An experiment in Prague might end up mattering more for Bitcoin than the usual ETF inflow chart.

Speaking on the “Crypto In America” show on 10 December, Coinbase Head of Institutional John D’Agostino highlighted that the Czech National Bank has begun testing Bitcoin in its national treasury and for payments, and argued that this sort of move by a Eurozone central bank is likely to spread.

Czech Bitcoin Pilot Could Spread Across Eurozone

“The Czech national bank chose very well in their service providers,” he said, adding that the central bank is “putting Bitcoin on their national treasury and they are experimenting with and learning in real time using Bitcoin for payments.” The pilot is small — “a million dollars of Bitcoin” — but for D’Agostino the signal is not in the size, it is in who is doing it and why.

He drew a deliberate contrast with earlier sovereign experiments: “No disrespect to El Salvador… this wasn’t a ‘I want to shake up my economy because I’m heading in the wrong direction’… This is, we are a stable Euro zone country… we don’t have to do this.”

Instead, the Czech move followed “all the bells and whistles” of a traditional process: RFPs, vendor selection, formal adoption into policy. That, he suggested, is exactly what makes it dangerous — for the status quo. “That type of thing is contagious and I can see more Euro zone [countries] following suit very very shortly,” he said.

The comment did not come in isolation. Throughout the interview, D’Agostino hammered a consistent thesis: institutional adoption has always been less about perfect regulatory clarity and more about liquidity, credible market structure and having the “right” types of participants in the pool.

“I’ve always been a bit of a skeptic on the argument that the reason institutions haven’t invested… is regulatory clarity,” he said. Clarity is “top three,” but in his ranking it comes after liquidity and sits alongside alpha potential. If two of the three are present, “people will find a way.”

Bitcoin’s spot ETFs, in his view, have already created something the asset previously lacked: a cohort of structurally compelled participants. “The ETFs, in my view, are kind of the surrogate commercial users of Bitcoin,” he argued. They “have to rebalance… it’s codified into their business model,” acting as a stabilizing force similar to industrial users in commodities markets.

A Eurozone central bank experimenting with Bitcoin on its balance sheet pushes that logic one step further up the food chain. D’Agostino did not spell out a grand theory of “Bitcoin as reserve asset” — he was careful, almost lawyerly, about what he could say — but the implication is not terribly subtle: when a central bank with access to normal EU funding “doesn’t have to do this” and still chooses to, it normalizes Bitcoin inside the most conservative layer of the monetary system.

That sits alongside a broader reputational repair job he thinks the industry still has to finish. Crypto, he argued, has had no more structural failures than other markets — he pointed to the London Metal Exchange’s cancellation of billions in nickel trades as an under-discussed parallel to FTX — but “we tend to push the jokers to positions of prominence,” whereas TradFi “does a good job of hiding their jokers.”

Between cleaner narratives, ETF-driven “surrogate” demand and now a Eurozone central bank quietly wiring a million dollars into Bitcoin, D’Agostino’s message was that the institutional story is less about a sudden wave and more about erosion. “There’s no wave,” he said earlier in the conversation. “It’s this gradual erosion as opposed to this crashing wave.”

If he is right about the Czech experiment being contagious, that erosion may soon be happening from the inside of the Euro system as well, not just from asset managers in New York.

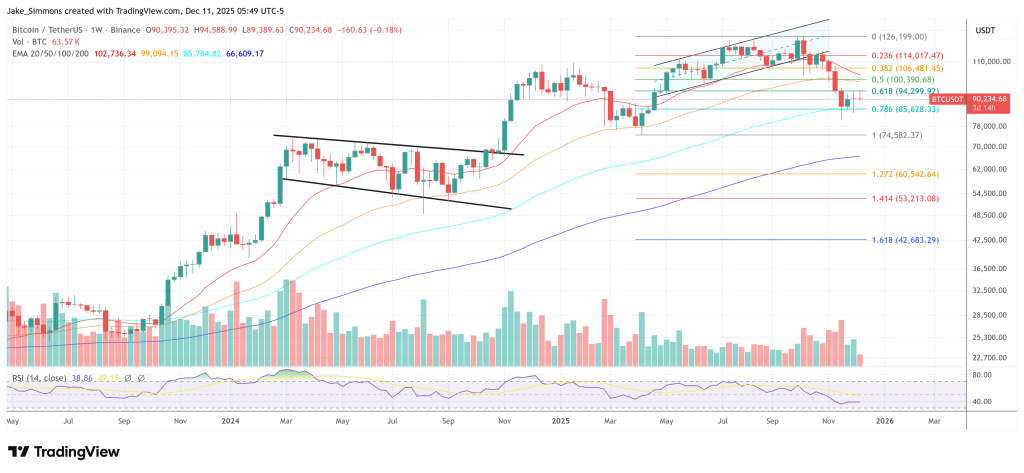

At press time, BTC traded at $90,234.