Crypto and NFT payments infrastructure company Transak has partnered with Visa to integrate Visa debit capabilities into its global off-ramp service. This move increases the options for crypto-to-fiat off-ramps, allowing users in over 145 countries to convert their crypto holdings into local fiat currencies.

Using a product called Visa Direct, Transak will allow the fluid conversion of digital assets into fiat currency across the industry. This collaboration addresses a critical gap in the market: the ease of crypto-to-fiat conversion. Historically, the focus has been on facilitating the flow of fiat into crypto, leaving the reverse process, from crypto back to fiat, less developed and often cumbersome.

This has led to a reliance on stablecoins or alternative, less-regulated conversion methods, which could be problematic regarding local compliance. The partnership between Transak and Visa introduces a solution to this challenge, offering real-time card withdrawals through Visa Direct. Yanilsa Gonzalez-Ore, North America Head of Visa Direct, highlighted the significance of this integration, emphasizing its role in providing a more connected and efficient experience for users.

“By enabling real-time card withdrawals through Visa Direct, Transak is delivering a faster, simpler and more connected experience for its users — making it easier to convert crypto balances into fiat, which can be spent at the more than 130M merchant locations where Visa is accepted.”

A key feature of Visa Direct is its real-time transaction processing capability, potentially completing transfers in under 30 minutes—a stark contrast to the often lengthy procedures in traditional banking. Further, most off-ramps today are limited to centralized exchanges, meaning investors are required to undergo at least a momentary move into centralized custody before withdrawing.

The ability to convert crypto to fiat directly from a wallet allows users to retain the self-sovereign aspect of self-custody in crypto. Transak is integrated into more than “350 leading Web3 wallets and games, such as MetaMask, Trust Wallet, Coinbase Wallet, and Ledger.”

Sami Start, CEO of Transak, views this partnership as a pivotal moment for Web3, commenting,

“We believe this partnership is an inflection point for Web3 as a whole. Now, millions across the globe have a straightforward way to cashout their digital asset holdings to their local currency in real-time and intuitively.

They no longer have to walk the treacherous path of compliance uncertainty or face risks of fraud — Transak and Visa have them covered for over 40 cryptocurrencies.”

Testing the wallet-based fiat off-ramp.

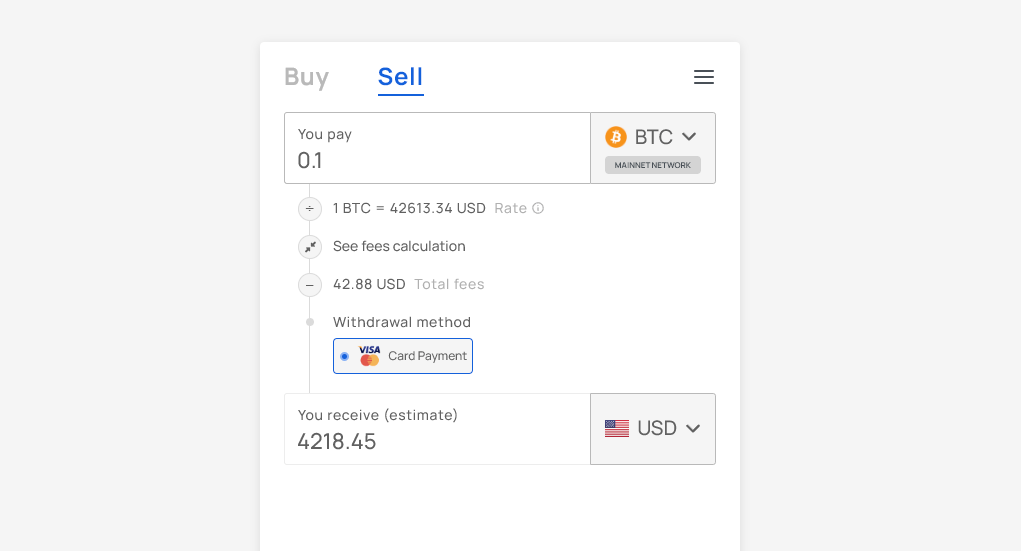

However, such a revelation is not without its downside. As of press time, the price of Bitcoin is $43,497. However, withdrawing 0.1 BTC would result in just $4,218 in fiat landing in an investor’s bank account, a 3% haircut on the current value. Transak takes a 1% fee and a nominal processing fee paid to “service providers.” However, an information bubble on the page does indicate that the price listed is an estimate, so it is currently unclear whether there is a spread along with the fee.

