The once-feverish NFT marketplace, where digital art and collectibles commanded millions, now resembles a deserted online bazaar. A new report paints a stark picture – a 97% plunge in trading volume since 2021 and a staggering 95% of NFT projects holding zero market value.

This dramatic decline begs the question: is the NFT market headed for extinction, or is this just a temporary hiccup?

From Jpeg Millionaires To Tumbleweed Sales

Just two years ago, NFTs were the new gold rush. Beeple’s $69 million digital collage sale became a cultural phenomenon, and stories of overnight millionaires from “on-chain jpegs” fueled a speculative frenzy. However, that frenzy seems to have fizzled out.

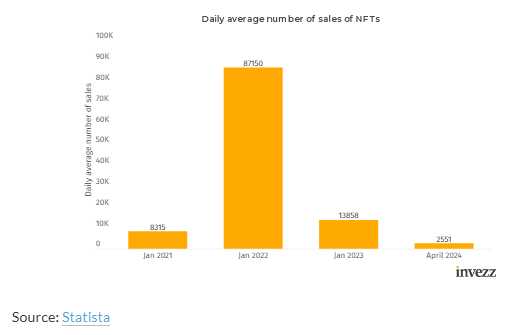

Today, the average NFT sale struggles to break the $200 mark, a far cry from the seven-figure sums of yesteryear. Daily sales have nosedived from a bustling 87,000 in 2021 to a mere 2,000 in 2024.

Crypto Winter And Beyond: A Cocktail Of Challenges

The blame for this downturn falls on several factors. The broader crypto market slump, often referred to as the “crypto winter,” has undoubtedly played a role. Economic uncertainty and geopolitical tensions haven’t helped either, dampening investor confidence.

However, the NFT market’s woes may run deeper. Critics point to a saturation of low-quality projects and a lack of utility for many NFTs beyond bragging rights. The multi-million dollar sales of 2021 might have been outliers, fueled by hype rather than genuine value.

A Glimmer Of Hope? Retail Investors Hold The Key

Despite the bleak landscape, the report suggests a potential comeback. The authors point to historical trends in the crypto market, where periods of decline have often been followed by resurgence.

A return of retail investors, those willing to take on higher risk for potentially high rewards, could breathe new life into the market. This hinges on a recovery in the broader market and a renewed sense of optimism among investors.

Regulation: A Looming Cloud

The future of NFTs isn’t without its hurdles. Regulatory scrutiny from the US government casts a long shadow. While some argue that clear regulations could bring stability and legitimacy to the market, others fear it could stifle innovation. Finding the right balance between protecting investors and fostering growth will be crucial for the NFT market’s future.

The Verdict: A Time Of Reckoning

We can view the current status of the NFT market as a reckoning era. The gaudy dreams of 2021 have made way for a more grounded reality. It will be interesting to watch if NFTs develop into a strong asset class with practical applications or if they become just another digital memory.

Featured image from Mundissima/Alamy, chart from TradingView