Solana, the self-proclaimed high-speed blockchain darling, finds itself facing an uphill battle. A confluence of a broader crypto market downturn and persistent network congestion threatens to stall its momentum and cast doubt on its long-term viability.

Solana Slides With The Market

The recent crypto market correction hasn’t spared Solana. The token, which enjoyed a stellar run for months, has mirrored the overall slump. On Tuesday, April 30th, Solana dipped to $127, marking a daily decline of 4% and a weekly drop exceeding 10%.

Lingering Congestion Woes Plague Solana

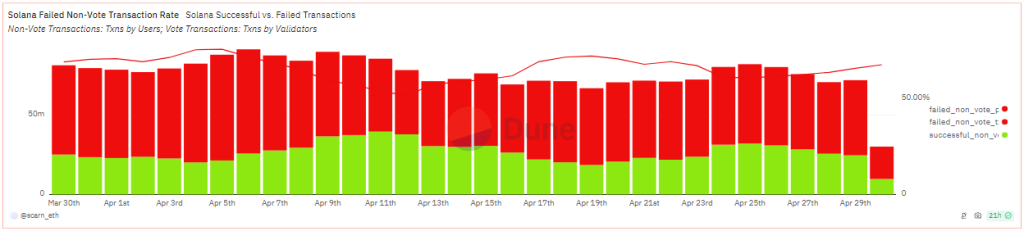

While the market downturn is a concern, a more pressing issue for Solana seems to be its network congestion woes. Recent updates aimed at fixing a bug related to the QUIC protocol haven’t delivered the promised network decongestion.

As of April 29th, the transaction failure rate remained stubbornly high at over 65%. This persistent network sluggishness directly contradicts Solana’s core value proposition of high transaction speed and efficiency.

The congestion issues are particularly worrisome for sectors like Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs), which rely heavily on fast and reliable transactions. Solana has carved a niche for itself in these areas, and prolonged congestion could tarnish its reputation and deter future projects and users.

Investor Optimism On Hold, But Long-Term Signals Remain

Interestingly, investor reaction to the congestion hasn’t been overwhelmingly negative – yet. Solana’s price movement has largely mirrored the broader market trend, suggesting investors might be taking a wait-and-see approach.

Perhaps there’s a flicker of hope that Solana can overcome these challenges. While the short-term technical indicators paint a bleak picture, some long-term signals, like the 200-day moving averages, still offer a glimmer of optimism.

Solana At A Crossroads

The coming weeks and months will be crucial for Solana. Can it address the network congestion issues definitively? Will it be able to regain the trust of developers and investors shaken by the recent performance?

Solana’s future hinges on its ability to navigate these rough waters. If it can overcome these hurdles and emerge with a more robust and scalable network, it might just weather the storm and reclaim its position as a leader in the blockchain space.

However, if the congestion problems persist, Solana could find itself falling behind competitors who can offer a smoother and more reliable user experience.

Featured image from Pexels, chart from TradingView