In the XRP lawsuit, Ripple has filed its opposition to the US Securities and Exchange Commission’s (SEC) motion for remedies and entry of final judgment. The fintech company counters the agency’s for nearly $2 billion in penalties with a proposed fine of just $10 million maximum. Filed late Monday, Ripple’s 186-page opposition document details its arguments against the SEC’s severe demands following a court ruling that found Ripple in violation of securities laws by selling XRP to institutional investors without proper registration.

Ripple Vs. SEC: $10 Million Or $2 Billion?

Ripple begins by acknowledging the violation, affirming its recognition of the court’s decision and detailing its compliance adjustments. “Ripple has publicly acknowledged that ruling, and does so again now. It has changed the way it sells XRP and changed its contracts to avoid the problems identified by this Court,” the document states. This acknowledgment is crucial as it sets the stage for the company’s argument that no further punitive measures, such as an injunction, are necessary.

The company strongly opposes the SEC’s proposed injunction, arguing that it has already implemented significant changes to prevent future violations. A key passage from the document asserts, “The SEC fails to establish a reasonable likelihood of future violations.” This argument is built on the premise that Ripple’s proactive remedial measures effectively mitigate the risk of repeating the past missteps.

Addressing the SEC’s demand for disgorgement, the fintech company contends that the request is unwarranted because the SEC has not demonstrated that Ripple’s actions caused any pecuniary harm to investors. The opposition states, “The SEC fails to show that any disgorgement is warranted. Govil bars disgorgement because the SEC cannot show pecuniary harm.” This point is critical in Ripple’s defense, emphasizing the lack of direct financial damage to investors as a result of its actions.

Regarding civil penalties, Ripple argues for a significantly reduced amount, citing the disproportionality of the SEC’s request compared to penalties in similar cases. “ANY CIVIL PENALTY SHOULD NOT EXCEED $10 MILLION,” the document states, suggesting that such a figure is more in line with precedent and the nature of the violations.

Legal precedents play a significant role in the defense, with numerous citations intended to bolster its position against harsh penalties. One such precedent is Arthur Lipper Corp. v. SEC, which the company uses to argue against the necessity of an injunction. The document notes that an injunction serves to “prevent threatened future harm” and requires “positive proof of a reasonable likelihood that past wrongdoing will recur,” something Ripple contends is not present given its corrective actions.

Reactions From The XRP Lawyer Community

Reactions from the pro-XRP legal community reflect a belief in the strength of arguments. Bill Morgan, a notable pro-XRP lawyer, commented on the strength of Ripple’s position against disgorgement, “In summary, I think this argument is correct and disgorgement should not be awarded where it would give investors a windfall. Ripple looks in good shape for Torres to apply Govil and order no disgorgement.”

Additionally, Jeremy Hogan argued via X, “The SEC has BIG legal problems to address if it wants to get a win against Ripple, and I still think it squandered its opportunity to get ahead with its first brief.”

James “MetaLawMan” Murphy explained what to expect next. According to him, Judge Torres has not set a deadline for a decision. “But, I would expect that this decision will come substantially quicker than the summary judgment rulings. Best guess would be 60 to 90 days after the last brief (May 6).”

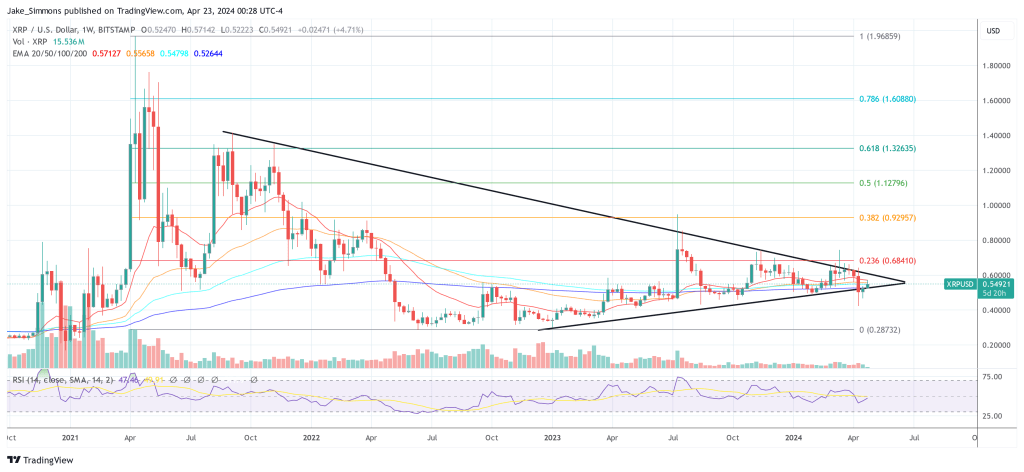

At press time, XRP traded at $0.54921, up 2.5% in the last 24 hours.