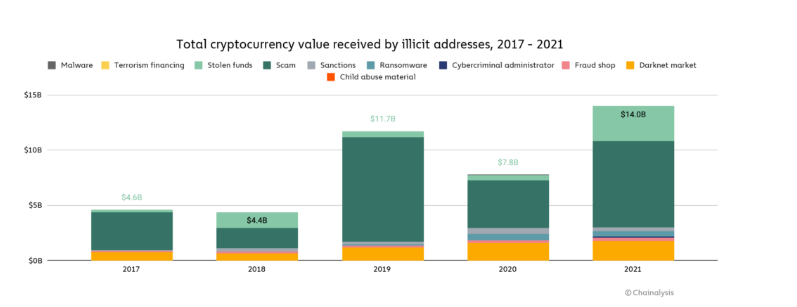

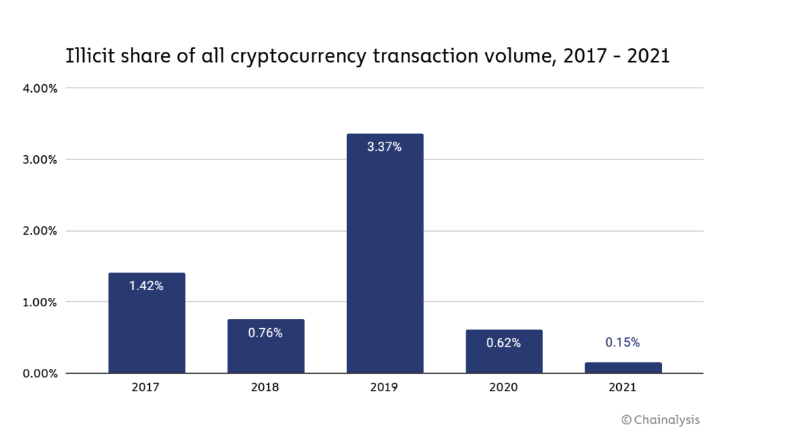

According to the latest data from Chainalysis, the total cryptocurrency value received by illicit addresses grew to a new all-time high of $14 billion in 2021. Although the new all-time high is almost twice the $7.8 billion that was recorded in 2020, it represents just 0.15% of the 2021 cryptocurrency transaction volume.

Percentage of Funds Sent to Illicit Addresses Falling

The value of cryptocurrency-related crimes recorded in 2021 surged to a new all-time high of $14 billion, a figure that is almost double the $7.8 billion which was received by so-called illicit addresses in the year 2020. Nevertheless, this increase in the value of funds transferred to illicit addresses is still much lower than the average growth of the crypto economy, the latest Chainalysis data has shown.

In a recent blog post breaking down the crypto economy’s 2021 transaction volume of $15.8 trillion, the blockchain analysis firm Chainalysis asserts that the growth in value of funds transferred to illicit addresses is not an indication that the space is now dominated by criminals. Rather, this growth may be a hint of just how far the crypto economy has expanded in 12 months.

To illustrate, the blog post points to the 567% growth in crypto transaction volume which the analysis firm is linking to the rising adoption of cryptocurrencies. Chainalysis also offers its viewpoint on the growing gap between illicit activity volume and legitimate volume:

In fact, with the growth of legitimate cryptocurrency usage far outpacing the growth of criminal usage, illicit activity’s share of cryptocurrency transaction volume has never been lower.

Crypto Crime Impedes Adoption

To support its position that illicit activity’s share of cryptocurrency transaction volume is on the wane, Chainalysis points to the data which shows that crime-related addresses only accounted for 0.15% of 2021 volumes. This figure is lower than the 0.62% recorded in 2020 and the 3.37% that was recorded in 2019.

Despite noting the low proportion of criminal crypto transfers relative to the overall transaction volumes, Chainalysis still concedes the “criminal abuse of cryptocurrency creates huge impediments for continued adoption.” The post argues that such abuse often “heightens the likelihood of restrictions being imposed by governments, and worst of all victimizes innocent people around the world.”

The blog post also suggested that law enforcement agencies are becoming more adept at combating cryptocurrency-based crimes. It cites the indictment of several crypto investment scams by the U.S. Commodity Futures Trading Commission (CFTC) as well as OFAC’s sanctioning of two Russia-based cryptocurrency platforms.

What are your thoughts on this story? Tell us what you think in the comments section below.