Quick Take

Metaplanet Inc. finalized its acquisition of 97.85 Bitcoins, amounting to a total purchase price of 1 billion Japanese yen. The investment and consulting company, listed on the Tokyo Stock Exchange, announced its purchase in a post on X on April 24.

Metaplanet Inc. first announced its plans to purchase Bitcoin on April 8. The Japanese company revealed that the acquisition will total 1 billion Japanese yen, equivalent to approximately $6.25 million. This move garnered significant attention as it would make it the first publicly traded company on the Tokyo Stock Exchange to purchase BTC.

In a post on X on April 8, MetaPlanet expressed enthusiasm about its new financial strategy, stating,

“Today, we’re thrilled to announce a groundbreaking shift in our financial strategy, as we embrace Bitcoin as the core treasury asset of the Company going forward by committing an initial JPY 1 billion. This strategic pivot is not just about embracing digital assets but also about pioneering a future where finance meets innovation at its core.”

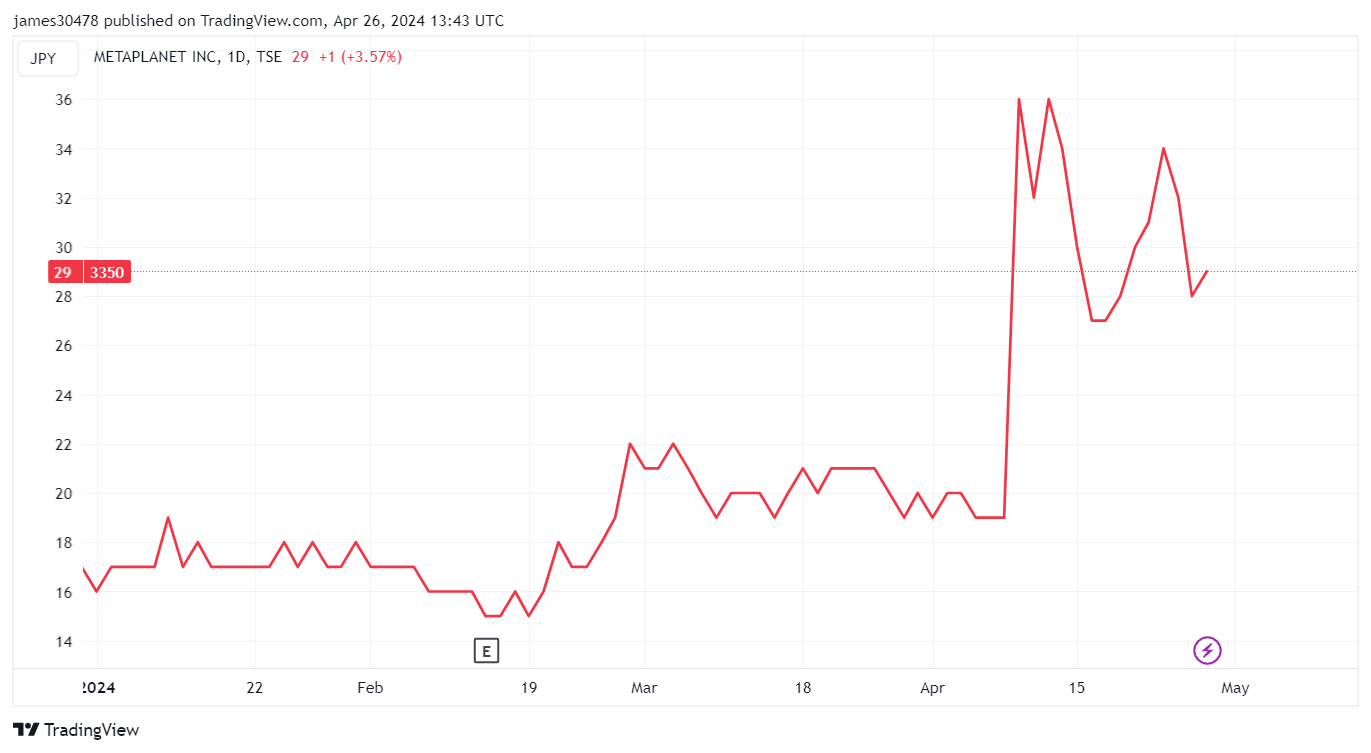

Since the beginning of the year, Metaplanet Inc.’s share price has increased by 81%. Following the April 8 announcement, the company’s stock surged from 19 yen to 36 yen before settling around 29 yen as of April 26.