The spread between the estimated price and the current market price is around 2% across all assets reviewed. A 2% spread is also shown for the ‘buy’ side trades from Visa Card, ApplePay, GooglePay, Cash App, and bank wire, again with a 0.99% transaction fee.

While the Transak website states a flat 1% fee, the partner docs describe the pricing mechanism in greater detail. The spread is intended to cover network fees and “a small slippage percentage.” Combining fees into a single variable may make such transactions appear more straightforward to non-native crypto users. However, daily users may prefer more finite control over the costs. Ultimately, there is a cost for convenience.

Harshit Gangwar, Marketing Head & Investor Relations Lead at Transak, confirmed to CryptoSlate that the “spread fluctuates based on factors like the complexity of sourcing liquidity and the risks associated with storing different cryptocurrencies.” Specifically, he said,

“[The spread is] variable and determined by our systems and team based on the challenges in storing and sourcing cryptocurrencies.

For example, if a cryptocurrency available for off-ramping suddenly drops significantly, it signals to our team the increased risk of storing it for an extended period, which could affect the spread percentage for that particular cryptocurrency.”

Further, for those hoping that the process would remove the need for KYC steps, this appears not to be the case. Name, address, date of birth, ID, and a selfie are all required when setting up an account for the Transak withdrawal service. Thus, buying or selling through this non-custodial off-ramp will link your personal information to your wallet address.

Those looking for a fully compliant method to buy and sell crypto with fiat without using centralized exchanges now have a method costing between 0.99% and 3%, which may be considerably less than other peer-to-peer options.

Ultimately, the collaboration between Transak and Visa Direct is a decisive step forward in the journey toward the mainstream acceptance of digital currencies. It attempts to simplify converting crypto to fiat and removes barriers of complexity and uncertainty, potentially accelerating crypto adoption among the general populace.

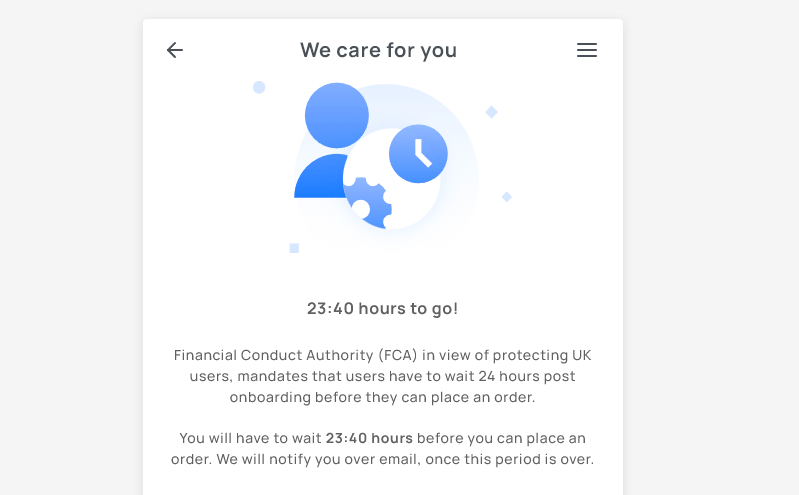

Editor’s Note: I attempted to conduct a transaction to test the process and verify whether there was a 2% spread. I intended to off-ramp $100 worth of MATIC, but this was the screen I was met with after completing the KYC process due to new FCA promotional rules.

The post Non-custodial fiat off-ramp now available in crypto wallets via Visa debit appeared first on CryptoSlate.