The U.S. Securities and Exchange Commission (SEC) alleged that Binance sent a foreign affiliate of stablecoin issuer Paxos nearly $20 billion of commingled funds in 2021, according to a declaration made by Sachin Verma, an Assistant Chief Accountant of the Commission.

In a June 7 court filing, Verma stated that Binance and its CEO Changpeng Zhao controlled several accounts at the defunct Silvergate and Signature Banks, which were used to carry out various transactions that involved Zhao-owned companies.

Merit Peak

The declaration alleges that Binance.US, under the name BAM Trading, and several other Binance-related accounts sent millions of dollars from accounts at Silvergate Bank to a trading firm called Merit Peak Ltd.

Merit Peak is a British Virgin Islands company beneficially owned by Zhao. The filing described the nature of its business as an OTC desk and proprietary trading of digital assets, and Silvergate closed its account in mid-2022.

Nearly $20 billion sent to Paxos’ foreign affiliate

Before the closure of the account, Verma stated that “millions of dollars from Binance-related accounts were commingled in Merit Peak’s accounts” and was later transferred to a foreign affiliate of the stablecoin issuer, Paxos. The official said:

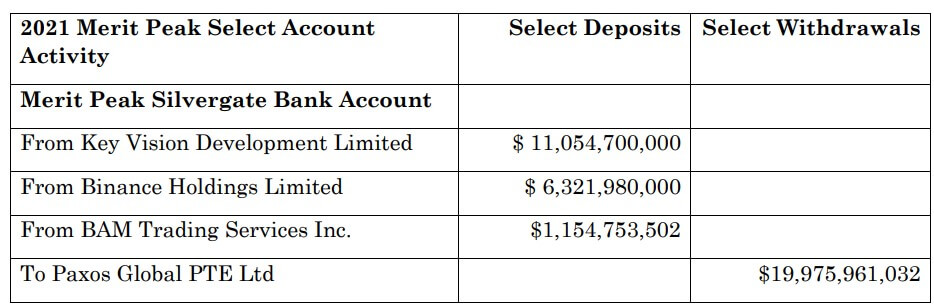

“For example, in 2021, funds from Key Vision ($11.05 billion), Prime Trust ($1.1 billion) (through BAM Trading) and Bifinity UAB ($6.3 billion) (through Binance Holdings Limited) were transferred to Merit Peak and Merit Peak transferred all of that money as part of its transfers of almost $20 billion to a foreign affiliate of Paxos in 2021.”

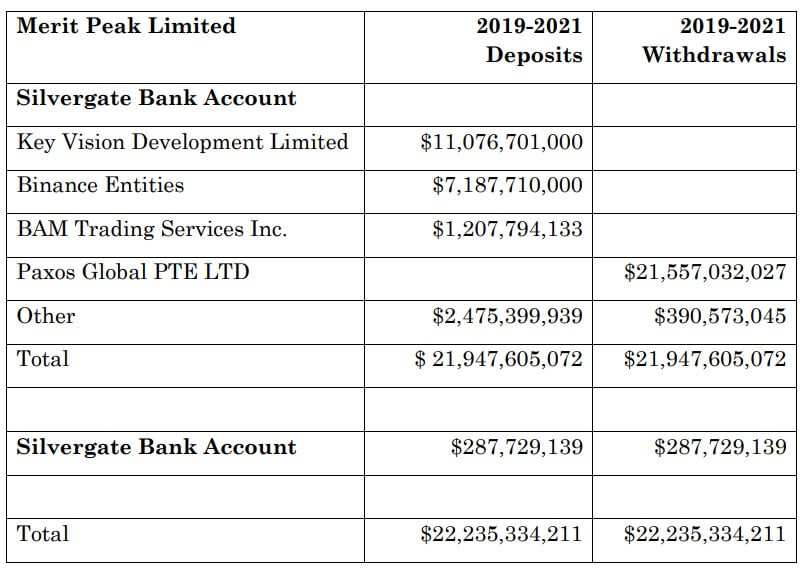

A closer look at the accounts’ transactions between 2019 and 2021 showed that Merit Peak received $22 billion from several Binance-related accounts, including $1.2 billion from Binance US. During this period, the trading firm transferred $21.6 billion to this foreign affiliate of Paxos.

This declaration corroborates previous reports that stated that Binance had commingled users’ funds in bank accounts at Silvergate Bank.

Binance has consistently maintained that the reports were false but was yet to respond to CryptoSlate’s request for additional commentary as of press time.

Meanwhile, Paxos is the issuer of Binance USD (BUSD) stablecoin. In February, New York regulators ordered the stablecoin issuer to stop other mints of BUSD. Binance and Paxos have also rejected the SEC’s classification of BUSD as a security.

Paxos has not responded to CryptoSlate’s request for comment as of press time.

The post SEC alleges Binance sent Paxos nearly $20B in commingled funds via Merit Peak in 2021 appeared first on CryptoSlate.