Quick Take

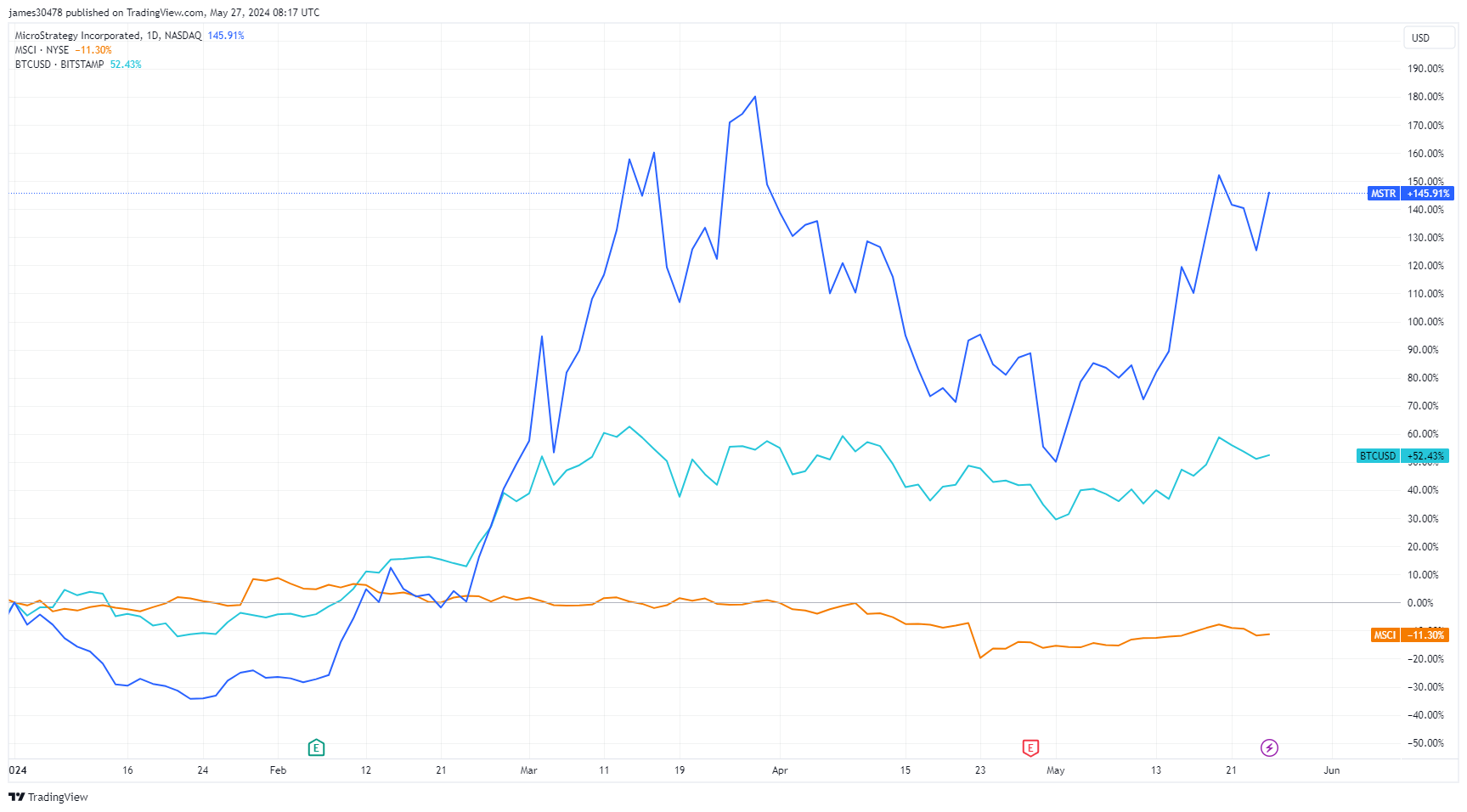

MicroStrategy, which holds a significant 214,400 Bitcoin on its balance sheet, has experienced a remarkable 146% rise in share price this year, pushing its market cap to approximately $30 billion. This impressive performance has earned the company inclusion in major stock indexes.

On May 15, Reuters reported that MicroStrategy (MSTR) would be added to the MSCI World Index, with changes set to take effect after market close on May 31. This addition comes while the MSCI World Index is down roughly 11% year-to-date.

