The post NEAR Price Eyes Breakout To $8 as AI Focus and Technical Setup Align appeared first on Coinpedia Fintech News

The NEAR price is showing a strong spike of nearly 15% today to trade at $3.2 with $4.15 billion market cap. This renewed strength appears extraordinary with the evolution in the AI sector, as it rebounds from deep lows coming down from $9 high, holding above the $2 level in Q3 is signaling strong resilience.

With a breakout on the daily chart and critical resistance at $3.5 in sight, NEAR crypto appears poised for a potential rally backed by rising institutional interest.

Strong Technical Structure Backing NEAR Price Today

Technically, NEAR Protocol has shown strong bullish signs in Q3 2025. After enduring a deep price pullback, the token held a structural base around $2, which is a significant achievement that signals underlying strength.

A look at the weekly chart reveals that the $3.50 level, marked by the Fixed Range Volume Profile’s Point of Control (POC), is now acting as a critical supply zone.

However, the daily chart adds further optimism by showing a clean symmetrical triangle breakout in NEAR that is driving the price toward this key resistance.

If NEAR manages to successfully flip the $3.50 level into support, it could open the door for a swift push toward the $8 zone back. If this happens then it will be clearly supported by both technical and sentiment-driven tailwinds.

NEAR Positions as the ‘Blockchain for AI’

Beyond just the charts, NEAR Protocol has been doubling down on its strategic positioning as the “blockchain for AI.”

This shift has been underscored by the recent integration of Allora Network’s predictive AI layer into the NEAR ecosystem, announced on September 16.

NEAR’s other recent collaborations are also adding momentum. Early week in September, NEAR also announced partnerships with other projects like Aptos and Shelby, that were aimed to improve cross-chain interoperability and decentralized data storage capabilities.

Meanwhile, the broader crypto market backdrop has turned supportive too, with increased institutional interest and the most recent Federal Reserve interest rate cut of 0.25 BPS. This shift has injected fresh capital into the market, boosting sentiment around major altcoins. As it seems the NEAR crypto has been one of the key beneficiaries of this renewed risk appetite.

Onchain Factors Supports The Optimism

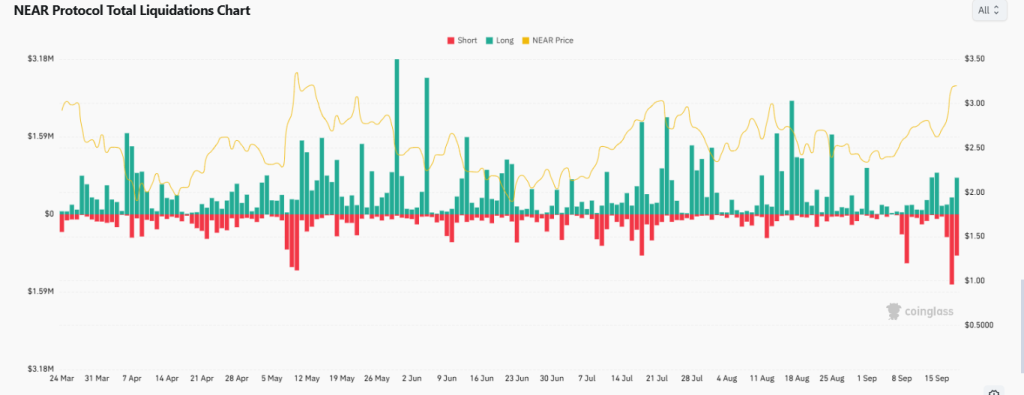

Over the last six months, NEAR Protocol’s market has seen its highest short position liquidations, with a total of $1.44 million in short positions wiped out. This figure surpasses the previous peak of $1.15 million in May, clearly indicating that bullish sentiment is dominating Q3.

This bullish demand can be further confirmed by the recent surge in NEAR’s futures Open Interest (OI), as well. The chart reveals that OI has climbed to $485 million, nearing its December peak of $542.49 million.

The rapid increase in contracts, driven by recent bullish developments, suggests that this trend will likely continue. The rising OI could propel NEAR’s price higher and potentially even surpass the December all-time high in Open Interest.

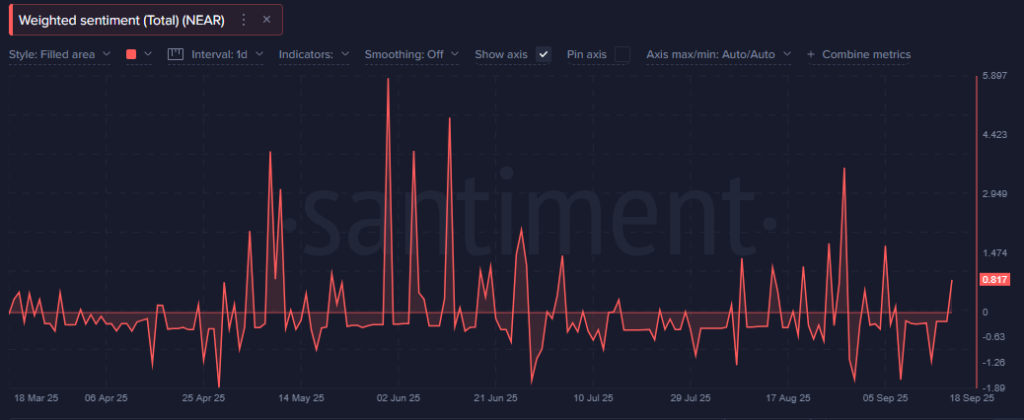

Additionally, recent on-chain analysis confirms this shift, showing a clear transition from negative to positive weighted sentiment, a strong signal that the market’s collective mood has shifted from bearish to bullish.