Polymarket, the predictions market on Polygon, is drawing global attention. Not only is it among the most active dapps without their token, but it is also closely being monitored by pollsters tracking the ongoing presidential campaign in the United States.

In the hotly contested campaign, the current vice president, Kamala Harris, is battling with Donald Trump. The former president lost to Joe Biden in 2020 but now wants to take over.

Is Polymarket Misleading Punters?

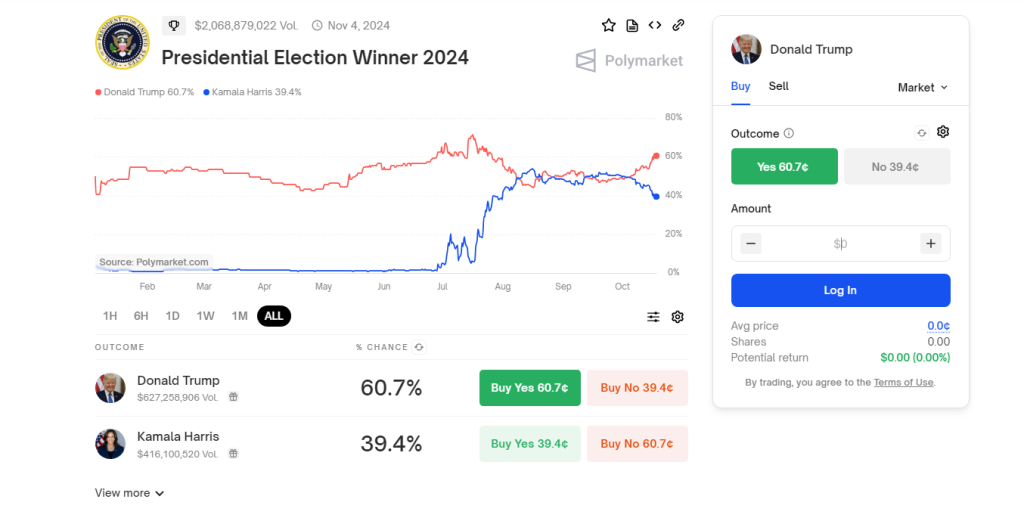

Looking at Polymarket, Trump has extended his lead over the past few days. Punters place the probability of Donald Trump winning at 61% versus 39% for Harris.

Interestingly, the Presidential Election Winner 2024 market has an overall volume of over $2 billion. As big as this may appear, one analyst thinks Polymarket is misleading people and doesn’t want to reveal the true open interest.

Open interest is the total number of outstanding contracts in Polymarket’s numerous markets. This metric is used as a gauge to measure liquidity and interest.

By the analyst’s estimation, its open interest stands at around $200 million, rising from around $100 million in the past 30 days. Cycling over to DeFiLlama, the portal has a total value locked (TVL) of just $211 million—and this is what the dapps manage, including all other active markets.

This figure is far less than the $2 billion in volume the Presidential Election Winner 2024 posts as of October 18. At over $211 million, the Polymarket TVL is at near all-time highs, rising from less than $50 million in April. Despite this rapid growth, the prediction market’s liquidity is not as deep as expected.

Transparency Questions Emerge

The analyst who pointed out this discrepancy is blasting Polymarket developers for fronting volume rather than open interest, saying it is unethical. This highlight points to a possible low emphasis on transparency that may, in the end, make it difficult for users to manage risks when placing bets on Polymarket accurately.

Americans will go to the polls on November 4 and choose their next president now that Joe Biden is stepping down. Afterward, the largest Polymarket market running on Polygon will close down, and rewards will be distributed depending on who wins.

So far, a punter, “markitzero” backing Harris to win has over 4.5million shares and is in red. Meanwhile, a Trump supporter, “Fredi9999” controls over 20.2 market shares and is currently in the money.