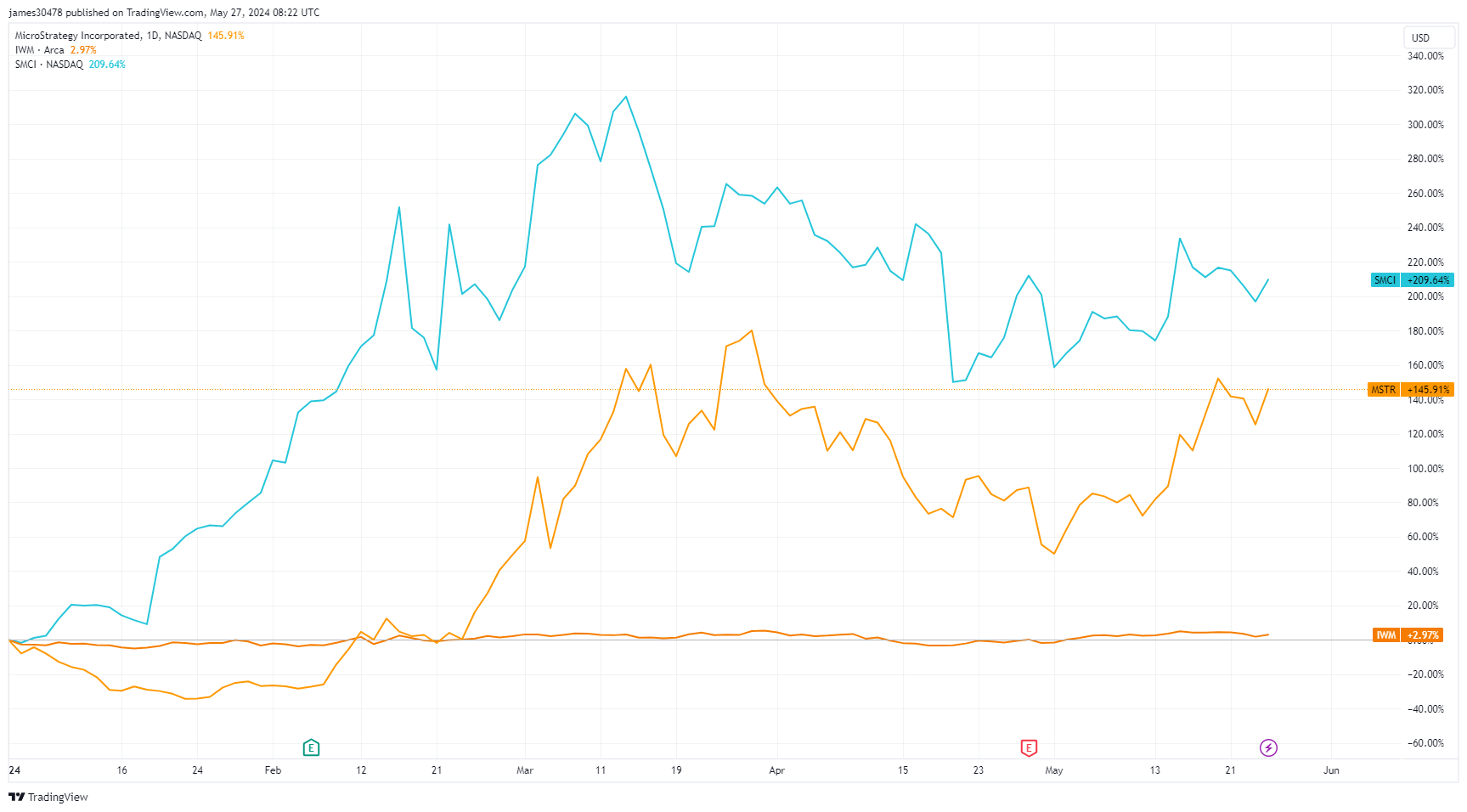

Furthermore, Investing.com revealed that MSTR is also set to join the Russell 1000, which tracks the top 1,000 stocks in the Russell 3000 Index. MSTR will transition from the Russell 2000 to the Russell 1000 alongside SuperMicro Computers (SMCI). The Russell 2000 is up a modest 3% year-to-date, while SMCI has surged an astonishing 210% in the same period. According to Yahoo Finance, the pair has been nicknamed “The Two Micros” due to their exceptional market performance.

According to Forbes, MicroStrategy (MSTR) will be included in the Russell 1000 on June 28.

“Every year on the fourth Friday of June, the Russell 1000, Russell 2000, Russell 3000 and other Russell indexes are reconstituted”.

If Bitcoin continues its upward trajectory, MicroStrategy stands to gain significantly due to its substantial Bitcoin holdings. This could drive further share price growth, increasing its presence in major indexes and attracting more passive investment flows. CEO Michael Saylor may leverage this opportunity to purchase additional Bitcoin. The ultimate goal for MicroStrategy would be to secure a place in the prestigious S&P 500.

The post MicroStrategy eyes S&P 500 after 146% share rise and inclusion in MSCI World, Russell 1000 appeared first on CryptoSlate.