The cryptocurrency industry has experienced a significant downturn in the last 18 months due to concerns about high inflation and its impact on finances. However, there is evidence of increasing institutional adoption of Bitcoin (BTC) amid these challenging market conditions.

Adoption Of Bitcoin Among Top Fintech Companies

Prominent fintech companies have amassed substantial amounts of BTC over the past three years, as revealed by a recent report. Notably, Microstrategy’s BTC purchases amount to nearly $4 billion, despite the current BTC price being 55% lower than its all-time high (ATH). Other notable companies like Tesla, Block (formerly Square), and Galaxy Digital Holding have also demonstrated commitment to retaining their Bitcoin holdings despite the market’s inherent volatility.

The report also highlights that certain regulatory uncertainties have hindered some top companies from adopting Bitcoin. But nevertheless, recent filings by renowned asset management firms indicate a positive sentiment towards this digital gold, reflecting a bullish momentum.

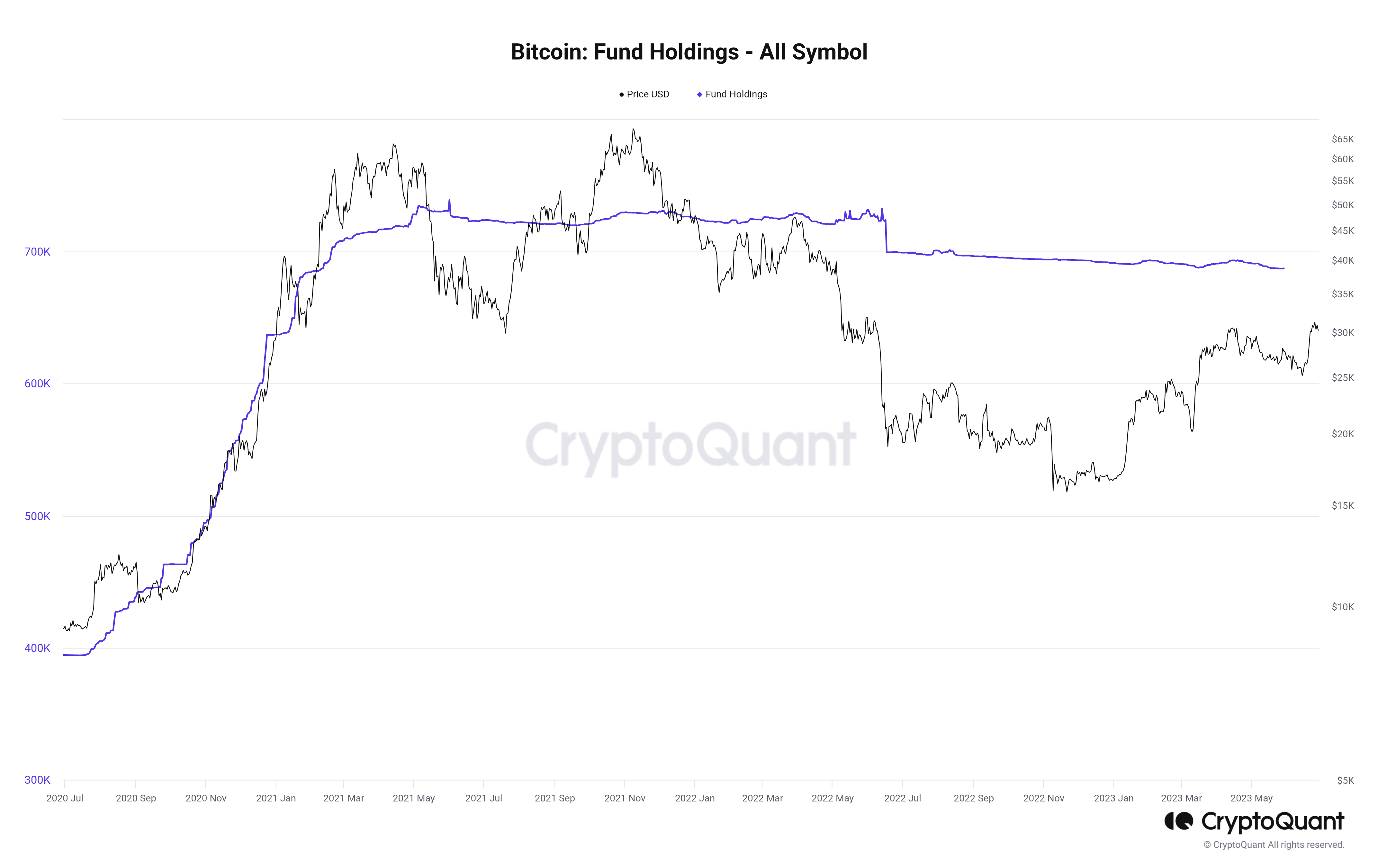

CryptoQuant chart shows that the forthcoming wave of institutional adoption of BTC may not only benefit the companies themselves but also have a significant impact on their clients.

Spot Bitcoin ETFs Generate Investor Interest

The embrace of Bitcoin’s futures exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) in late 2021 triggered the entry of major players into the digital asset industry, leading others to push forward and file for Spot Bitcoin ETFs.

Esteemed companies such as BlackRock, Fidelity, Citadel, Charles Schwab, and even Nasdaq have entered the fray. As financial experts analyze the situation, they offer valuable advice to investors seeking to capitalize on this evolving landscape.

On Wednesday, the price of bitcoin surpassed the $30,000 mark, driven by growing optimism surrounding spot BTC ETF applications submitted by industry giants like BlackRock, WisdomTree, and Valkyrie.

However, while BTC has witnessed a remarkable 80% surge in value in 2023, it still remains more than 50% below its peak in November 2021.

Presently, US investors have access to bitcoin futures ETFs, which involve investing in futures contracts of BTC—agreements to buy or sell the asset at a predetermined price in the future. But the long-awaited introduction of bitcoin spot ETFs would enable direct investment in the digital currency itself, marking a significant development in the market.

Considerations For Investors Amid Prospects Of BTC Spot ETFs

The potential introduction of a bitcoin spot exchange-traded fund (ETF) has raised expectations for increased accessibility to the digital currency, enabling investors to buy and sell bitcoin through a brokerage account. However, it is important to approach this development with caution and thorough consideration, as emphasized by financial experts.

While the prospect of easier access may be enticing, it is essential to exercise prudence and avoid rushing into investments without proper evaluation.