The governor of India’s central bank, the Reserve Bank of India (RBI), has reiterated his concerns that cryptocurrency is a “big threat” to the country’s financial and macroeconomic stability. He also warned investors of the risks of investing in crypto, stating this type of investment has no underlying value.

RBI’s Multiple Concerns About Crypto

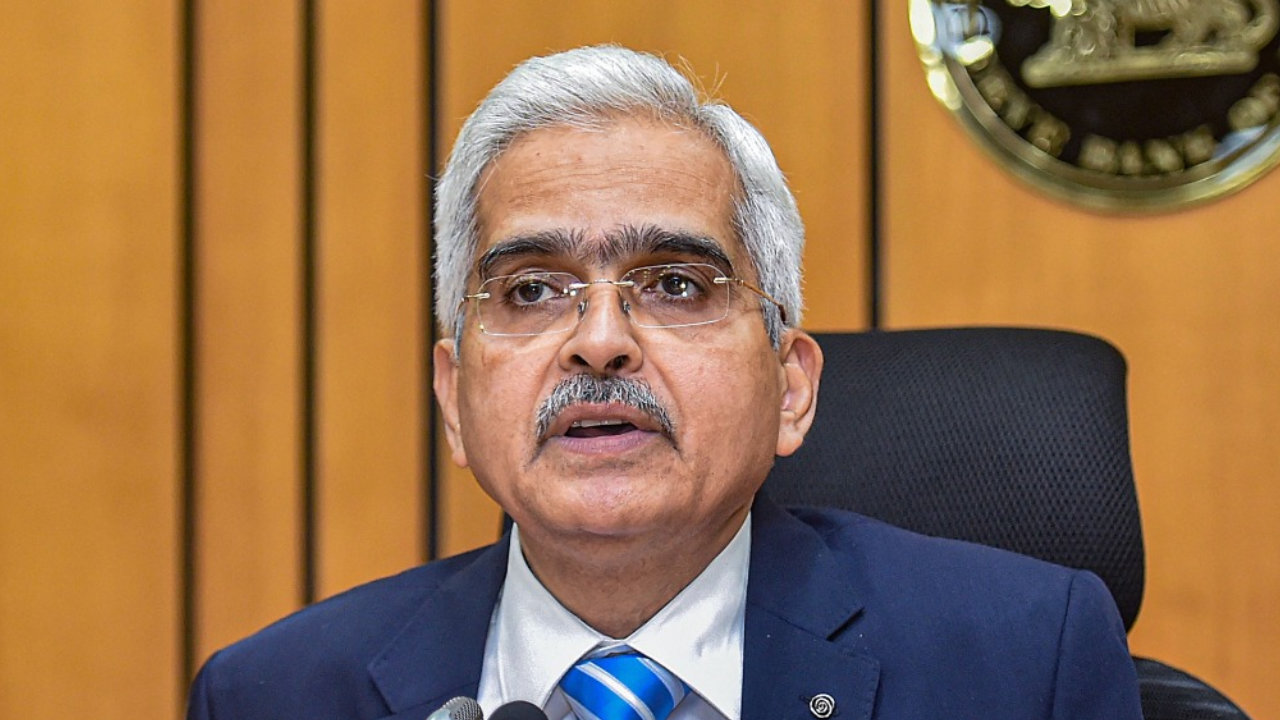

Reserve Bank of India (RBI) Governor Shaktikanta Das said during a press conference Thursday that cryptocurrency is a major threat to India’s macroeconomic and financial stability.

Referring to any crypto not backed by the central bank as “private cryptocurrency,” Governor Das was quoted by local media as saying:

Private cryptocurrency, or whatever name you call, is a big threat to our macroeconomic stability and financial stability.

He explained that any cryptocurrencies with currency-like property will undermine the RBI’s ability to deal with financial and macroeconomic stability issues.

The central bank governor proceeded to warn investors about the risks of investing in cryptocurrencies. Referring to the Dutch tulip bulb market bubble in the 17th century, he cautioned:

Investors in cryptocurrency should keep in mind that they are investing at their own risk. They should also keep in mind that the cryptocurrency has no underlying, not even a tulip.

Das noted that the RBI’s position is very clear on crypto. He said in early January that cryptocurrencies are “prone to fraud and to extreme price volatility, given their highly speculative nature.” The governor stressed: “Long-term concerns relate to capital flow management, financial and economic stability, monetary policy transmission, and currency substitution.”

In December last year, the RBI urged the Indian government to completely ban cryptocurrency, stating that a partial ban will not work. However, the government is still consulting with various stakeholders to come up with an appropriate crypto policy.

Meanwhile, the RBI is working on a central bank digital currency (CBDC), the digital rupee. India’s finance minister, Nirmala Sitharaman, announced last week during her budget speech that the digital rupee will be issued in the financial year 2022-23.

What do you think about the comments by the RBI governor? Let us know in the comments section below.