Ethereum is holding strong above the $2,500 mark after a volatile two-week stretch marked by heavy resistance and indecisive price action. While bulls have successfully defended key support levels, ETH continues to struggle against the supply wall just below $2,800. The broader crypto market mirrors this sideways trend, with Bitcoin and total market cap also trapped within tight ranges, limiting bullish momentum across the board.

Analysts are growing optimistic about the potential for an altseason — but only if Ethereum can convincingly reclaim the $3,000 level. A decisive breakout above that mark would signal renewed strength and likely spark a broader rally in altcoins, many of which have lagged behind in recent weeks.

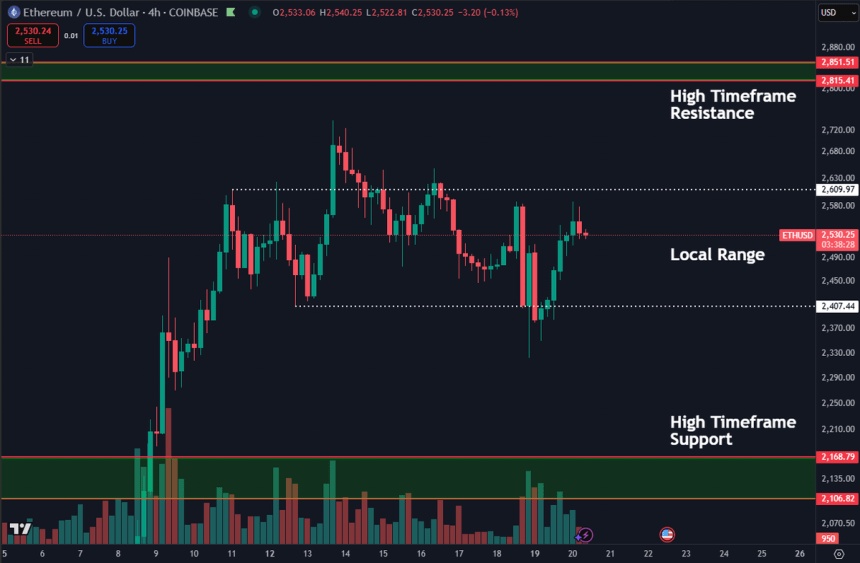

Top analyst Daan shared a technical breakdown, noting that Ethereum’s price action has been volatile over the past two weeks. He emphasized that ETH is currently range-bound, much like BTC and the rest of the crypto market. Until there’s a clear breakout from this local structure, traders remain cautious.

Ethereum Bulls Hold Structure But Momentum Cools

Ethereum bulls gained traction earlier this month when the price surged above the $2,200 level with ease, establishing a bullish structure for the first time in weeks. Momentum accelerated quickly, with ETH breaking through $2,550 on Sunday before retracing just as fast into the $2,400 zone. The rapid up-and-down action highlights the current uncertainty in the market, where investors remain cautious despite recent strength.

The Sunday pullback added weight to analyst warnings that Ethereum could face short-term selling pressure before confirming the next leg up. While many remain bullish on ETH’s medium-term trajectory, they acknowledge that momentum has cooled and the market is pausing to reassess.

Daan provided insights into Ethereum’s behavior, describing the price action as “pretty messy” over the past two weeks. He pointed out that ETH, like Bitcoin and the broader crypto market cap, is currently trapped in a tight range. According to Daan, he’s “not looking to do much until we at least convincingly break out of this local range.”

The defined range sits between $2,100 (key support) and $2,800 (major resistance). If Ethereum holds above current levels and pushes past $2,800, it could trigger a fresh wave of bullish momentum. Until then, consolidation may persist.

ETH Consolidates Below Resistance As Bulls Hold The Line

Ethereum (ETH) is currently trading at $2,539 after a volatile week marked by strong bullish attempts and growing resistance pressure. The daily chart shows ETH attempting to hold above the 200-day EMA ($2,440.71), which has now turned into a short-term support zone. Meanwhile, the 200-day SMA sits higher at $2,701.31, acting as a key resistance level Ethereum must overcome to confirm a sustained rally.

After a sharp rally in early May that propelled ETH from under $2,000 to above $2,700, the price has entered a period of consolidation. This pause comes after multiple failed attempts to break and hold above the $2,700 resistance, just under the 200SMA. Volume has decreased, and the recent price action suggests a battle between bulls trying to defend the $2,500 level and bears pressing to cap upside moves.

The bullish structure remains intact as long as ETH stays above the 200EMA and within the $2,400–$2,600 range. However, a failure to maintain current support could expose Ethereum to a deeper retracement toward $2,200. For bulls, reclaiming $2,700 is essential to unlock the next leg higher toward the psychological $3,000 level. Until then, traders should expect choppy price action and tightening volatility.

Featured image from Dall-E, chart from TradingView