Quick Take

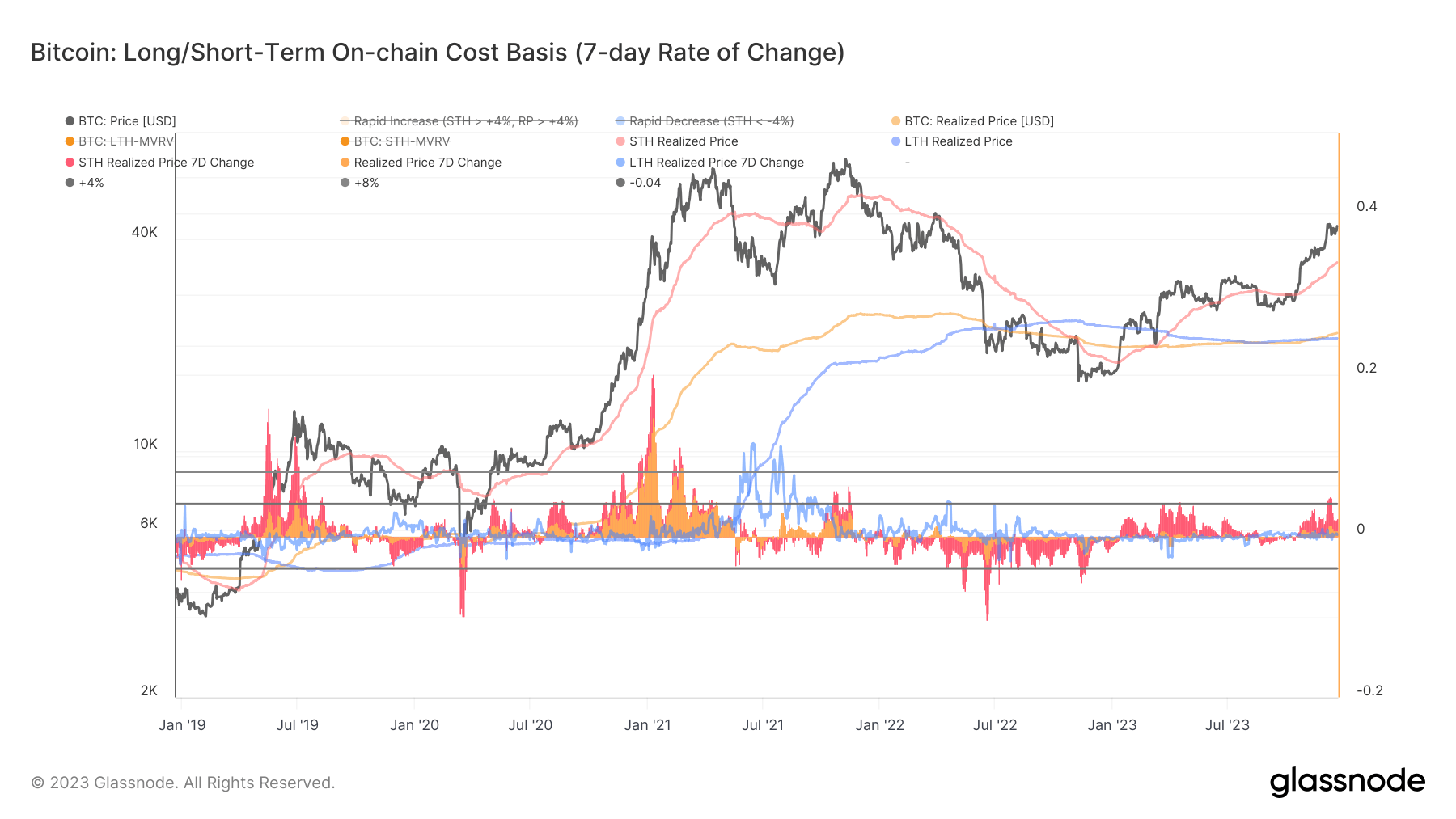

A recent analysis of Bitcoin’s on-chain cohorts shows a significant divergence in the realized price between short-term holders (STHs) and long-term holders (LTHs). The realized price, an indicator of the average on-chain acquisition price, serves as a proxy for the aggregate cost basis.

For the first time in 2023, the realized price change for STHs saw a notable surge, peaking over 4%. This level of volatility was last seen in March when Bitcoin’s market price fell to $20,000 amid the collapse of Silicon Valley Bank (SVB). As of Dec. 21, the STH realized price is continuing its upward trend, reaching $34,400. This upward momentum demonstrates that STHs are actively accumulating Bitcoin, and thereby increasing their cost basis.

In contrast, the long-term holders’ realized price (LTH RP) is currently at $20,927, indicating a lower average acquisition cost. The growing gap between the STH and LTH cost-basis suggests a shift in market dynamics, with coins exchanging hands at an increasingly higher price. This divergence could indicate a change in investor sentiment, with more new holders acquiring Bitcoin.

The post Short-term holder accumulation sends Bitcoin’s realized price soaring appeared first on CryptoSlate.