Quick Take

Notable financial analysts have corroborated that the recent outflows from Grayscale’s Bitcoin Trust (GBTC), to the tune of $1.6 billion in four days, may signal significant investors’ shifts towards other Bitcoin ETFs.

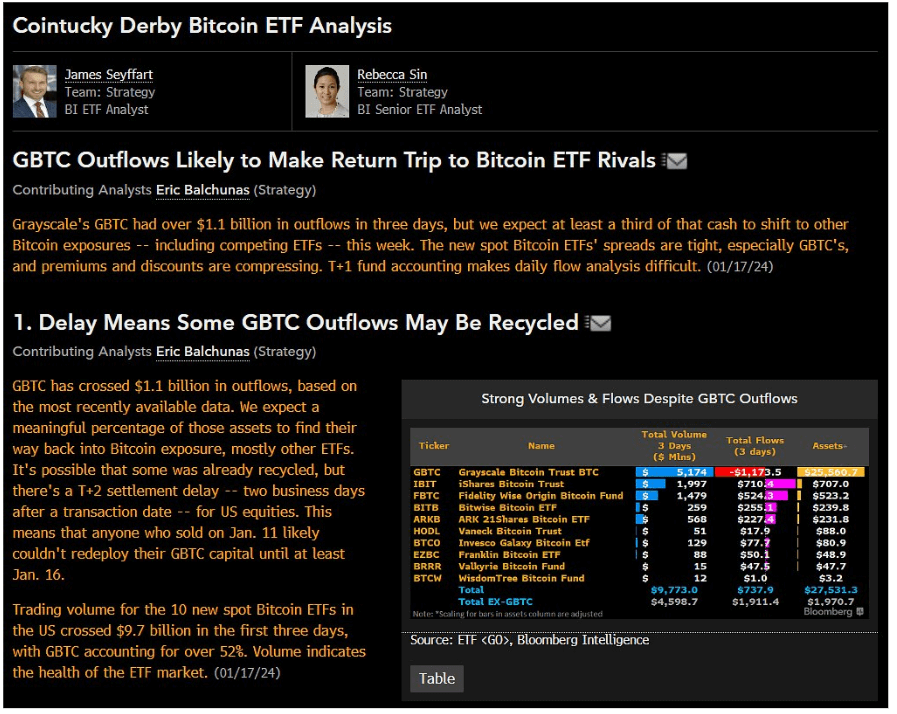

James Seyffart notes that as much as a third of the outflows could transition towards other ETFs and other Bitcoin exposures within the week, primarily due to their tighter spreads compared to GBTC, an advantageous attribute for investors. Furthermore, the complexities of T+1 fund accounting can make these daily flow shifts difficult to track, according to Seyffart.

On a similar note, analyst Blachunas goes a step further to predict that a large chunk of GBTC’s assets will eventually find their way back into other ETFs, although this movement might not be immediately visible due to the T+2 settlement data for US equities, causing a lag in the data. This means that sales from Jan 11, for example, may not reflect until Jan. 16.

Adding to this financial landscape is the fact that the trading volume for the top ten spot ETFs reached $10 billion in the first three days. As of Balchuna’s latest update, the total volume for all ten ETFs is now at $12 billion.

Interestingly, despite the outflows, GBTC accounted for over 52% of that volume, showcasing its still significant role in the market.

The post One-third of GBTC outflows could be redirected to Spot Bitcoin ETFs: Bloomberg Analysts appeared first on CryptoSlate.