The Solana decentralized finance (DeFi) sector is experiencing a period of phenomenal growth, with decentralized exchanges (DEXes) witnessing record-breaking trading volumes and the native token, SOL, reaching a new 20-month high. However, amidst the euphoria, experts advise caution due to potential market risks.

Solana: ‘Greed’ Index

While Solana’s DeFi landscape flourishes, it’s crucial to acknowledge the potential risks associated with the current market sentiment.

Market data from CFGI indicates that the current sentiment is characterized by “Greed,” implying a scenario where the market might be overbought. This raises concerns about the possibility of sharper price corrections in the near future.

DEXes Drive The Surge

Data from DeFiLlama reveals that between February 25th and March 2nd, Solana-based DEXes processed a staggering $11.24 billion in cumulative trading volume, marking a significant milestone in weekly activity.

This surge surpasses previous benchmarks and outpaces major blockchains, including Ethereum. NewsBTC analysis shows a remarkable 177% increase in Solana’s DEX activity over a single week, solidifying its position as a major player in the DeFi arena.

This growth is a stark contrast to the subdued performance during the recent bear market. However, the fourth quarter of 2023 witnessed a reversal of fortunes, culminating in December with the highest-ever monthly DEX volumes, exceeding $28 billion.

Jupiter, the largest DEX on Solana, has been instrumental in this surge. CoinGecko reports that Jupiter executed $1.5 billion in trading volumes within the last day, temporarily surpassing the established leader, Uniswap V3.

Related Reading: Bitcoin On The Brink, Price Soars Above $68,000 – Will BTC Break Its 2021 Record?

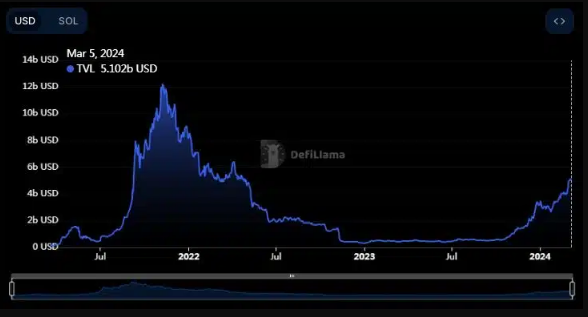

Beyond Trading: TVL And SOL Price Rally

The growth extends beyond trading volumes. Solana’s Total Value Locked (TVL), which represents the combined value of all cryptocurrencies deposited in its DeFi protocols, has surged by an impressive 52% in the last month, reaching $5.13 billion. This growth can be partly attributed to the remarkable gains observed in SOL, Solana’s native token.

SOL’s price performance has been exceptional, currently trading at $132, marking a 4% increase from the previous day. This upward trend includes a 30% surge in the past week and a stellar 37% increase in the last 30 days.

This price appreciation signifies a significant breakthrough, reaching a new peak not seen since November 2021, placing it 20 months removed from its all-time high of $260.

Featured image from Freepik, chart from TradingView