Quick Take

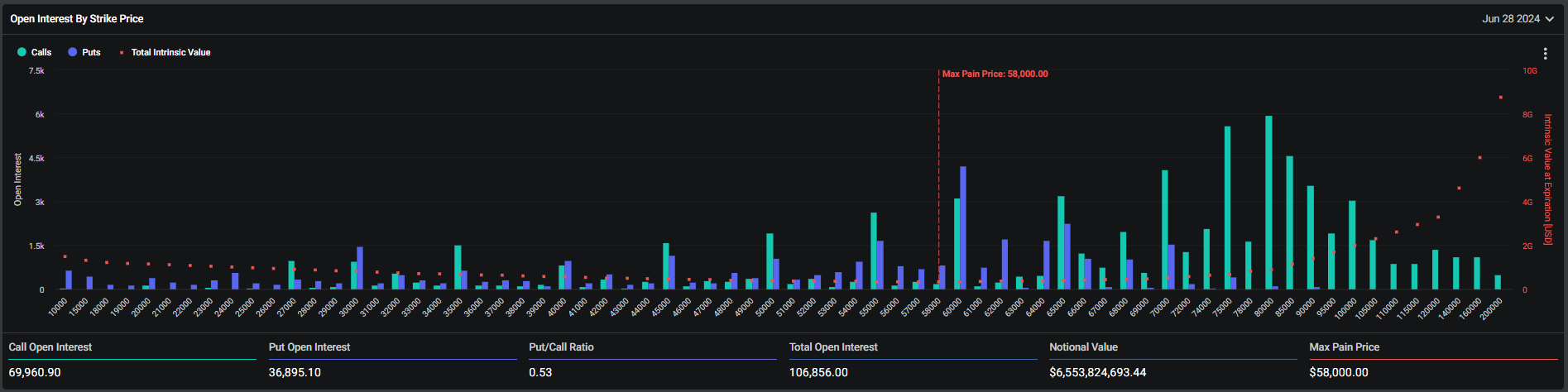

As June draws to close, significant expiration in Bitcoin (BTC) and Ethereum (ETH) options loom, potentially impacting market conditions. On June 28, BTC options worth $6.6 billion will expire. Deribit data reveals a put/call ratio of 0.53, indicating a bullish sentiment, with total open interest roughly around 107,000 BTC—70,000 in calls and 37,000 in puts. Despite this, BTC’s price has been declining, dropping 10% over the past month to as low as $60,500, edging towards the max pain price of $58,000.

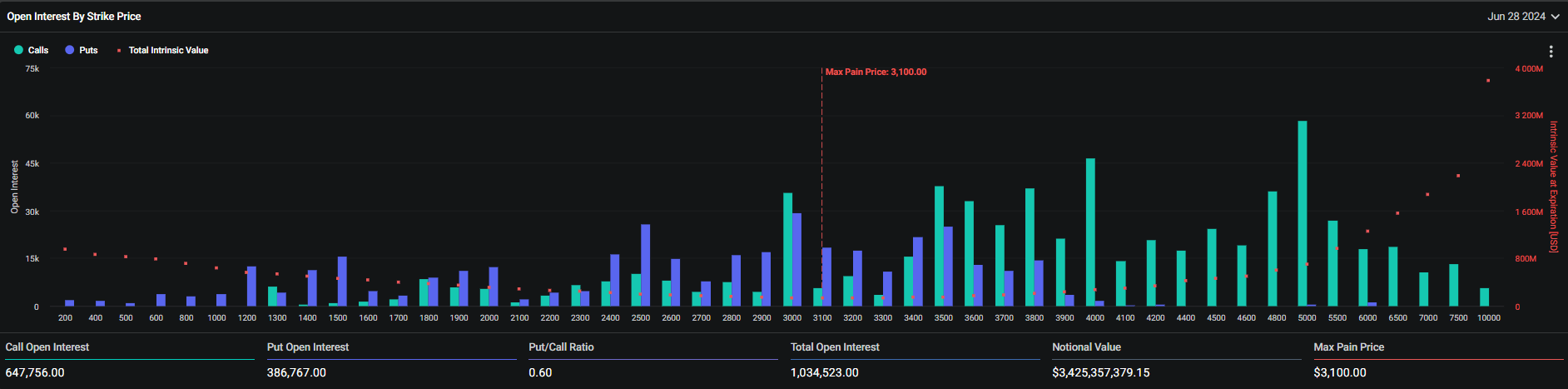

ETH options are also set for expiry, with $3.4 billion in notional value. The max pain price for ETH stands at $3,100, while the current price is $3,300, after a 13% decrease over 30 days. The total open interest for ETH options exceeds 1 million ETH, with calls dominating at roughly 648,000 ETH, according to Deribit data.

The max pain price, the level at which the most options lose value, is crucial in these expirations. As the expiry date approaches, market movements can gravitate towards these levels. Investors are keenly observing whether BTC and ETH prices will align with their respective max pain prices, potentially indicating significant shifts in market sentiment and positioning.

The post Market eyes max pain prices as $6.6 billion BTC and $3.4 billion ETH options expiry nears appeared first on CryptoSlate.