Recent reports informed of an alleged circular released by the Central Bank of Nigeria (CBN). The document warned financial institutions that engaging with cryptocurrencies and facilitating operations for crypto exchanges was prohibited.

The news raised alarms as, four months ago, Nigeria lifted the ban that prevented banks and other financial institutions from operating accounts for virtual asset service providers (VASPs).

Latest Crypto Crackdown Turned Out A Bluff

On Tuesday, reports of a CBN’s tackle on financial institutions that facilitated operations for crypto exchanges in Nigeria started spreading.

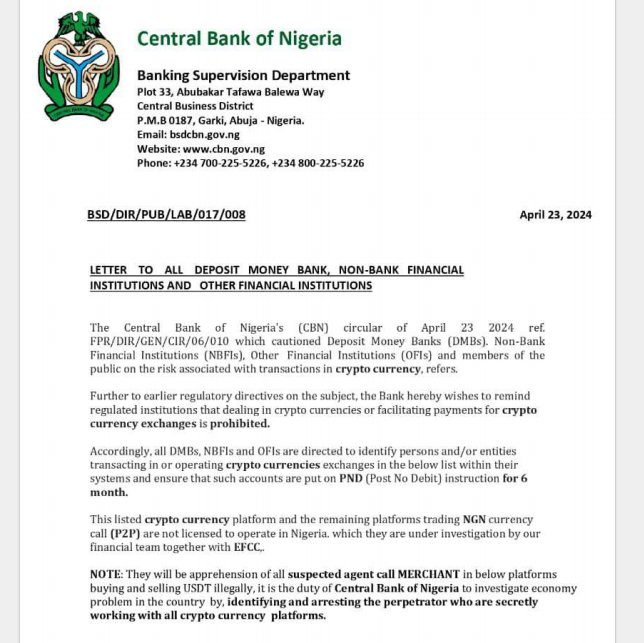

The alleged circular “cautioned” Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), Other Financial Institutions (OFIs), and the public about the risks associated with crypto transactions.

The document “reminded” regulated institutions they were banned from dealing in cryptocurrencies or facilitating operations for exchanges due “to earlier regulatory directives on the subject.”

Nonetheless, the mentioned ban was lifted in December 2023 and was followed by strict guidelines that allow banks and other institutions to deal with cryptocurrencies under a set of rules.

The alleged circular directed DMBs, NBFIs, and OFIs to identify and report all individuals and entities within their system that were “transacting in or operating cryptocurrencies” on exchanges.

Binance, OKX, KuCoin, and Bybit were listed as prohibited platforms. Per the document, the listed exchanges and other platforms trading the Nigerian Naira in the Peer-to-Peer (P2P) Market were not licensed to operate in the country.

As such, these platforms were “under investigation” by the CBN and the Economic and Financial Crimes Commission (EFCC). The circular ordered the financial institutions to ensure that the accounts that dealt with cryptocurrencies were “put on PND (Post No Debit) instruction for six months.”

Furthermore, it warned that all suspected agents that traded “USDT illegally” could be apprehended. The document stated that any breach of the new directive would result in “severe regulatory sanctions” for the involved parties.

Nonetheless, Nigeria’s Central Bank clarified on Wednesday that the alleged circular was “fake content.” On an X post, CBN stated that the information was unauthentic and didn’t originate from the institution.

Nigeria’s EFCC Freezes 300 Accounts

Despite the CBN circular turning out fake, the EFCC recently froze over 300 illegal forex accounts that traded on a P2P platform.

According to a local report on Tuesday, EFCC Chair Ola Olukoyede revealed that the commission suspended the accounts on Monday following a court order.

The Chairman explained that the agency discovered a “worse scheme” than Binance’s system, which has been under a regulatory crackdown in the country. The largest crypto exchange in the world and two of its executives are currently facing four charges for Tax Evasion in Nigeria.

Per the report, Olukoyede affirmed that “there are people in this country doing worse than Binance.” As a result, these actions were taken to “ensure the safety of the foreign exchange market and protect the economy.”

The EFCC considers P2P financial trading a “scheme” operating outside the official financial corridors as, in the last year, over 15 billion Nigerian Naira, worth around $11 million, passed through one of the forex platforms.