A recent report by market intelligence firm Messari has highlighted an extraordinary performance by Solana (SOL) during the fourth quarter of 2024, characterizing it as potentially the best quarter for any blockchain in history.

Solana Becomes Second-Largest DeFi Network

The report reveals a staggering 213% quarter-over-quarter (QoQ) growth in Chain GDP—essentially the total app revenue generated on the Solana network—rising from $268 million in Q3 to an impressive $840 million in Q4. November stood out as the most lucrative month, contributing $367 million to the ecosystem.

Among the leading applications driving this revenue surge were Pump.fun, which generated $235 million, marking a 242% QoQ increase, and Photon, which saw even more explosive growth with a 278% increase, bringing in $140 million.

The overall uptick in revenue can be attributed largely to renewed speculation in memecoins and a surge in AI-related cryptocurrencies launched during this period.

Solana’s decentralized finance (DeFi) total value locked (TVL) grew by 64% QoQ, reaching $8.6 billion and positioning it as the second-largest DeFi network, surpassing Tron in November.

The DeFi TVL, when expressed in SOL, saw a 28% QoQ increase, totaling 46 million SOL. The average daily spot decentralized exchange (DEX) volume also skyrocketed by 150% QoQ to $3.3 billion, driven by a resurgence in memecoin trading and the rise of AI-themed tokens.

In terms of stablecoins, Solana’s market cap grew by 36% QoQ to reach $5.1 billion, making it the fifth-largest stablecoin market among competing networks. The dominance of USDC continued, with its market cap increasing by 53% to $3.9 billion, capturing a 75% market share.

Increased Activity And Speculation

The liquid staking rate, which measures the percentage of liquid-staked SOL, rose by 33% to 11.2%, indicating that a significant portion of the eligible SOL supply—66%—is now staked. This growth is crucial for a thriving ecosystem built on yield-bearing SOL.

The NFT market also saw a modest increase, with average daily volume rising by 7% QoQ to $2.7 million. Tensor dominated this space, achieving $103 million in volume—a 14% QoQ increase—while Magic Eden experienced a decrease of 28% to $68 million.

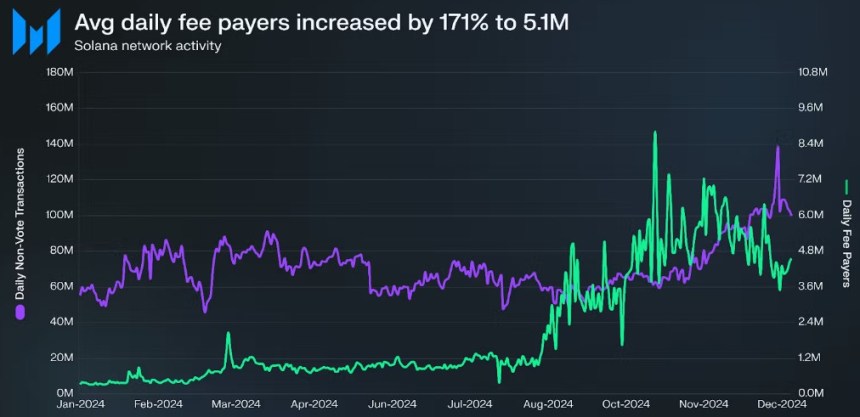

Network activity metrics reflected robust engagement, with average daily fee payers increasing by 171% QoQ to 5.1 million. The number of new fee payers surged even more dramatically, growing by 189% to 3.8 million. Average daily non-vote transactions rose by 32%, reaching 81.5 million.

Interestingly, the average transaction fee saw a notable uptick, increasing by 122% QoQ to $0.05, driven by heightened network activity fueled by speculation regarding a more favorable regulatory environment for cryptocurrencies in the US.

Despite these gains, staked SOL experienced a decrease of 5% in Q4, attributed in part to the FTX estate unlocking its tokens. However, SOL’s market cap itself grew by 27% QoQ to $91 billion, peaking at $120 billion in November.

By the end of the quarter, SOL ranked sixth among all cryptocurrencies in market cap, trailing behind Bitcoin (BTC), Ethereum (ETH), Tether’s USDT, XRP, and Binance Coin (BNB).

Currently, SOL is trading at $199, down 22% over the last two weeks, amid growing macroeconomic challenges that are having a significant impact on risk assets.

Featured image from DALL-E, chart from TradingView.com