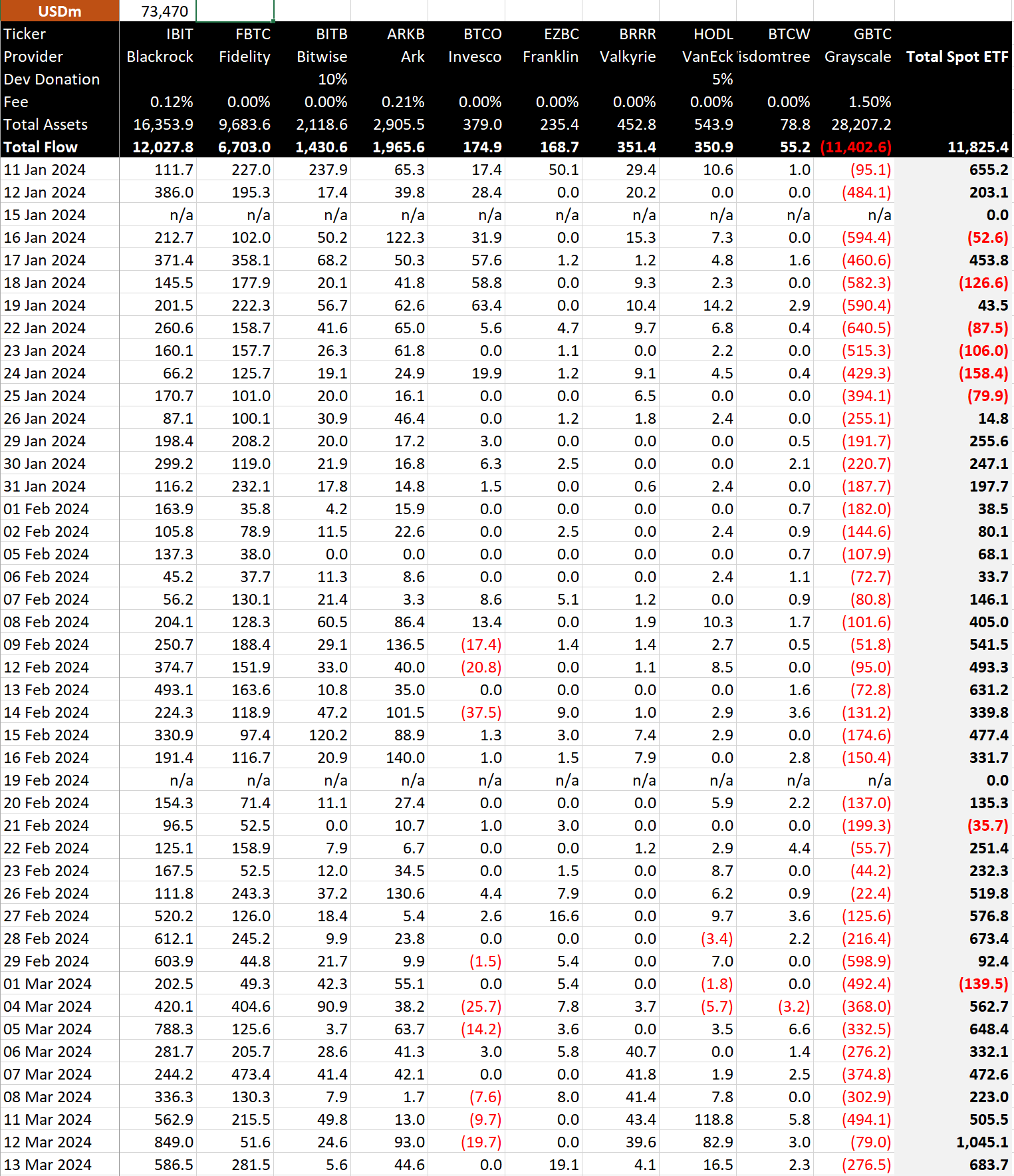

Bitcoin ETFs continued their strong performance on March 13, with a net inflow of $683.7 million, according to data from Bitmex Research. This marks another positive day for Bitcoin ETFs, following the surge in inflows seen on March 12.

Per Bitmex Research ETF flow data, BlackRock’s iShares Bitcoin ETF (IBIT) again led the way, attracting $586.5 million in new investments. Fidelity’s FBTC fund also maintained its momentum, with inflows of $281.5 million.

Other Newborn Nine ETFs that experienced significant inflows include Bitwise’s BITB fund ($5.6 million) and ARK Invest’s ARKB fund ($44.6 million). Franklin Templeton EZBC fund saw a strong uptick with flows of $19.1 million, its highest inflow since launch day. Invesco Galaxy stemmed the bleeding somewhat with zero net flows after three days of heavy outflows. VanEck continued to see increased flows after waiving fees with a further $16.5 million after two days of heavy inflows. However, Grayscale saw increased outflows again, with $276.5 million leaving the fund.

