The governance token of Render has been performing poorly in the past few days as the bears took control of the market.

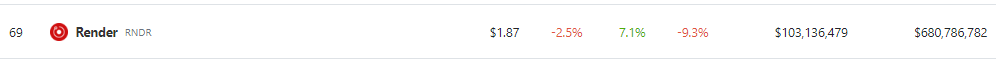

According to CoinGecko, RNDR is down 7% in the past 24 hours, indicating that the general market downturn affected its upward momentum. However, external developments might help a bullish scenario to form.

In the case of Render, its entry to the AI space earlier this year will inevitably help the token reverse the bearishness surrounding the crypto market.

Stable Diffusion is LIVE on the #RNDR site!

@ProTharan‘s awesome thread shows you how you can give it a try!

This is definitely a game-changer for the way AI technology will be used and deployed in the coming years! @RenderToken & @StabilityAI

https://t.co/ytHk7jth9M

— Render Network | RNDR (@RenderToken) April 17, 2023

Big Tech Invests In Blockchain and AI – Here’s What We Know

The new wave of AI announcements by corporate heavyweights may help revive prices of AI-based crypto assets like Render, SingularityNET, and Fetch.ai.

Recently, tech giant Microsoft experienced a bout of bullishness a few months after announcing its $10 billion investment in OpenAI, the creator of the popular AI tool, ChatGPT.

This was part of Microsoft’s expansion into the artificial intelligence industry, with the company releasing an AI chatbot for Bing, its in-house search engine.

Microsoft is also planning to enter the crypto industry along with major players in the finance space. Bitcoinist has reported yesterday that Goldman Sachs, Microsoft, and Deloitte are partnering up for a major blockchain partnership. Over 30 other companies will participate in this project set to be launched later this year.

Recent announcements from major US corporations including Meta, Humane, IBM, and Wendy’s have also bolstered the narrative surrounding AI tokens.

If these innovative endeavors prove to be successful, the realm of AI on Render stands poised to undergo a profound transformation, whereby the emergence of AI-generated media, with its strikingly realistic and captivating attributes, shall undeniably become increasingly prevalent over the course of time.

Render’s Foray Into AI Positions It For Long-Term Success

While the impact of major corporations investing in blockchain and AI technology can be observed, the financial market is currently grappling with challenges.

The US economy is approaching a potential default on its loans, leading some investors to anticipate a dampening of market sentiment due to forthcoming consumer price index data.

At the time of writing, the bears have temporarily broken through the $1.76 support level. However, the bulls are picking up the slack, but short buyers still dominate the market by a small margin.

However, investors and traders can find reassurance in the Render Network’s underlying fundamentals, which are poised to shape a bullish outlook.

With its venture into the AI realm and its utility in media creation, RNDR is poised to gain a significant advantage in the long term. However, on a broader scale, if the CPI data enters negative territory, the token might encounter additional market challenges.

-Featured image from Invezz