According to Bank of America analysts, the Nigerian currency is currently undervalued and will likely end the year trading at around NGN680 per dollar. The analysts assert that higher oil revenues and a liberalized import regime will likely see Nigeria record current account surpluses in the medium term.

Freely Floating Naira

Just under a month after Nigerian monetary authorities abandoned the fixed exchange rate regime, analysts at Bank of America recently now argue that the local currency — the naira — is presently undervalued. However, according to analysts, the naira, which is hovering above NGN700 per US dollar, will likely end the year trading at around NGN680 per U.S. dollar.

The latest forecast by Bank of America analysts came more than nine months after an economist with the financial institution predicted a 20% devaluation of the naira which would translate to an exchange rate of NGN520:USD1.

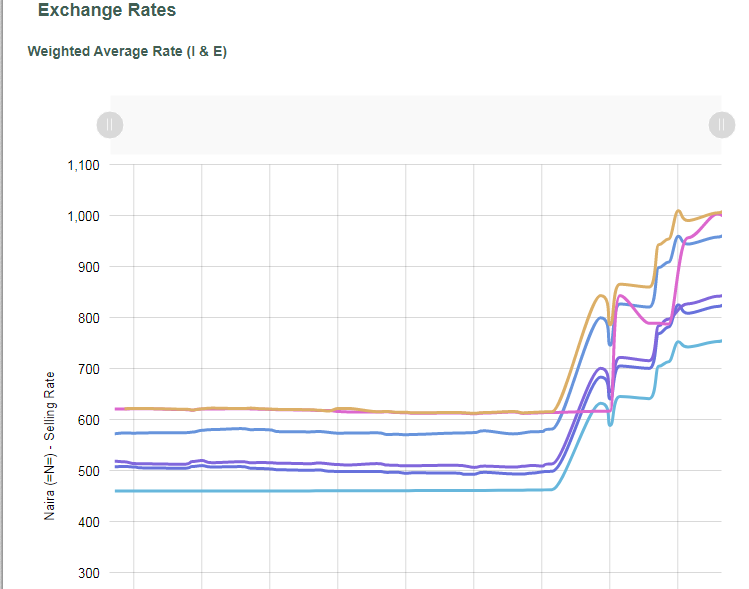

However, as reported by Bitcoin.com News in mid-June, the Central Bank of Nigeria (CBN)’s decision to allow the naira to freely float initially saw the currency tumble from just under NGN470 per dollar to NGN634 per dollar. Since then the currency has continued to lose ground versus the dollar.

As shown by the CBN’s June 26 data, the naira to dollar exchange rate stood at NGN753:USD1. Meanwhile, on the parallel market, one U.S. dollar was buying NGN768 on July 1, 2023.

Nigeria’s High Debt Burden

Meanwhile, in their latest note on Nigeria, the analysts shared some of the reasons which made them conclude that the naira will start 2024 trading at around 680 per dollar. They said:

The caution is transition time, aligning rates and still to unlock more USD into the formal market will take some time. When the dust has settled, the value of the naira should be stronger and appreciating.

Meanwhile, in their latest note on Nigeria, the analysts also stated that higher oil revenues ($12 billion more) and a liberalized import regime could still see the West African country recording consistent current account surpluses.

The note also urged Nigerian President Bola Ahmed Tinubu to consider tackling oil theft because doing this could easily result in the country earning more from hydrocarbons. Doing this will in turn ease Nigeria’s high debt service burden.

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.