Quick Take

Grayscale’s Bitcoin Trust (GBTC) is experiencing a notable flow shift driven by positive Bitcoin price movements. This shift contrasts with earlier this year when even favorable Bitcoin price action failed to curb GBTC outflows. Since the launch of US Bitcoin ETFs, which collectively amassed $14 billion in inflows, BlackRock’s IBIT has surpassed Grayscale’s GBTC in BTC holdings. Initially holding 619,000 BTC, GBTC now retains 285,081 BTC, while IBIT holds 291,563 BTC, according to heyapollo data.

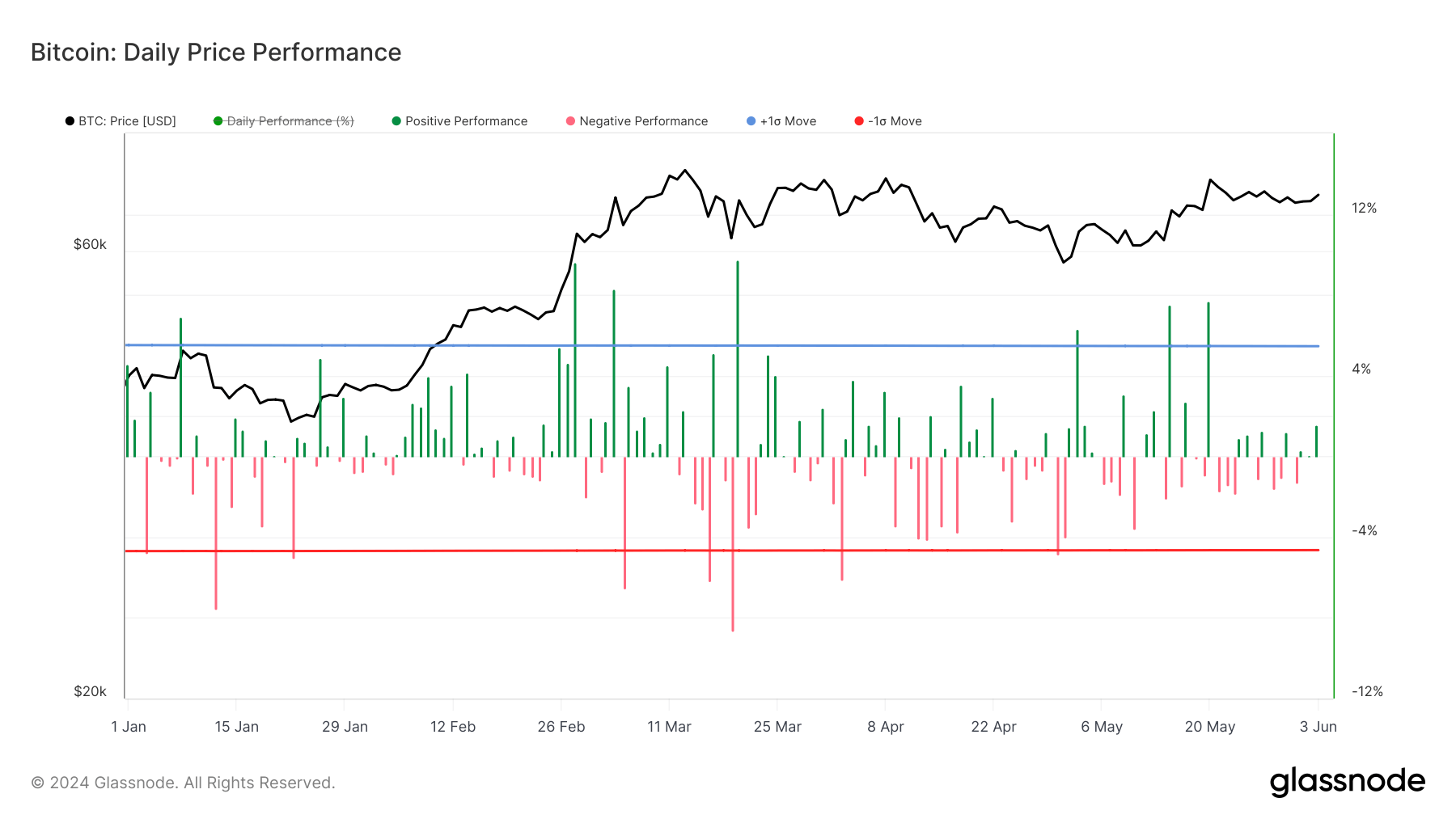

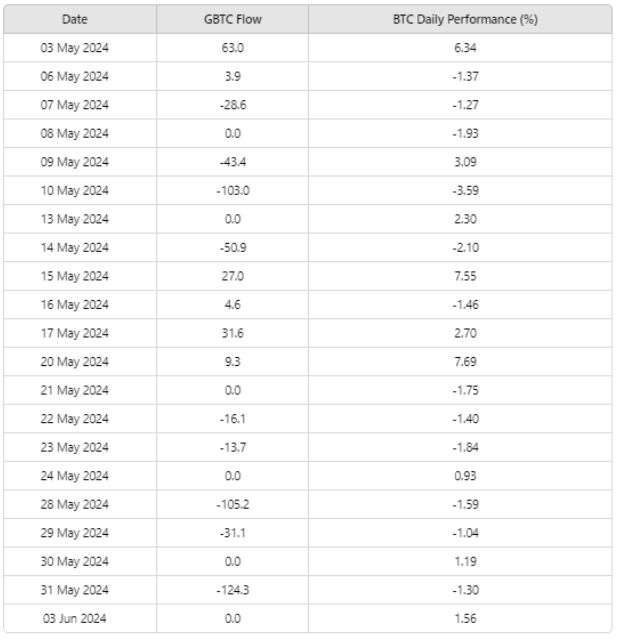

Between Jan. 11 and May 2, GBTC experienced 109 consecutive trading days of outflows. However, the trend began reversing in May. On May 3, GBTC recorded a $63 million inflow alongside a 6.34% BTC price increase. This was followed by a $27 million inflow and an 8% BTC surge on May 15, a $31.6 million inflow with a 2.70% BTC rise on May 17, and a $9.3 million inflow as BTC jumped 7.69% on May 20. These instances highlight how positive Bitcoin price action now influences GBTC inflows, a significant departure from previous patterns.

Furthermore, there have been six days with no GBTC inflows or outflows, which largely coincided with positive Bitcoin price performance, underscoring a stabilizing trend. This evolving dynamic indicates a strengthened correlation between Bitcoin’s market performance and GBTC’s investment flows, signaling a potential shift in investor sentiment and strategy.

The post Positive Bitcoin price action drives renewed interest in Grayscale’s GBTC appeared first on CryptoSlate.