The cryptocurrency world is witnessing a familiar sight: a meme coin on fire. PEPE, a token emblazoned with the internet’s favorite frog, has skyrocketed in recent weeks, leaving investors wondering if this is the dawn of a new era or a fleeting fad.

PEPE On A Tear: New Highs And Whale Activity

Over the past month, PEPE has been on a tear, exceeding expectations and leaving a trail of green for investors. The price triumphantly reached a new all-time high, surging over 100% in just 30 days. This astronomical rise translated to happy hodlers, with IntoTheBlock data revealing that a whopping 97% were sitting pretty in profit.

CoinGecko data show that Pepe has risen 56% in the previous week and 99% in the last month, recovering its position as the third-largest meme coin by market capitalization from Dogwifhat (WIF).

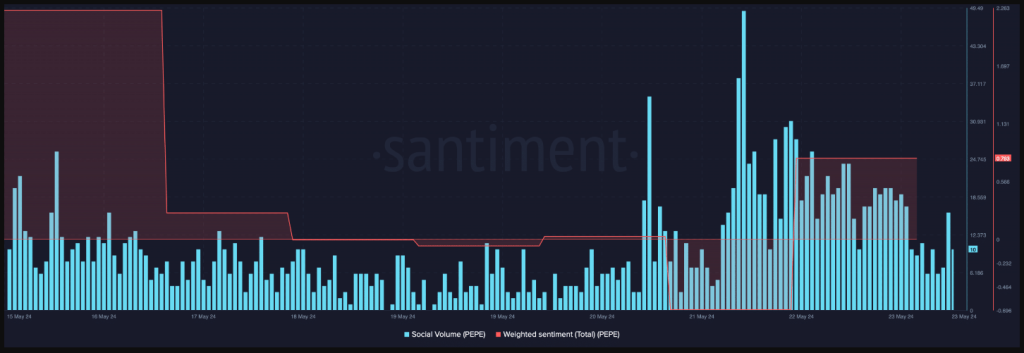

The bullish momentum hasn’t shown any signs of slowing down. The past 24 hours saw another surge of 3.7%, further propelling PEPE to its current peak. This impressive performance has garnered significant attention, not just financially, but also on social media. The coin’s social volume has spiked, indicating a surge in interest and online chatter.

Adding fuel to the fire, a whale, a term used for large investors with significant buying power, has been making waves. Lookonchain, a blockchain analytics platform, recently reported a whale withdrawing a staggering 500 billion PEPE from Binance, a major cryptocurrency exchange. This mass accumulation suggests a whale-sized vote of confidence in PEPE’s future.

Buying Frenzy Or Overheated Engine?

While the recent price increase and social media buzz are undoubtedly positive signs, some analysts are urging caution. A closer look at technical indicators reveals potential signs of an overheated market. The Chaikin Money Flow (CMF), which measures buying and selling pressure, has registered a decline.

Similarly, the Money Flow Index (MFI) and Relative Strength Index (RSI) are both hovering in the overbought zone, suggesting PEPE’s price might be due for a correction.

Further complicating the picture is the presence of selling pressure. While some investors are piling in, others might be cashing out on their profits. Santiment, a crypto analytics platform, observed a rise in PEPE’s exchange outflow last week, indicating buying pressure. However, they also noted an increase in supply on exchanges, suggesting some investors might be taking advantage of the high price to sell.

Potential Price Correction

NewsBTC analyzed PEPE’s daily chart to gauge the impact of this potential selling pressure. Their analysis suggests that the price might first fall to $0.0000122 before potentially finding support and initiating another bull run. However, a deeper correction could see PEPE plummet to $0.000010 or even lower.

The Most Traded Memecoin

Meanhwhile, Pepe was still among the most traded cryptocurrency assets over the previous day, according to data from Binance, with only BNB Coin (BNB), Bitcoin (BTC), and Ethereum (ETH) surpassing it.

Pepe continues to be the most traded meme coin, surpassing popular coins such as Dogecoin (DOGE), Floki (FLOKI), and Shiba Inu (SHIB).

Featured image from ART street, chart from TradingView