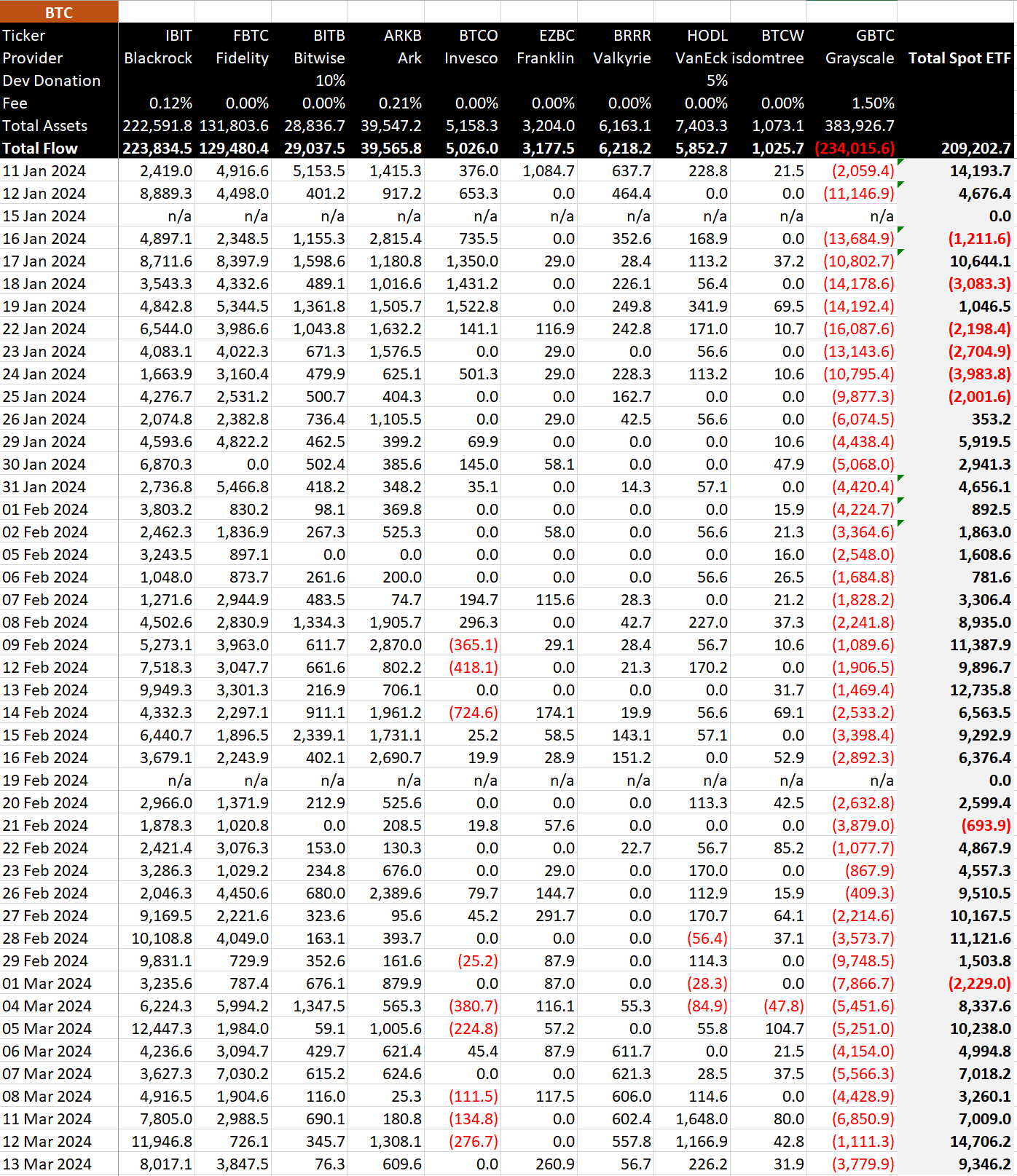

In terms of Bitcoin, the net inflow amounted to 9,346.2 BTC, per Bitmex Research ETF flow data. BlackRock’s IBIT fund accounted for 8,017.1 BTC of the total inflow, while Fidelity’s FBTC fund added 3,847.5 BTC. Bitwise’s BITB fund saw an inflow of 76.3 BTC, ARK Invest’s ARKB fund gained 609.6 BTC, and VanEck’s HODL fund attracted 226.2 BTC.

The consistent growth in Bitcoin ETF inflows demonstrates the sustained mainstream adoption of Bitcoin as an investment asset. As more institutional and retail investors allocate funds to Bitcoin ETFs, the crypto market will likely experience greater stability and liquidity in the long run.

The post Net $680 million flows into Bitcoin ETFs as Grayscale outflows tick back up to $276 million appeared first on CryptoSlate.