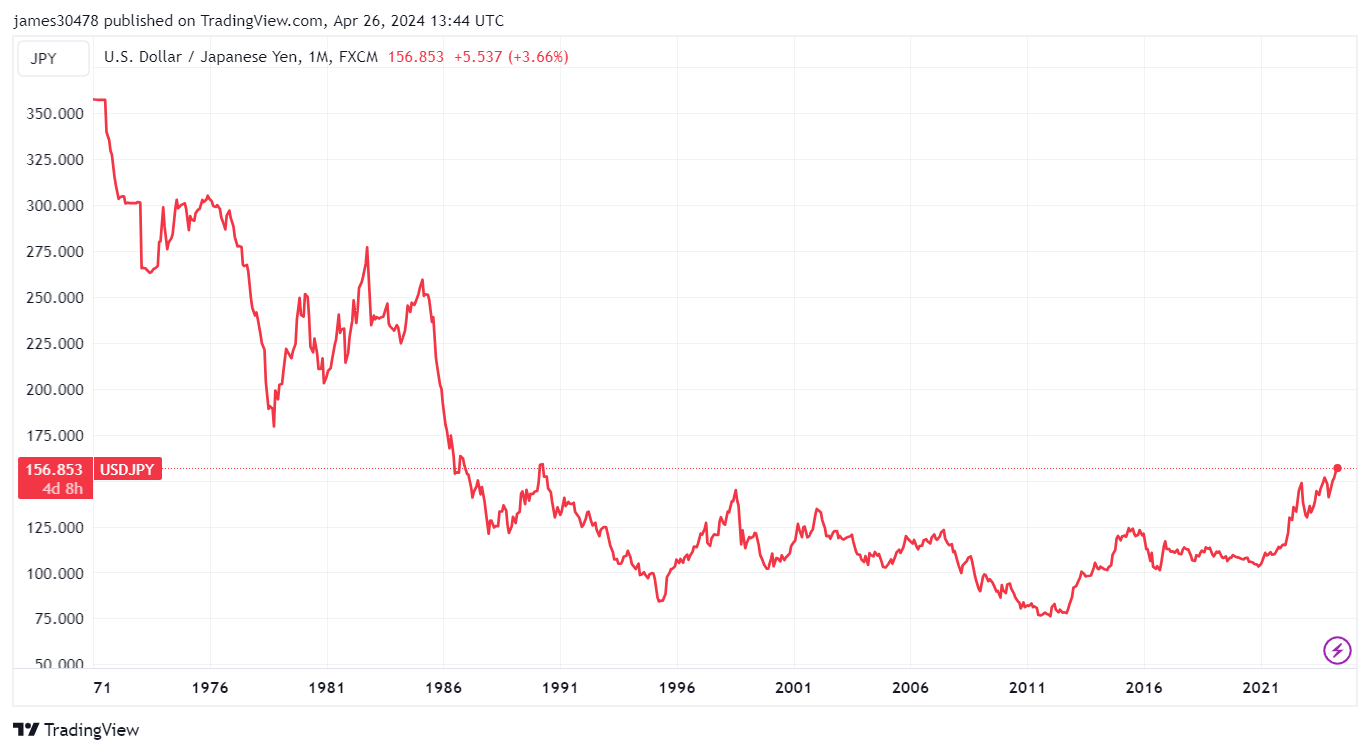

Meanwhile, Japan is grappling with economic challenges, particularly in terms of its currency. The Japanese yen’s value against the dollar is nearing 157, a level not seen since 1990.

The post Metaplanet Inc. purchases 1 billion yen worth of Bitcoin appeared first on CryptoSlate.