Quick Take

On May 23, Bitcoin experienced a slight decline, dropping to a low of approximately $66,300. This dip was triggered by the S&P US Composite PMI Flash exceeding consensus expectations, pushing anticipated rate cuts further away. Consequently, short-term holders—those who have held the digital asset for less than 155 days and are particularly sensitive to market volatility—reacted strongly.

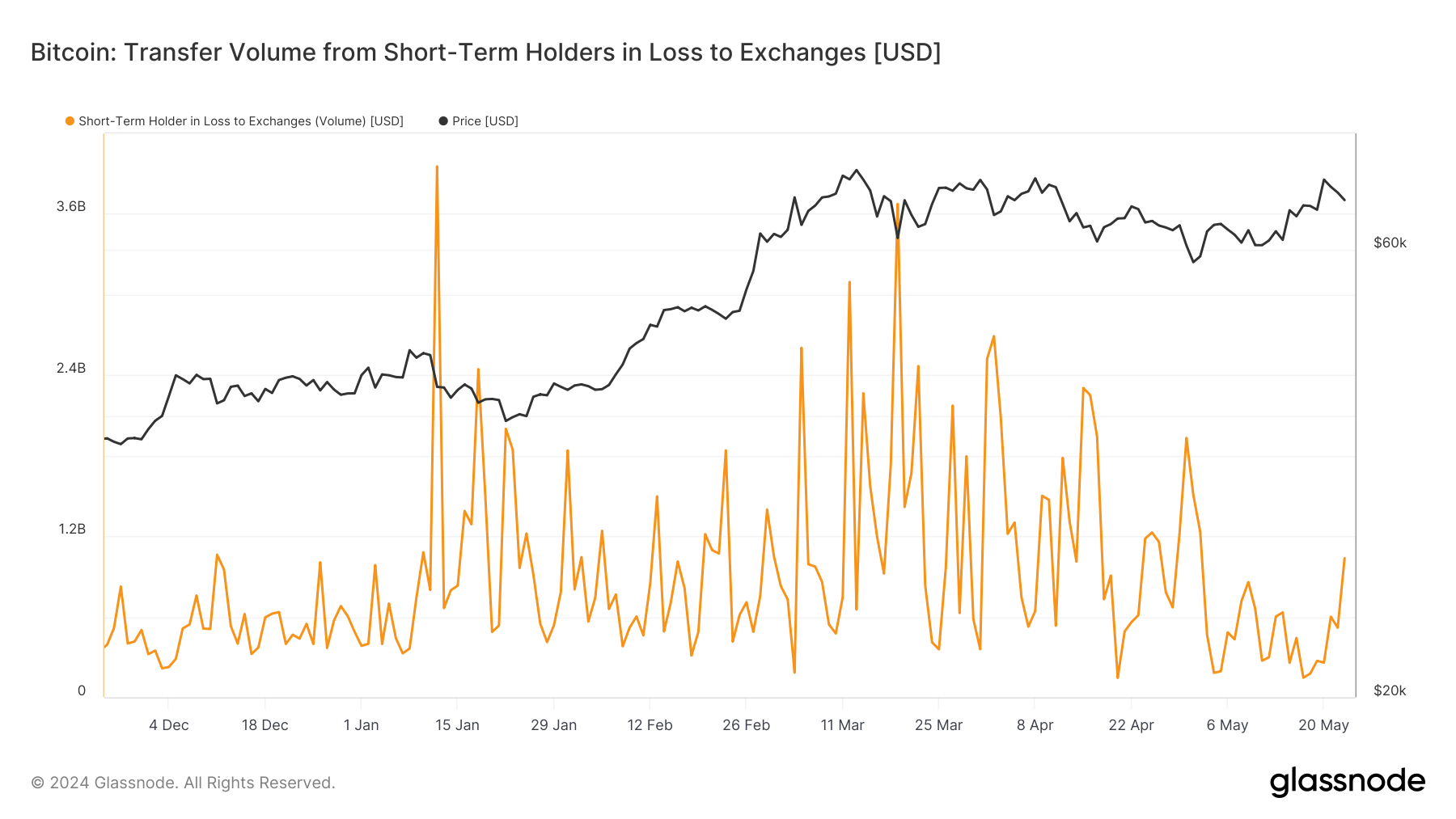

Data from Glassnode reveals that this cohort sent over $1 billion worth of Bitcoin, or around 15,000 BTC, to exchanges at a loss, the highest since May 2. Despite this significant event, it is encouraging to note a pattern of decreasing sell pressure with each subsequent sell-off, indicating that these holders are becoming more accustomed to Bitcoin’s inherent volatility.

