Ordinal inscriptions have quickly consumed Bitcoin’s available block space since their debut last year, a study by blockchain analytics firm Glassnode found. These text and image files act as “packing filler,” filling any remaining space in blocks after higher-value transactions are added, the study showed.

Bitcoin’s Block Space: Monetary Transfers Overpower Inscriptions

Though there’s been a surge in Ordinal inscriptions in 2023, a Glassnode study found that financial transactions remain the priority on Bitcoin’s blockchain. Glassnode researchers emphasized that “there’s little evidence inscriptions are pushing out monetary transfers.”

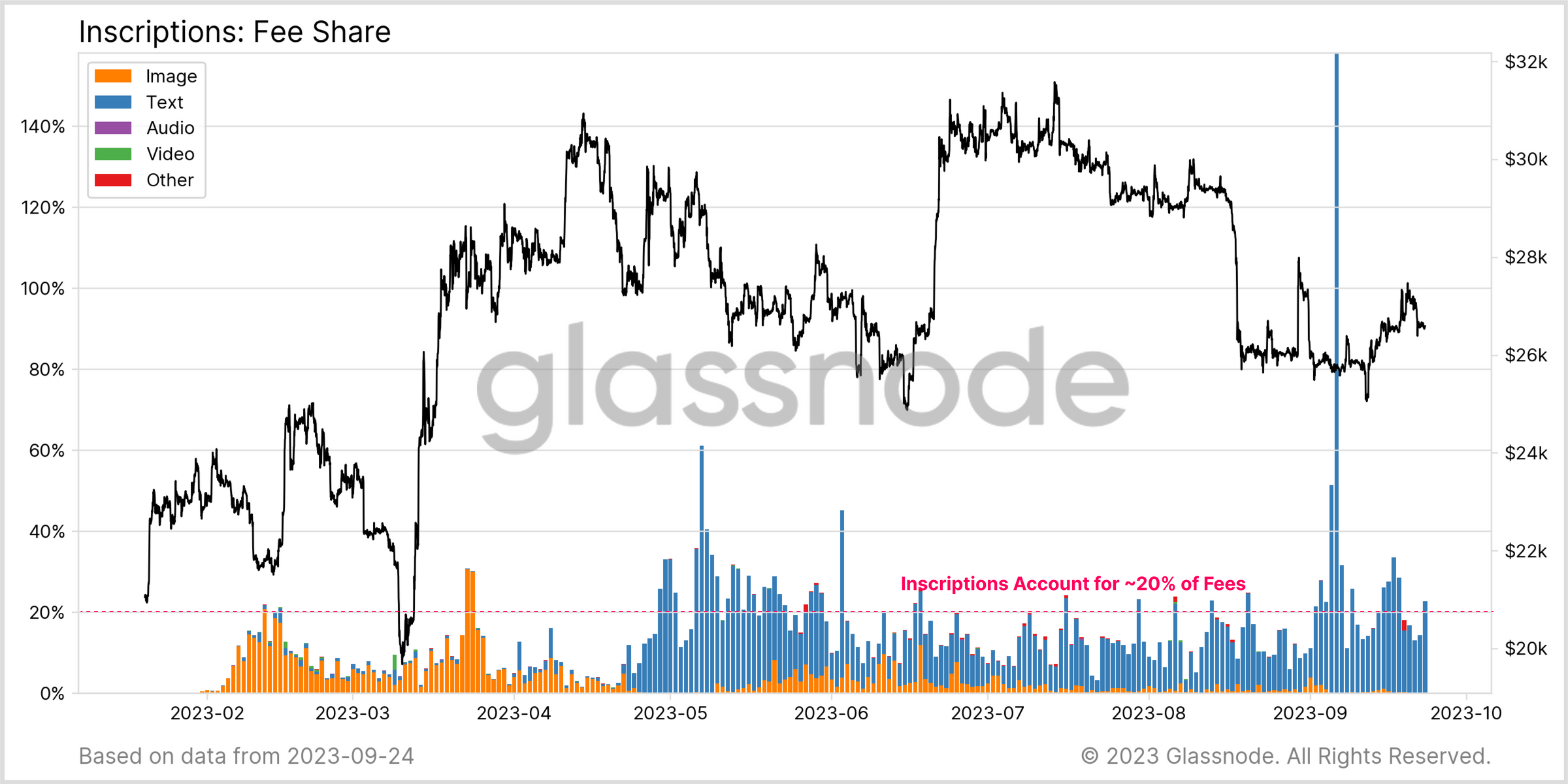

“Inscriptions appear to be buying and consuming the cheapest available blockspace, and are readily displaced by more urgent monetary transfers,” the report states. Despite the increase, inscriptions account for about 20% or less of transaction fees paid to miners.

The technology lets users add content to the Bitcoin blockchain using the Segwit data structure and Taproot. An initial wave of image NFTs shifted to mainly text files as the BRC-20 token standard appeared, Glassnode researchers said.

Daily transaction counts have exceeded 550,000 several times this year as inscriptions add more transfers to the limited block size. The average block now contains up to 3,500 transactions, up from 2,500 in past years, the report showed.

Of all confirmed transactions, inscriptions comprise 40% to 60% since May. The resulting UTXO set grew by more than 46 million entries (up 34%) in 2023, the quickest growth ever recorded. While miner revenue has increased, income per hash rate is near historic lows.

“With extreme miner competition in play, and the halving event looming, it is likely that miners are on the edge of income stress,” Glassnode said.

Overall network fees have doubled to about 38 BTC daily but represent only 4% of miner rewards. At the same time, Bitcoin’s mining difficulty has risen by 50% as more specialized and advanced mining equipment is used.

With the next halving predicted in just 206 days, Glassnode believes most miners will experience significant income challenges unless BTC prices increase significantly. Glassnode noted that while inscriptions might be taking up space, they haven’t boosted miners’ earnings.

What do you think about Glassnode’s report on inscriptions and monetary transfers? Share your thoughts and opinions about this subject in the comments section below.