Maxine Waters has sent a probing letter to Meta, querying the tech giant’s recent spate of trademark applications related to digital assets and blockchain technology.

Maxine Waters Suspects Meta’s Renewed Interest in Digital Assets Through Trademark Filings

Maxine Waters, the ranking Democrat of the House Financial Services Committee, has raised concerns over Meta’s recent trademark applications which suggest the tech giant’s potential re-entry into the digital asset space. Waters sent a detailed letter to Meta’s CEO Mark Zuckerberg and COO Javier Olivan, questioning the company’s intentions regarding digital assets and blockchain technology.

In her letter, Waters pointed out five trademark applications filed by Meta over the past year. These applications cover a range of services, including an online social networking and dating service facilitating digital currency exchange, development of blockchain-related computer hardware and software, and cryptocurrency trading services. This move comes despite previous statements from Meta staff indicating no ongoing digital asset projects at the company.

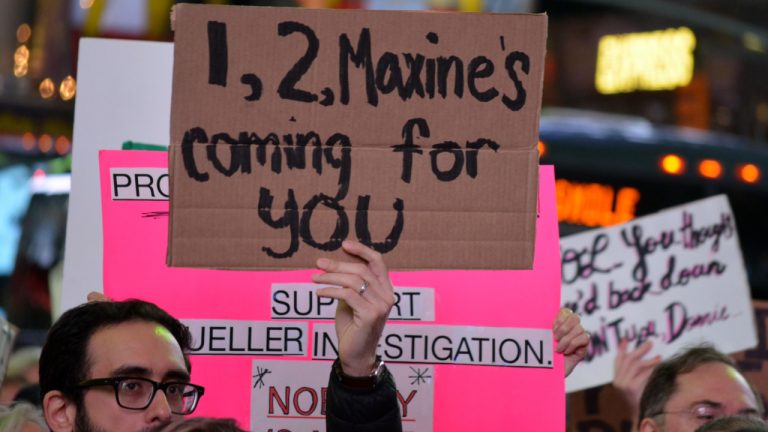

Waters, a vocal critic of Meta’s crypto ventures, particularly the Libra (later Diem) stablecoin project, expressed her concerns about the company potentially delving back into digital asset plans. She highlighted the incongruity between Meta’s trademark filings and their public disavowal of current digital asset ventures.

In 2019, Meta faced significant regulatory and legislative scrutiny over its plans to launch the Libra cryptocurrency and the Calibra digital wallet. Waters, along with other lawmakers, had requested a moratorium on these projects due to privacy and national security concerns. Despite these challenges and the eventual shutdown of the Diem project, Waters’ letter suggests that Meta’s interest in digital assets persists.

The congresswoman’s letter also seeks clarity on whether Meta intends to launch a cryptocurrency payments platform and its plans for the recently filed trademark applications. She emphasized the need for transparency, especially given the company’s troubled past with digital currencies.

As of now, Meta has not publicly responded to the letter.

Is Meta pursuing several potential digital asset related business opportunities? Share your thoughts and opinions about this subject in the comments section below.