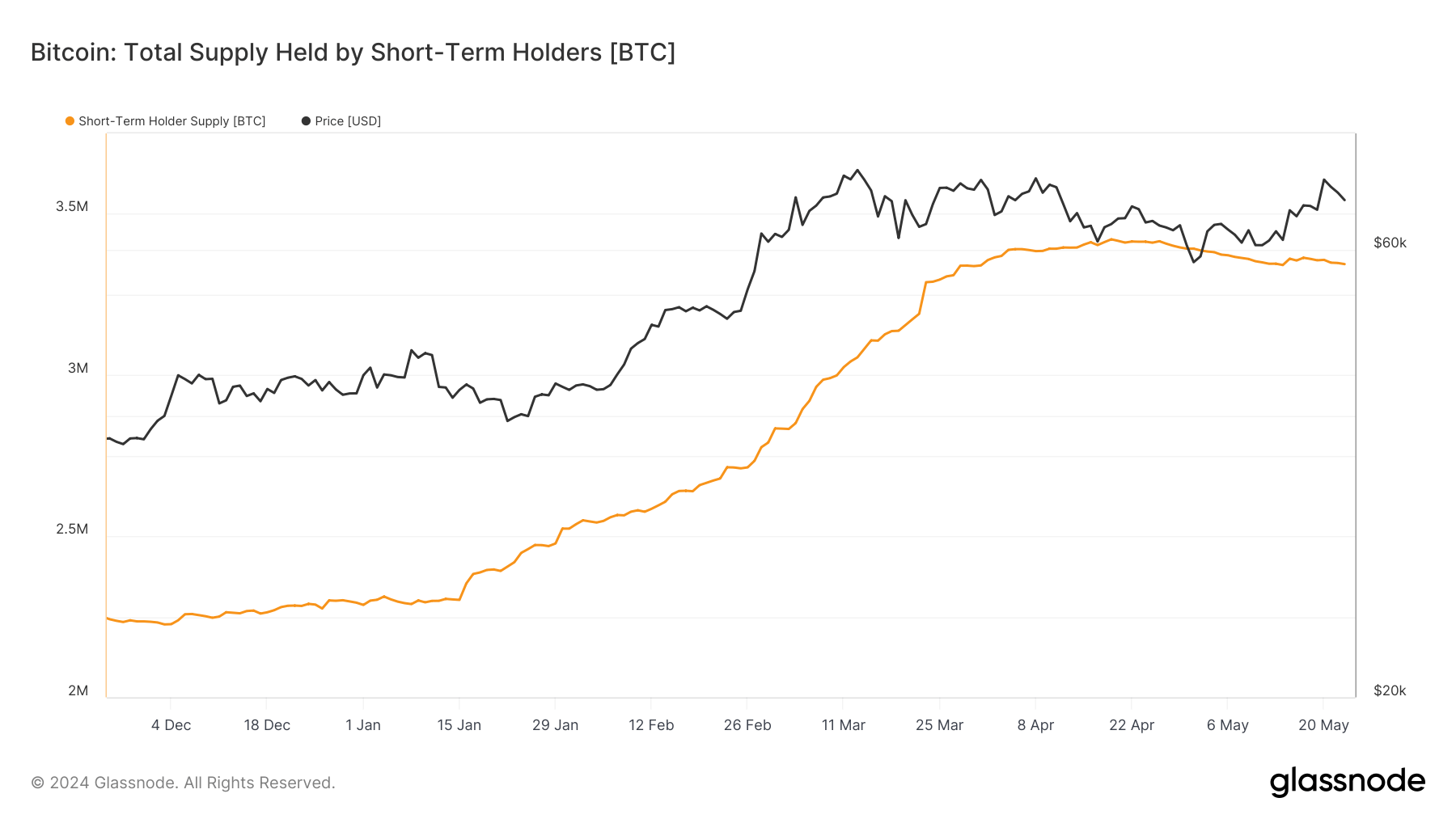

Data from Glassnode shows that the supply of Bitcoin held by short-term holders has seen a slight decline since its peak in April, dropping from 3.4 million BTC to 3.3 million BTC. This shift suggests a growing maturity among short-term investors, as they’ve held through a correction exceeding 20%. In earlier stages of the cycle, this cohort would likely have exhibited a more substantial decline.

The post Market volatility triggers $1 billion worth of Bitcoin sent to exchanges at a loss by short-term holders appeared first on CryptoSlate.