According to market watcher Sir Chartist, Strategy’s stock (MSTR) may be headed for a sharp drop before it bounces back. He thinks shares could slide as low as $350. Then, once selling dries up, a fresh push might carry the price back to $700. It’s a two-step move he believes will play out soon.

Prime Setup Signals Breakdown

Sir Chartist points out that MSTR has slipped below its 9-day exponential moving average and its 20-day simple moving average. Those lines are now converging in a bear-leaning pattern. When that happens, short-term momentum often fades fast. He notes that April’s trend—where green candles kept driving the stock higher—has given way to heavier selling.

Let’s break down this chart on $MSTR.

At the end of this thread I will give my opinion on it as of TODAY!

As traders and chartist, knowing and STUDYING charts is KEY to success.

Lets have a look

THREAD

pic.twitter.com/gqxG9yRx2d

— SIR CHARTIST (@ChartBreakouts) May 24, 2025

Volume Trends Could Mark A Bottom

He’s watching for a panic-driven drop toward $350. Volume spikes on red days mean sellers are in control. But a sharp fall followed by lower selling volume and bigger green bars could signal the end of the decline. Based on reports, he’ll only flip bullish once buying volume clearly outpaces the selling.

Equity Raise And Bitcoin Buying Plans

Strategy (formerly MicroStrategy) plans to raise $2.1 billion through a stock sale. That money will go straight into more Bitcoin. On one hand, more BTC could lift the share price later on. On the other, fresh shares hitting the market might weigh on MSTR while the deal is underway. Sir Chartist says this dilution effect is part of why he expects the initial slide.

Past Patterns Hint At Rally

He reminds investors of the breakout from an earlier sideways channel. That move delivered a little over 100% gain with barely any pullback. Based on that pattern, he argues a repeat rally is likely once the stock stages its next low. His view: history doesn’t repeat exactly, but it often rhymes.

Cautionary Views Add Weight

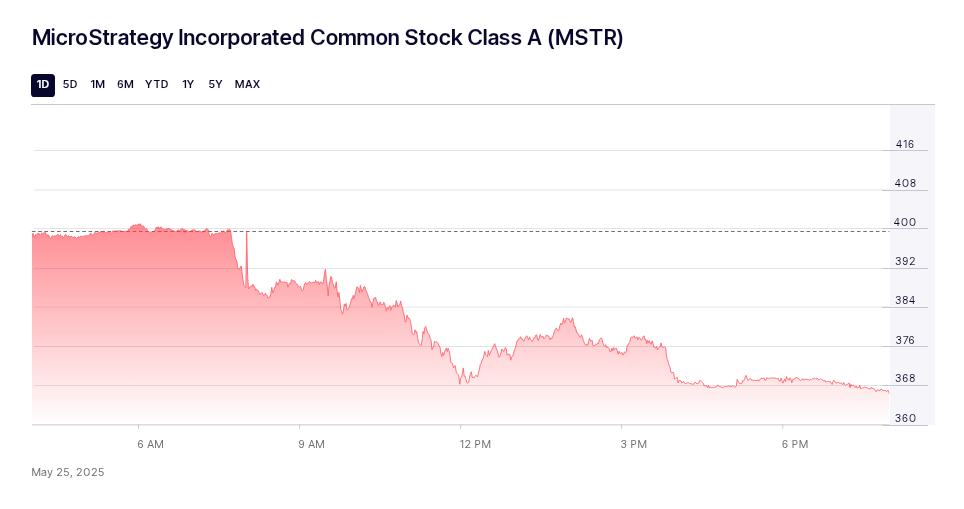

Crypto analyst Ali Martinez has also chimed in. He saw a TD Sequential sell signal on MSTR’s weekly chart, which often flags a pending drop. And Strategy’s recent Bitcoin buy—7,390 BTC for roughly $765 million—lifted the stock above $400 earlier this week. Yet even that big purchase wasn’t enough to stop the bearish signals on the charts.

In short, Sir Chartist is calling for a quick shakeout toward $350 before a bigger rally. He’s leaning on moving averages, volume shifts, past breakouts and Bitcoin’s pull.

Featured image from Livewire Markets, chart from TradingView