In a highly anticipated court hearing on January 17, the ongoing legal battle between the US Securities and Exchange Commission (SEC) and Coinbase, the US-based cryptocurrency exchange, took a dramatic turn.

Coinbase argued that the tokens traded on its platform should not be considered securities, which could positively impact the entire crypto community if the case turns out to be a win for the exchange.

Judge Shows Favorable Leanings Towards Coinbase

As reported by Bitcoinist, the SEC filed a lawsuit against Coinbase in June, alleging that the exchange facilitated trading of several crypto tokens that should have been registered as securities.

The SEC accused Coinbase of operating illegally as a national securities exchange, broker, and clearing agency without registering with the regulatory body. The SEC specifically targeted Coinbase’s “staking” program, which allows users to pool assets to verify activity on blockchain networks and receive rewards.

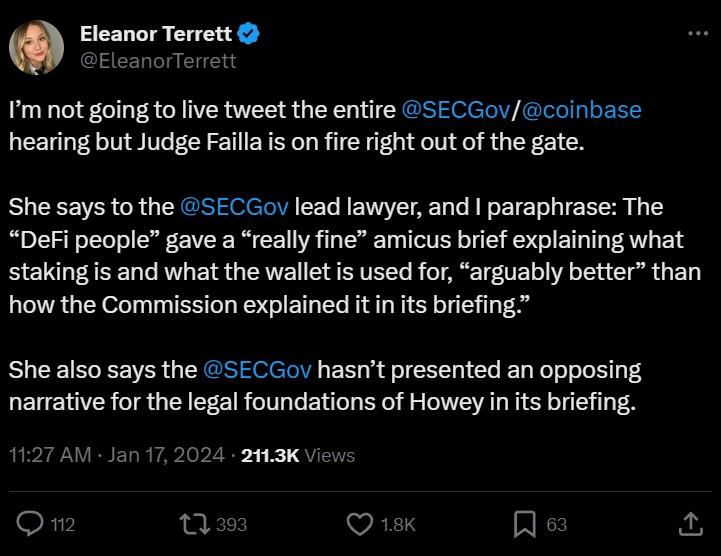

According to live coverage of the hearing by Fox reporter Eleanor Terret, Judge Failla demonstrated a keen interest in the case and seemed to lean in favor of Coinbase.

Interestingly, the Judge commended a “really fine” amicus brief submitted by the decentralized finance (DeFi) community, highlighting its superior explanation of staking and wallet usage compared to the SEC’s briefing.

Furthermore, Judge Failla questioned the SEC’s failure to present an opposing narrative regarding the legal foundations of the Howey test, a key element in determining whether an investment qualifies as a security.

In a noteworthy exchange, the SEC lawyer referred to the tokens in question as “computer code,” prompting Judge Failla to express skepticism about the SEC’s position and purpose in pursuing the case.

The SEC lawyer cited Judge Rakoff’s ruling in the Terra case, emphasizing that the ecosystem surrounding a token determines its security classification. However, Judge Failla referenced former SEC official Bill Hinman, who suggested that a token in and of itself may not necessarily be a security.

The discussion also touched upon the risks associated with staking on Coinbase. The SEC lawyer highlighted that these risks are not unique to crypto staking but also exist in traditional savings and loan banks.

Judge Failla expressed concerns about the SEC’s broad definition of securities and its potential implications for purchasers of the tokens involved in the case. She questioned whether purchasers would have the right of rescission if the tokens were deemed securities.

The SEC lawyer argued that if the tokens were classified as securities, purchasers would indeed have the right of rescission. Notably, Judge Failla demonstrated her consideration for the impact of the SEC’s actions on retail investors, emphasizing the importance of developing legal precedent and its implications for future cases.

Judge Failla Skeptical Of SEC’s Claims

The hearing also delved into collectibles, with Judge Failla expressing caution about implicating commodities or other non-security assets.

The SEC lawyer contended that the key distinction between tokens and collectibles lies in the enterprise or network associated with the tokens, suggesting that the token serves as the “gateway” to the network.

In a moment of skepticism, Judge Failla ridiculed the SEC lawyer’s use of the term “strict liability” to argue that Coinbase should have known it was offering unregistered securities. She demanded precise explanations about how Coinbase could have reasonably known about the unregistered securities.

Overall, the hearing outcome remains uncertain, but Judge Failla’s probing questions and skepticism toward the SEC’s arguments indicate a potential shift in favor of Coinbase.

The implications of this case extend beyond the immediate parties involved, as it could set a precedent for how cryptocurrencies are regulated and classified as securities in the United States.

Featured image from Shutterstock, chart from TradingView.com