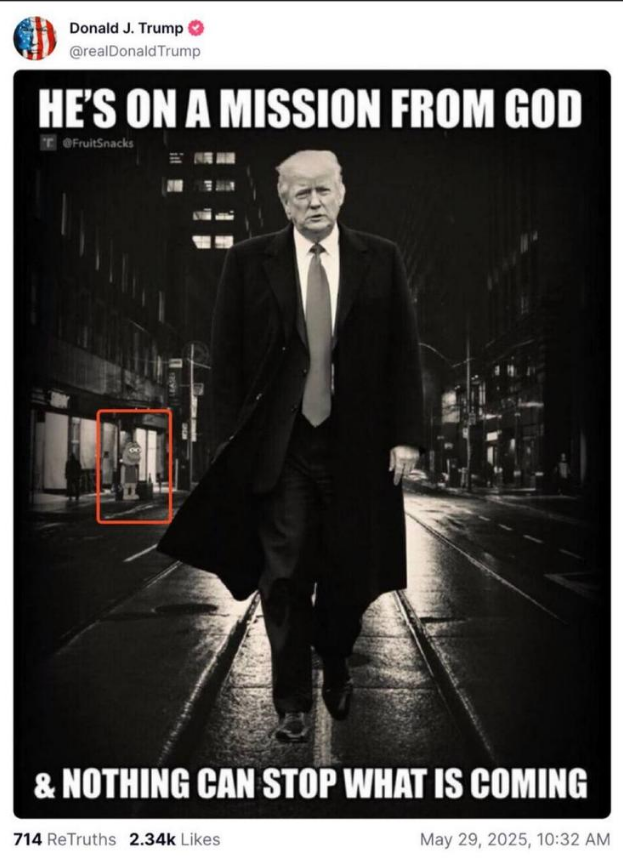

US President Donald Trump’s brief post on Truth Social on May 29 sparked a quick burst of excitement among crypto traders. Based on reports, some users saw a hidden reference to the Pepe meme coin (PEPE).

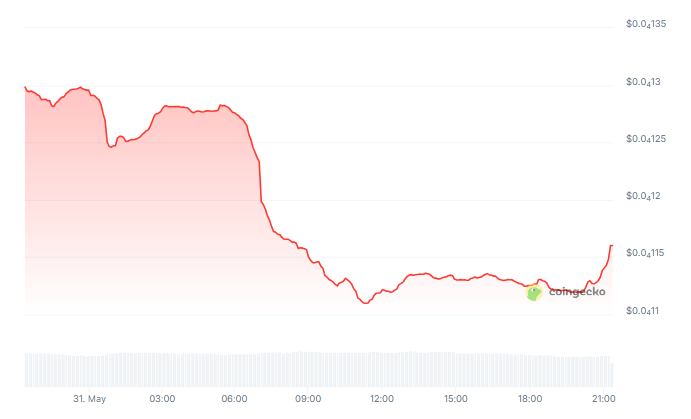

In the next few hours, PEPE shot up by 5% but then fell back by 15%. Traders are now watching to see if this social push can do what Elon Musk once did for Dogecoin.

Pepe Price Moves

According to market data, PEPE’s price hit its upper resistance after the Trump post. A short surge brought a 5% gain. Then profit-taking and wider market pressure drove an 18% correction.

The flip in momentum shows how fast things can change in meme-coin land. A small tweet or post can send prices soaring, but it only takes a bit of selling to push them down again.

Wait, what Trump just dropped a $PEPE pic on Truth Social

Is this a secret crypto endorsement or just trolling the internet?

Either way the $PEPE rocket might just have a new co-pilot.

What’s next a $PEPE rally or a Twitter melt down Stay tuned

pic.twitter.com/cu8RF7D55b

— Josh Mair (@WizzOfCrypto) May 29, 2025

On Drama & Speculation

Trump’s message saying he’s “on a mission from God” makes him sound like he has a special purpose, not just a political goal. The dark street scene and the words “nothing can stop what is coming” hint that something big is coming, even if he doesn’t explain it. This kind of talk can fire up his most loyal supporters – especially PEPE aficionados – because it feels dramatic and urgent.

Chart Patterns In Focus

Based on reports from chart watchers, PEPE appears to be forming a cup-and-handle pattern that began about five months ago. If the coin breaks above the handle, some say it could reach $0.000026—double its current level.

Right now, the MACD line sits below the signal line after a recent death cross, hinting at a near-term downtrend. The RSI has dipped toward 52 and may cross below it soon, which could keep sellers in control.

The 0.618 Fibonacci retracement level sits at $0.00001 and could act as a bounce point. If that level gives way, traders will look at $0.000008 as the next support.

Tariff Ruling Adds Pressure

Based on US Court of International Trade filings, the court reversed Trump’s tariff suspensions right around the same time that PEPE spiked. That move seems to have dampened the market’s risk-on mood.

For many traders, broader trade news can be a bigger factor than any single tweet. If traders worry about tariffs and slower growth, they often sell off riskier assets like meme coins. That mix of social hype and market worry helped push PEPE down after its brief rally.

Looking Ahead For Traders

Based on this mix of social buzz and chart signals, it’ll take more than a hint in a post to keep PEPE climbing. If the coin can break above its current resistance by mid-June, $0.000026 seems to be the main target.

But a falling MACD and RSI point toward more selling pressure first. Traders should watch the 0.618 level at $0.00001 for signs of a bounce. If that level breaks, they’ll likely aim for $0.000008 next.

Featured image from Inverse, chart from TradingView