Bitcoin prices surged this week, increasing from $84,100 on Monday to $93,549 at the time of the most recent market update. This 6.5% increase over a 24-hour period occurs as the cryptocurrency is seen breaking its historical link with tech stocks, market analysts say.

Bitcoin And Gold Chart Different Paths From Traditional Markets

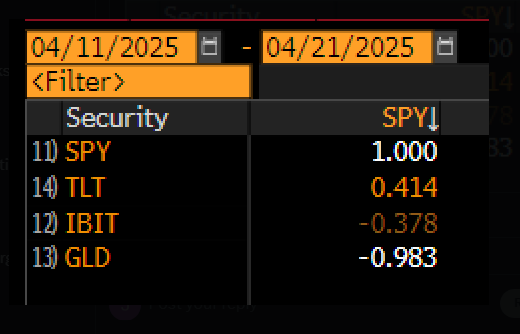

Eric Balchunas, Bloomberg Senior ETF Analyst, noted that Bitcoin has performed better than treasury bonds, which he described as “unreliable” in current market trends. Gold also defied expectations, dropping 0.983 points while stocks fell. The precious metal recently reached a record high of $3,500 per ounce before it settled at approximately $3,400.

Though Balchunas conceded the time period is short, he emphasized that the crypto must continue to “win” these short-term skirmishes to gain its position as an actual alternative asset. These small wins may ultimately put Bitcoin in front of global stocks, much like gold has done over time.

Bitcoin up big yest when stocks down, showing negative correlation to stocks past week or so, better than treasuries (which are unreliable once again), altho gold is in league of own (-98). Obv a ridic small time frame but gotta get get these small wins if it ever wants to be… pic.twitter.com/JydPKuDRNA

— Eric Balchunas (@EricBalchunas) April 22, 2025

ETF Money Flows Reach Highest Levels Since January

As per Matthew Sigel, VanEck’s head of research, Bitcoin’s rally from its April 7 low has freed it from its historical correlation with US tech stocks. This is as Bitcoin Exchange-Traded Funds (ETFs) recorded their largest inflows since January 30, indicating increasing investor confidence.

The timing of such inflows may be pivotal in maintaining Bitcoin’s present price rally. According to reports from market observers, without ongoing investment via these ETFs, the momentum may be lost.

Bitcoin Surges As NASDAQ Stumbles

Latest data pointed out a rare divergence between Bitcoin and the NASDAQ index. As Bitcoin prices rose, the NASDAQ struggled – a trend that never lasts long.

When the NASDAQ’s 200-day moving average has declined in the past, the crypto generally encountered challenging market conditions. Today, Bitcoin is at its own 200-day moving average, but some analysts are thinking that this time may go differently if investment flows continue to be robust.

Investor Sentiment Shows Signs Of Recovery

Statistics show that sentiment towards investing in digital assets is getting better. The majority of fresh funds entering crypto during the last week went straight into Bitcoin, although mid-week retail activity led to $146 million in outflows.

The recent price action of the cryptocurrency has been noticed as it implies Bitcoin could be settling in as an investment asset. While financial assets and technology stocks follow their own patterns in the market, current capacity for Bitcoin to do something different piques interest concerning whether it will play a long-term function.

Featured image from PixelPlex, chart from TradingView