Ethereum is on the brink of reclaiming its all-time high, after setting a fresh multi-year peak at $4,792. Bulls remain firmly in control, driving momentum as Bitcoin pauses in a consolidation range. This stall in BTC’s advance has created room for altcoins to shine, igniting a broad bullish phase across the market.

Institutional demand continues to play a pivotal role in Ethereum’s rally. On-chain data shows a steady accumulation by large investors, with wallets linked to major institutions and funds consistently adding to their holdings. This buying pressure is reinforced by a tightening supply dynamic — ETH balances on exchanges and over-the-counter (OTC) desks are rapidly declining, reducing the amount of coins readily available for sale.

The combination of shrinking supply, strong investor confidence, and a favorable macro backdrop has put Ethereum in a prime position to challenge its previous highs. Market participants are closely watching the $4,800–$4,900 range as a critical resistance zone. A breakout above this level could set the stage for new price discovery and accelerate the altcoin market’s bullish momentum.

Ethereum Whale Activity Signals Confidence Ahead of Potential Altseason

According to blockchain intelligence firm Arkham Intelligence, Ethereum has just witnessed one of its largest single whale transactions of the year. A newly created wallet withdrew 60,000 ETH — valued at approximately $284.76 million — from Coinbase Prime last night. The entire sum is now being staked, signaling a strong long-term commitment to holding and securing the network.

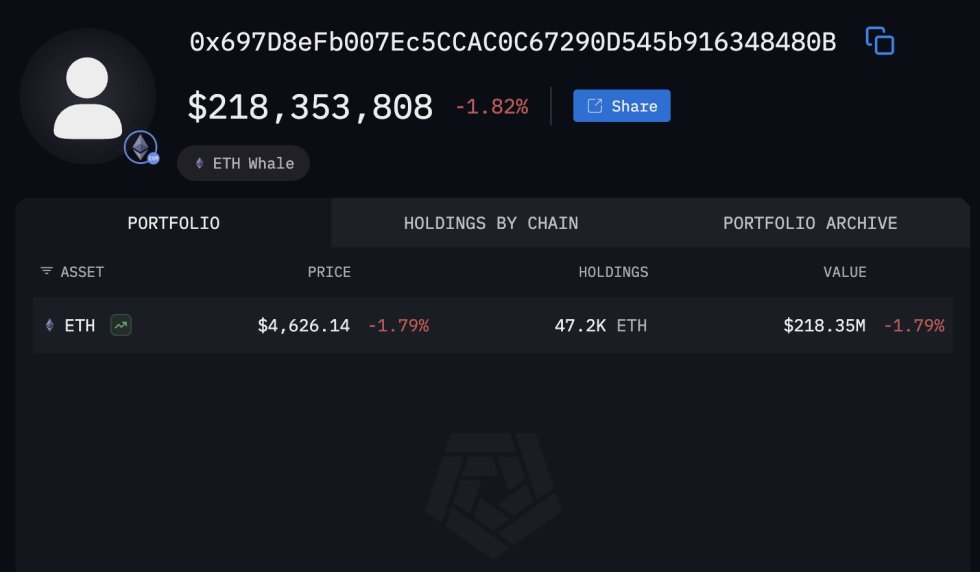

Further analysis shows that the whale has already moved 3,200 ETH (worth $14.75 million) into four separate wallets. Notably, one of these wallets has deposited its share directly into Coinbase Staking, confirming that this is not a speculative short-term trade but rather a deliberate accumulation and yield-generation strategy. The wallet address, 0x697D8eFb007Ec5CCAC0C67290D545b916348480B, is now on the radar of market watchers.

Analysts suggest that such large-scale staking activity is a bullish signal for Ethereum’s price trajectory. By locking up a substantial amount of ETH, this whale effectively removes significant liquidity from the market, potentially tightening supply during a period of strong institutional demand.

Some market experts believe Ethereum could become the primary catalyst for a broader altseason in the coming weeks. With Bitcoin consolidating near record highs, capital rotation into high-quality altcoins — led by ETH — could ignite a fresh wave of market enthusiasm, pushing the sector into a more aggressive bullish phase.

Price Action Details: Weekly Chart Analysis

Ethereum (ETH) continues its impressive rally, closing the week with a strong gain and pushing to a multi-year high near $4,792, just shy of its all-time high. The weekly chart shows a steep upward trajectory over the past month, with ETH breaking through key resistance levels at $3,200 and $4,000 with little hesitation.

The 50-week moving average (blue) has crossed decisively above the 100-week MA (green), signaling strong bullish momentum. Price action remains well above the 200-week MA (red) at around $2,443, underlining the strength of the current uptrend. Volume has also spiked notably during this rally, indicating that buying pressure is supported by solid market participation rather than thin liquidity.

However, the sharp vertical move suggests overextended short-term conditions, raising the risk of a pullback or consolidation before the next leg higher. As long as ETH holds above the $4,200–$4,300 support zone, the bullish structure remains intact, with traders eyeing a potential breakout into uncharted territory.

Featured image from Dall-E, chart from TradingView