Robinhood, a significant player in the United States financial technology sector, has recorded major growth. The platform has seen a notable rise in monthly user inflow.

Robinhood Monthly Deposits Surges To New Height

A correspondent at CNBC, Kate Rooney, recently shared the development with the crypto community on the X (formerly Twitter) platform. The CNBC reporter said Robinhood recorded increased profits in its most recent quarterly results.

Rooney pointed out that the platform is making some headway in its attempt to overtake established “brokerage companies” for market dominance. Additionally, Robinhood aims to expand beyond its “original base of inexperienced and younger traders” in the crypto market.

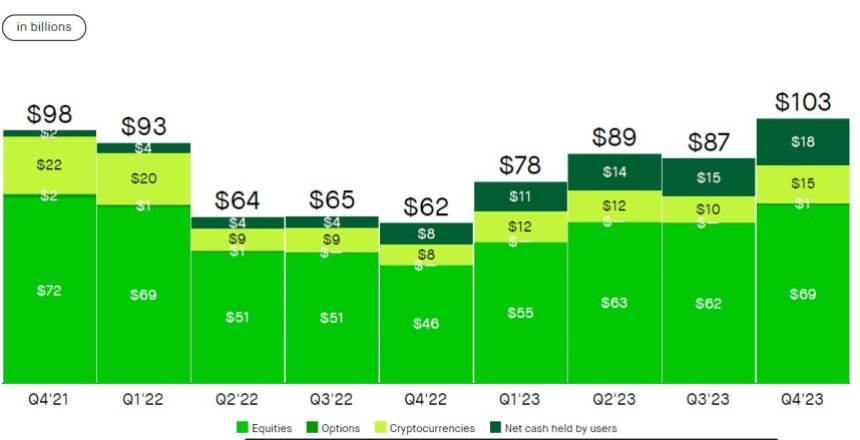

She further highlighted that over $100 billion of the firm’s assets are currently “under custody.” In addition, a “net positive transfer from every major brokerage competitor” drove the Q4 deposits to approximately $4.6 billion.

Consequently, this suggests its increasing popularity among investors looking to include digital assets in their portfolios for diversification. It also indicates the growing confidence and inclination toward the trading firm among crypto investors.

The CNBC correspondent asserted that the numbers above consist of an “average customer transfer balance” of $100,000.

As per Rooney’s X post, Robinhood saw a substantial rise in monthly deposits valued at $4 billion in January. So far, the recent uptick signifies the online trading platform’s strongest month since early 2021.

During the same quarter last year, the trading platform lost $166 million, or $0.19 per share. However, this year, it made a profit of $30 million, or $0.3 per share.

As was revealed, Robinhood’s income rose due to increased net interest and transaction-based and other revenue streams. Over the three months, its net interest income grew by 4% to $236 million.

Taking Over The Active Trader Market

Vlad Tenev, Robinhood’s Chief Executive Officer (CEO), has revealed Robinhood’s intentions to take over the active trader market. Tenev recently disclosed this objective during a quarterly earnings call.

He stated that the firm’s user base and revenue have grown “nearly seven times” in the past four years. “looking at what is in front of us, we are excited by the opportunity to continue growing significantly from here,” he added.

Robinhood has gained market share and attracted net asset inflows from its major rivals. According to Tenev, the company will continuously invest in its “user experience on mobile” to achieve its goal.

Currently, the crypto enterprise stands out as the dominant player in market share. Tenev has confirmed the addition of futures and index options to the platform in the coming months of this year.