The on-chain analytics firm Santiment has revealed a Cardano pattern that may have contributed as a trigger for the recent 65% rally in ADA’s price.

Cardano Observed A Sudden Loss Of Wallets Prior To Rally

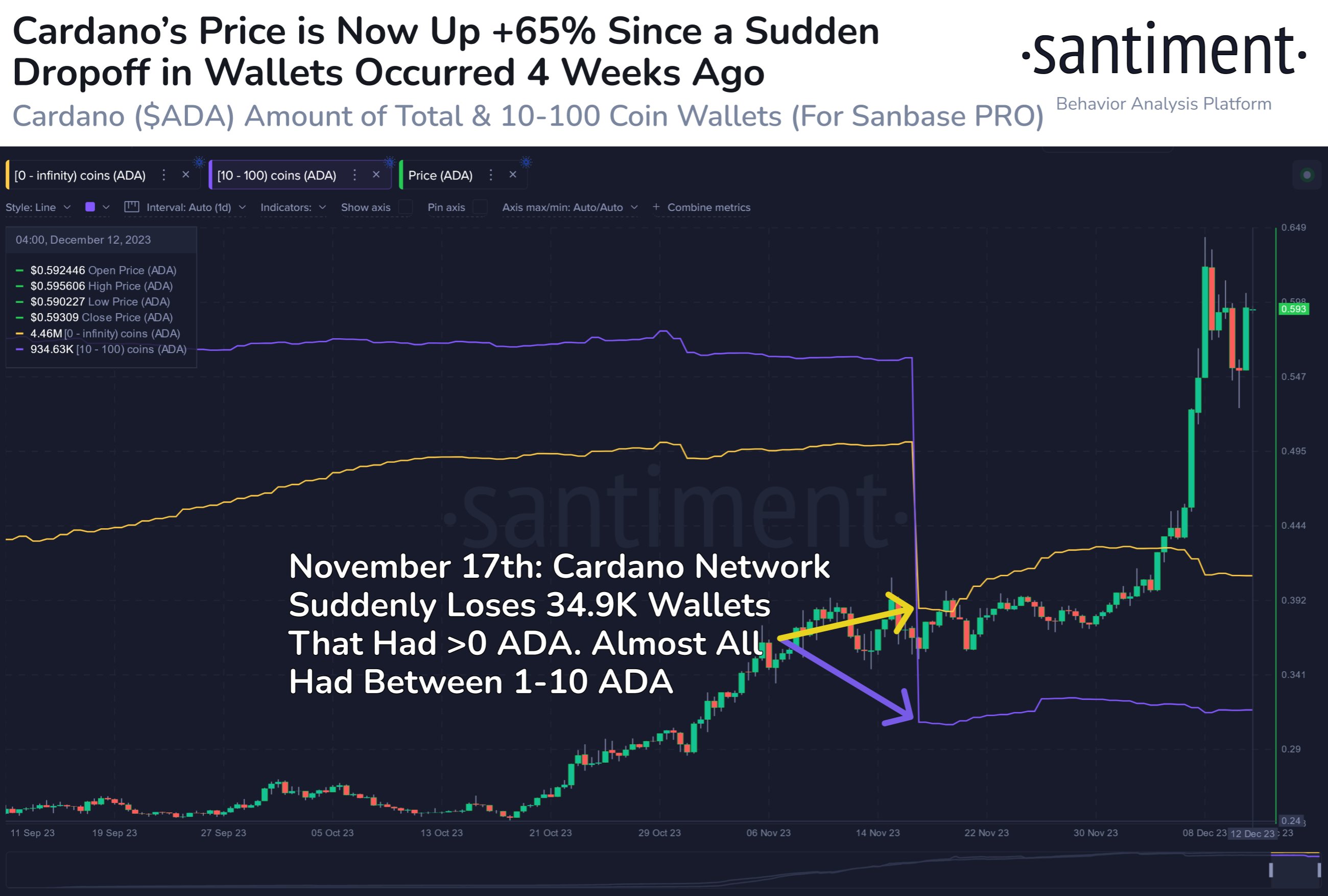

As explained by Santiment in a post on X, ADA witnessed a large number of small wallets clear themselves out last month. The relevant indicator here is the “Supply Distribution,” which keeps track of the total amount of Cardano wallets that belong to the different groups in the market.

The wallets or investors are categorized into these groups based on the number of tokens that they are carrying in their balance. For example, the 1 to 10 coins cohort includes all holders owning at least 1 and at most 10 ADA.

If the Supply Distribution is applied to this group, it would (among other things) total up the number of wallets satisfying this condition right now. In the context of the current discussion, Santiment has discussed about the Supply Distribution of two groups: 10 to 100 coins and 0 to infinity. The second one here is naturally a combination of all the wallet groups in existence, as there is no upper bound.

Now, here is a chart that shows the trend in the indicator for these two Cardano groups over the last few months:

As displayed in the above graph, both of these Cardano groups observed a plunge in their wallet count back on November 17. In total, the addresses carrying some ADA balance dropped by almost 35,000 on this day.

Generally, this kind of mass exit can be a bearish sign for the cryptocurrency, as it indicates a selloff is taking place. However, the finer details about which groups exactly have taken part in such selling can affect the outlook of the asset.

Interestingly, as Santiment has noted, 98.1% of the wallets involved in the aforementioned selloff belonged to the small holders. This would suggest that the larger entities like the sharks and whales only saw a minimal amount of exit during this plunge.

“A drop of addresses this size or smaller often indicates capitulation, and a potential price turning point,” explains the analytics firm. It would appear that the retail investors may have fallen prey to fear and sold off their holdings, which the big money investors potentially scooped up.

Related Reading: Bitcoin Rushes To Exchanges, But This Sign Remains Positive For The Bulls

Since this mass exodus of the small hands, Cardano has rallied around 65%, perhaps suggesting that this pattern may have been one of the contributors behind the surge.

ADA Price

While Cardano kicked off the month with some sustained bullish momentum, the rally has cooled off in the last few days as ADA has observed a notable pullback.

Since the $0.648 local top, the asset’s price has come down almost 11% as it now floats around the $0.577 mark.