On-chain Highlights

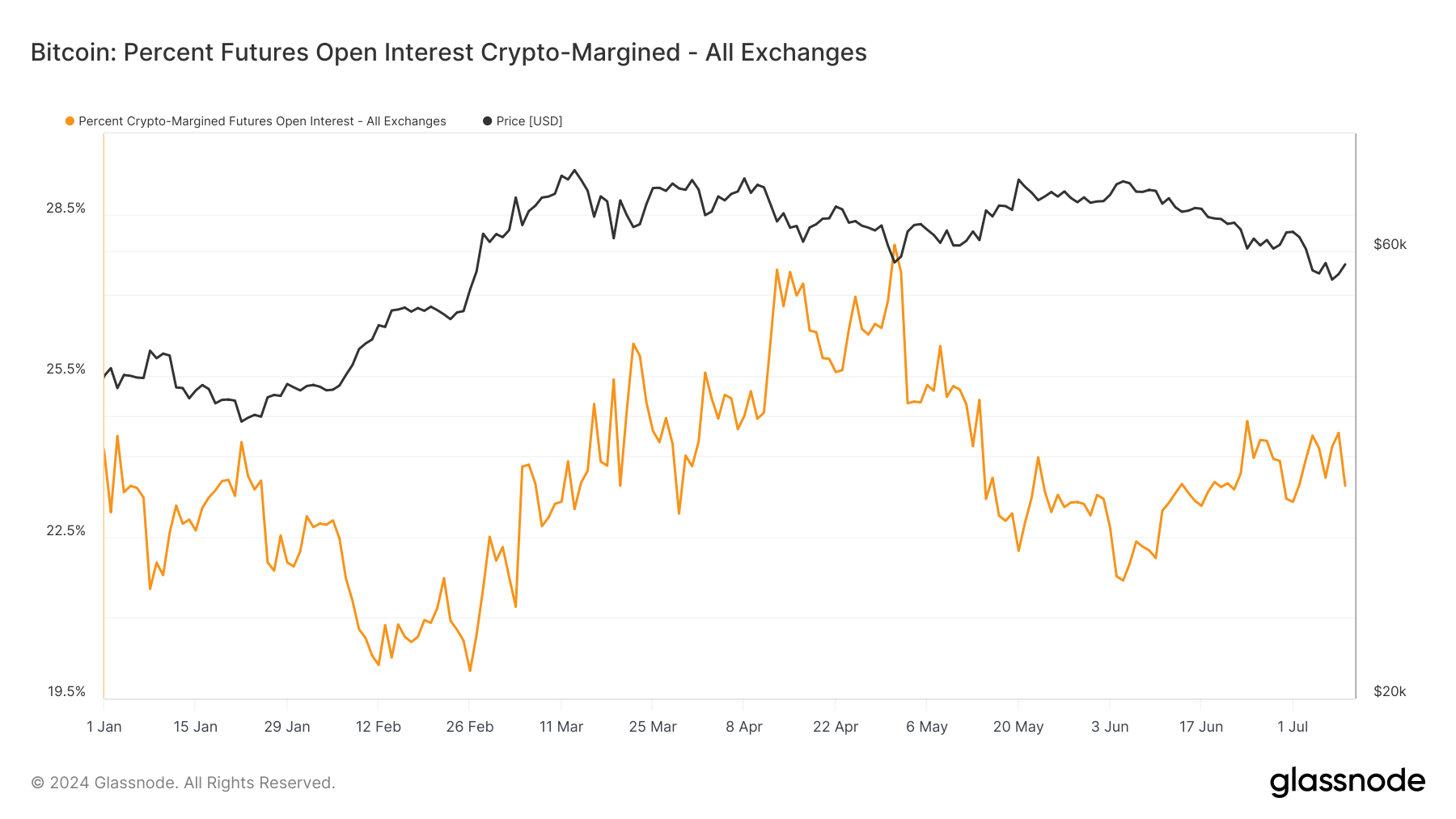

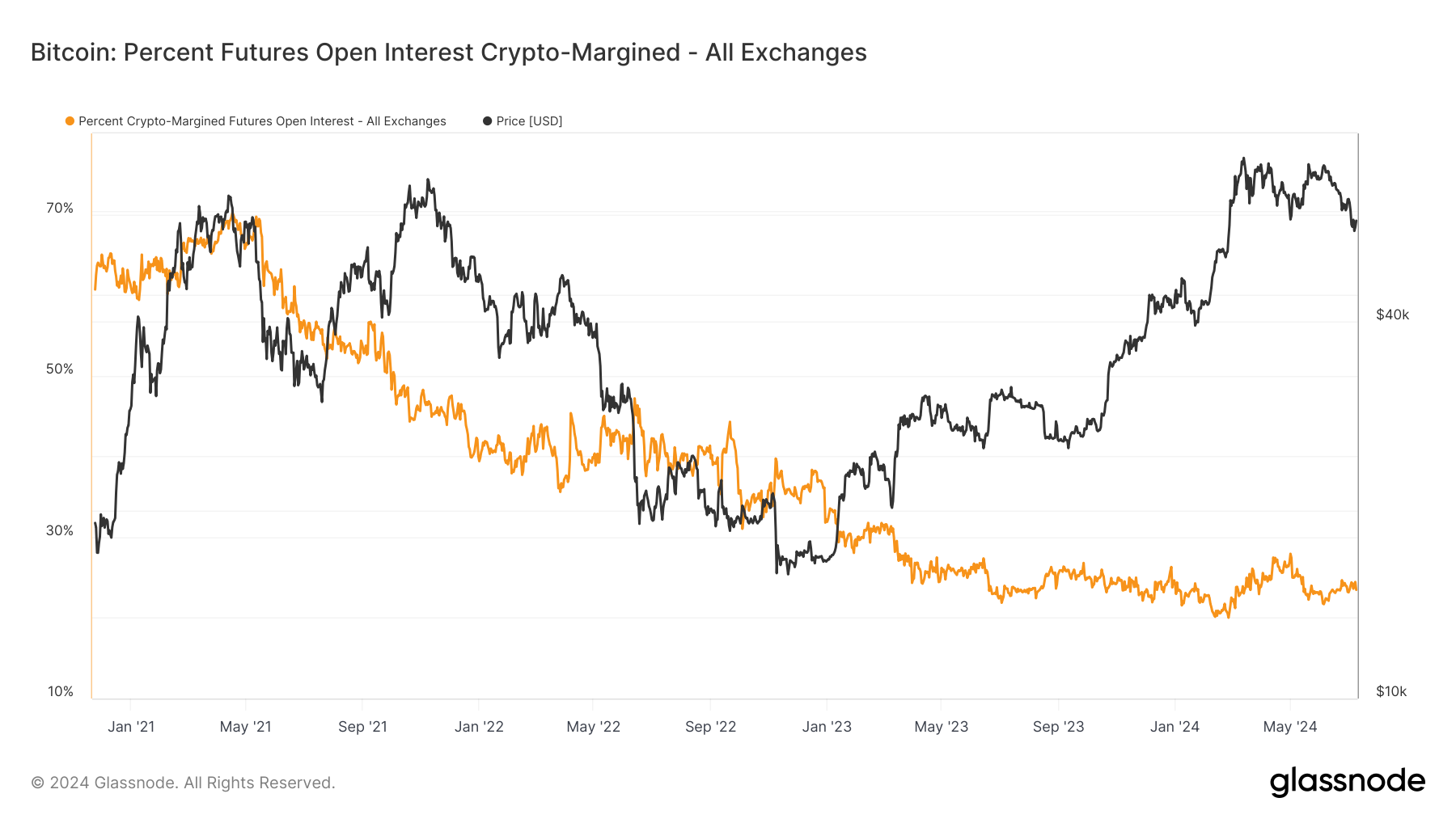

DEFINITION: The percentage of futures contracts open interest that is margined in the native coin (e.g. BTC), and not in USD or a USD-pegged stablecoin.

Bitcoin’s percentage of crypto-margined futures open interest on all exchanges shows notable fluctuations. The percentage declined from around 23% in January 2024 to approximately 20% by mid-February, aligning with a rising Bitcoin price. Notably, after the April 2024 halving, the metric saw heightened volatility, spiking above 27% before retreating below 24% by June.

Looking at the historical data from 2021 to 2023, the percentage steadily decreased from around 70% to 25%, reflecting a broader shift towards cash-margined contracts.

The post Shift from crypto to cash-margined contracts continues post-2024 halving appeared first on CryptoSlate.