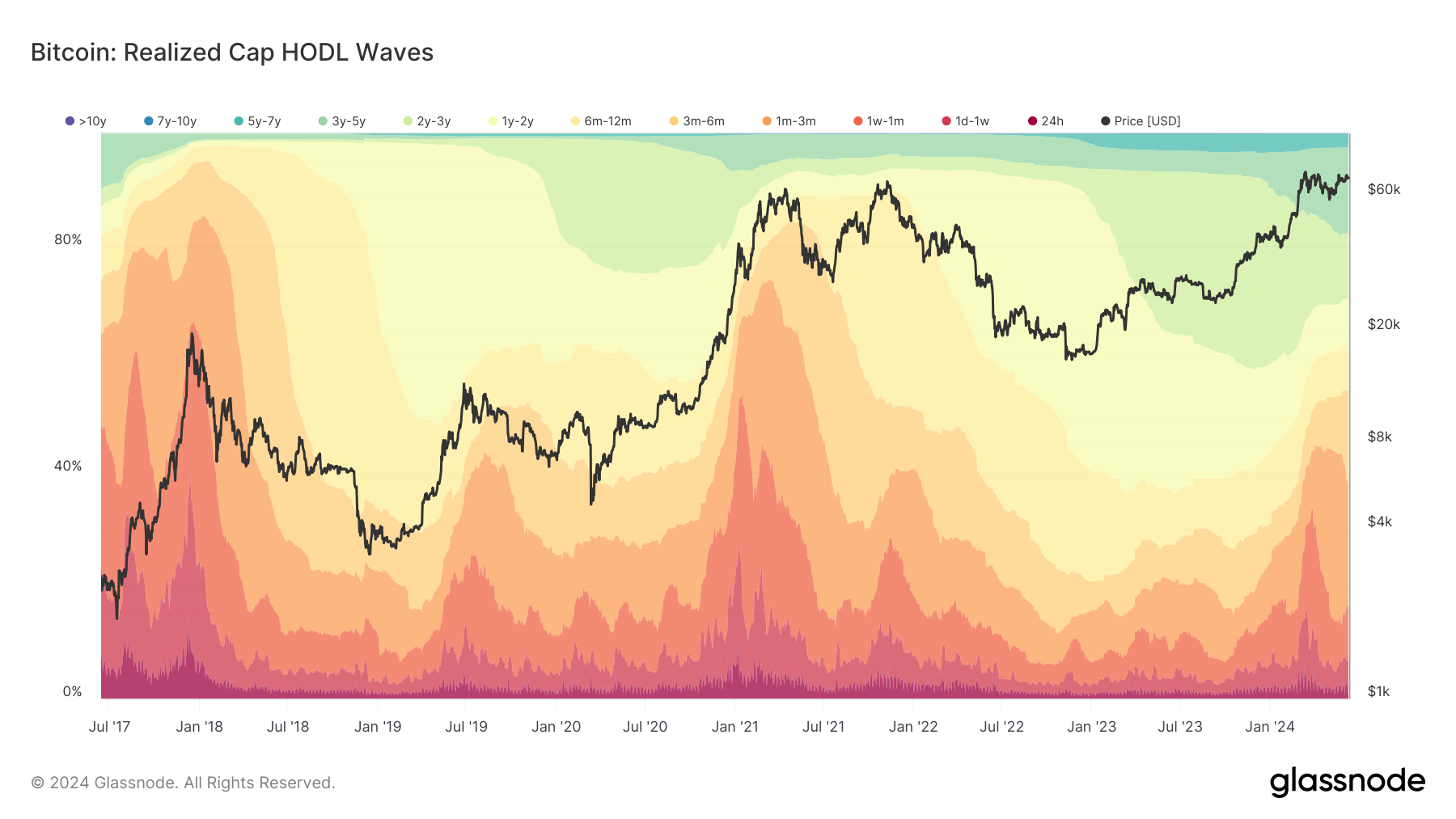

DEFINITION: Bitcoin realized cap HODL waves are a bundle of all active supply age bands, aka HODL waves. Each colored band shows the percentage of Bitcoin in existence that was last moved within the period denoted in the legend.

Bitcoin’s realized cap has moved significantly throughout 2024, reflecting market conditions and investor behavior shifts. The year’s first half showed notable trends in long-term and short-term holder activities.

The realized cap HODL waves data indicates an increase in the proportion of Bitcoin held for extended periods (3 – 5 years), signaling increased confidence among long-term investors. Bitcoin’s realized cap approached $600 billion, showcasing rising investor confidence post-halving, which historically triggers bullish market sentiments.

Additionally, Bitcoin’s realized price surpassed $30,000, driven by heightened market activity and significant short-term holder accumulation. This trend suggests that more recent investors are willing to enter the market at higher price points, contributing to the overall price appreciation.

Short-term holder activity, in particular, has shown a rejuvenation in market forces. The proportion of Bitcoin held for less than 155 days has risen, typically indicating increasing market engagement and potential new investment cycles. Such movements historically correlate with renewed market optimism and speculative investment strategies.

Overall, the first half of 2024 highlights a complex interplay of long-term confidence and short-term speculative behavior, reflecting broader market sentiment and economic conditions. Short-term holder spikes have been seen at the peak of each bull market throughout Bitcoin’s history. The current surge to a new all-time high saw a spike in short-term holders, but it has not yet reached the highs of 2017 or 2021. These insights underline the importance of monitoring HODL wave patterns to gauge market trends and investor behavior in the evolving Bitcoin landscape.

The post Market dynamics show complex interplay between long-term stability and short-term speculation appeared first on CryptoSlate.