The post Michael Saylor’s Bitcoin Strategy: Following Satoshi’s Footsteps with $16B Holdings appeared first on Coinpedia Fintech News

While responding to a New Zealand-based media outlet about his personal motivation, MicroStrategy Co-Founder Michael Saylor revealed his intention to follow the footsteps of Bitcoin creator Satoshi Nakamoto. His plan to leave his wealth to humanity has left many crypto en“`thusiasts stunned. Saylor, in the interview, expressed confidence in the future prospects of Bitcoin, comparing it to steel and electricity, and emphasizing its immortal nature. Read on!

Michael Saylor’s Vision: Wealth for Humanity

Saylor asserted that he would leave his wealth for humanity. He primarily presented an emotional justification for his decision, emphasizing that he has no children. However, when he highlighted the case of Satoshi Nakamoto, it became evident what actually was his original inspiration to turn towards philanthropy. It seem`s that like most crypto leaders Saylor is also an ardent follower of Nakamoto – a noble figure in the crypto world whose real identity is still ‘unknown’.

MicroStrategy Bitcoin Holdings: An Overview

MicroStrategy, Marathon Digital Holdings, Riot Platform, Tesla, Hut 8 Corp, Coinbase Global, and Block are the top seven public companies in terms of Bitcoin holdings.

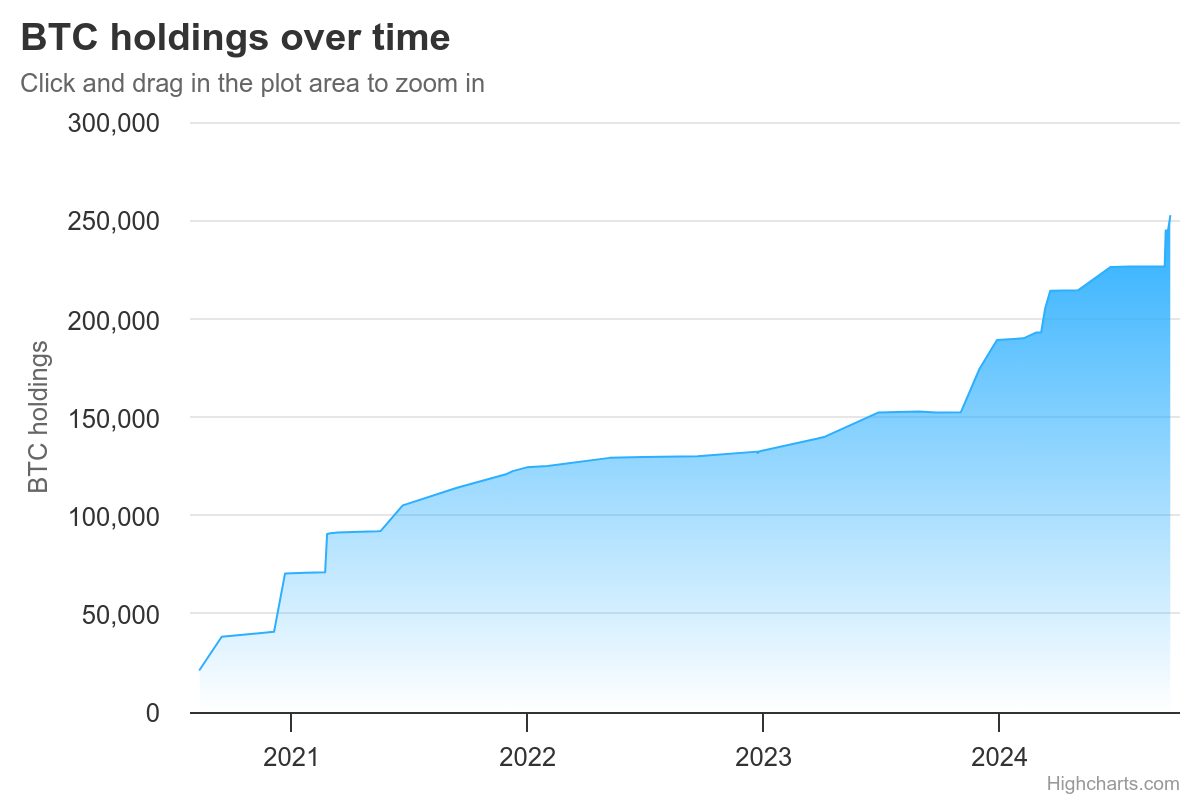

MicroStrategy at present holds at least 252,220 BTC, worth $16,885,763,281. The company has at least 1.201% of the total Bitcoins. Since August 2020, the company has consistently increased its BTC holdings. On 11 August 2020, the BTC holdings of MicroStrategy were just 21,454. By mid-May, 2021, it had reached 91,326 BTC.

By late January 2022, it further rose to 125,051 BTC. In the period between November 1, 2023, and July 21, 2024, it steeply increased from 152,400 BTC to 226,500 BTC. Last month alone, MicroStrategy purchased 25,720 BTC. At the start of this year, the BTC holding of the company was around 189,150 BTC. This year alone, at least 63,079 BTC purchases have been made by the company, indicating its growing confidence in Bitcoin.

Why Bitcoin Outshines Traditional Currency

Explaining why he is so confident about Bitcoin, Saylor claimed that traditional currencies lose value over time. Meanwhile, he metaphorically likened Bitcoin to a battery that never loses its charge.

He also opined that Bitcoin can solve at least half of the world’s problems.

MicroStrategy: Transforming to a “Bitcoin Bank”

Recently, speaking to a different audience, Saylor described his plan to shift the company from a software company to a ‘Bitcoin Bank’. This explains why the company has been aggressively purchasing BTC for the last few years.

In conclusion, Saylor’s noble wealth plan is expected to inspire many young crypto leaders to rethink what they want to achieve with their crypto journey – both personal and professional.