Solana (SOL) has seen a “dramatic increase in allocations” from institutional investors, according to a recent survey conducted by CoinShares. The Digital Asset Fund Manager Survey, involving responses from 64 investors managing a cumulative $600 billion in assets, points to a burgeoning interest in altcoins, with Solana leading the charge among emerging favorites.

Solana See Increased Demand From Institutions

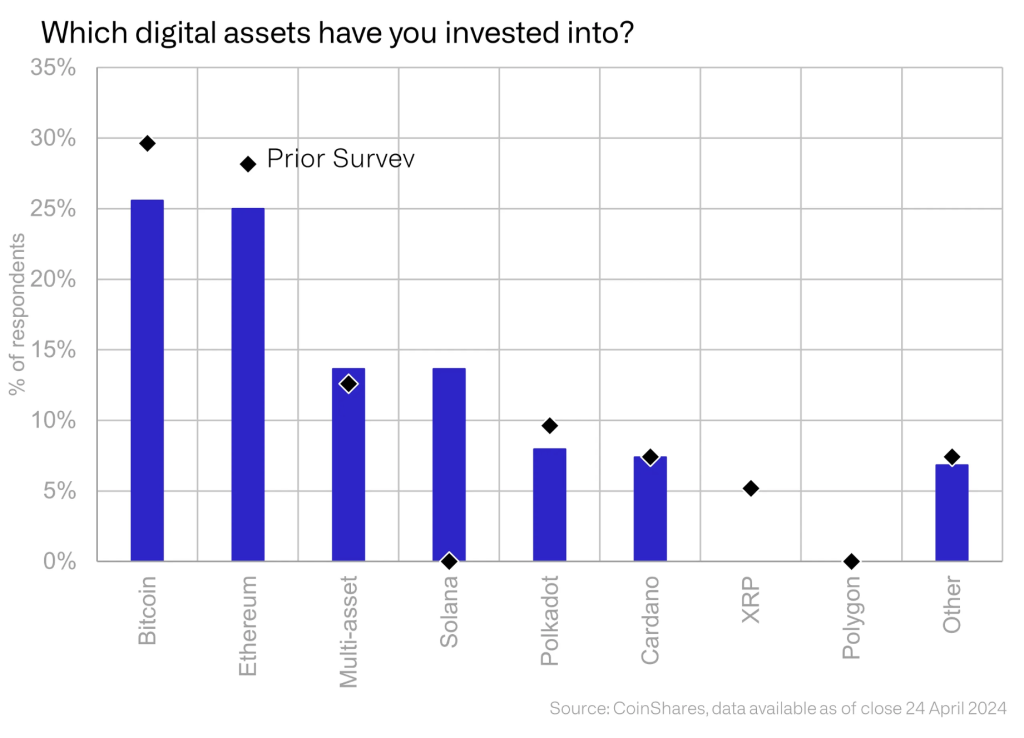

James Butterfill, Head of Research at CoinShares, detailed the findings, stating, “investors have been broadening their exposure to altcoins, with Solana seeing a dramatic increase in allocations,” highlighting that nearly 15% of participants now hold investments in SOL. This marks a significant uptrend from previous surveys, including January’s results, which showed no institutional investments in Solana.

Butterfill emphasized the growing institutional acceptance of Solana, noting its enhanced appeal following recent technological advancements and increased market presence. Meanwhile, Bitcoin still leads the market with more than 25% of respondents having invested in the leading cryptocurrency. Just behind is Ethereum with just under 25% as well.

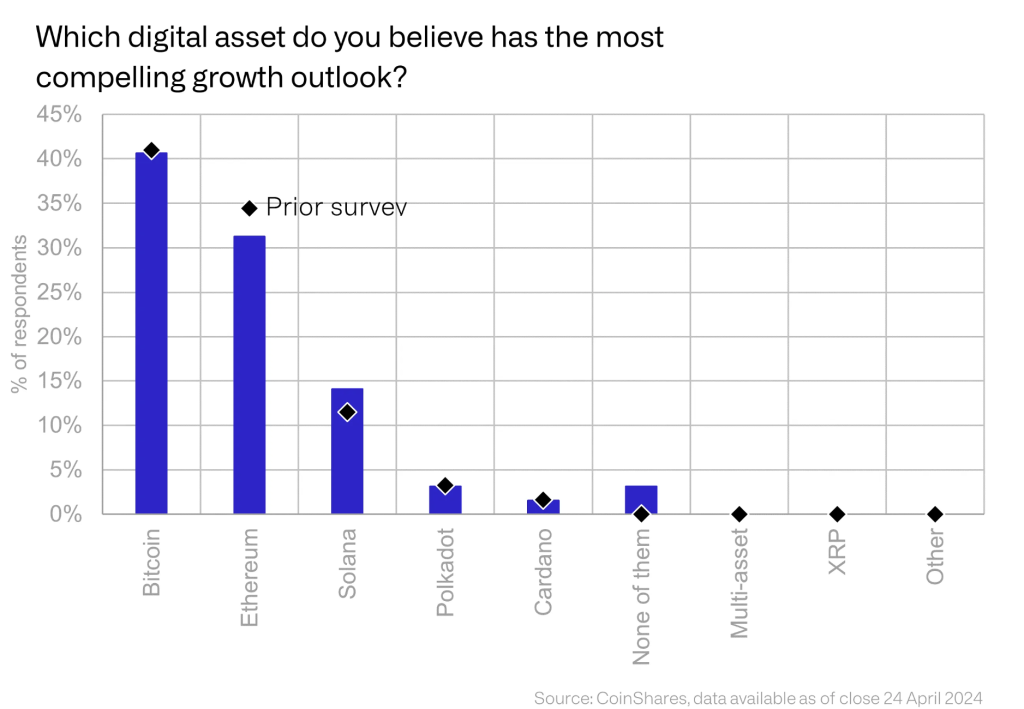

Bitcoin and Ethereum, while maintaining their status as the dominant digital assets, are experiencing shifts in investor sentiment. Bitcoin remains the preferred asset with 41% of investors bullish on its growth outlook, though this is a slight decrease from previous surveys.

Ethereum has seen a dip in investor confidence, with about 30% of respondents optimistic about its future, down from 35%. This decline in Ethereum’s allure coincides with the rising interest in alternative blockchains like Solana, which offer different technological benefits and potential use cases.

In contrast, “investors are more optimistic for Solana,” the report finds. Around 14% of respondents think Solana has a promising growth outlook, which is higher than the previous survey’s indication of around 12%.

The survey also sheds light on the overall composition of digital asset investments. Digital assets now represent 3% of the average investment portfolio, the highest level recorded since the inception of the survey in 2021. This increase is attributed significantly to the introduction of US spot Bitcoin ETFs, which have allowed institutional investors direct exposure to Bitcoin without the complexities of direct cryptocurrency holdings.

Despite the optimistic influx of institutional capital into cryptocurrencies like Solana, the report reveals that substantial barriers still impede broader adoption. Regulation remains a significant concern, with many investors citing it as a key obstacle to further investment in the asset class. According to Butterfill, “Regulation remains stubbornly high as a barrier, yet it’s encouraging to see that concerns over volatility and custody continue to diminish.”

Additionally, the survey highlighted that while investor interest in distributed ledger technology remains high, the perception of cryptocurrencies as a good value investment has increased notably. From January to April, the percentage of investors who view digital assets as “good value” jumped from under 15% to over 20%, driven by increasing client demand and positive price momentum.

Looking ahead, the report suggests that the landscape for digital assets is evolving rapidly. As institutional investors continue to diversify their portfolios and seek exposure to innovative technologies, altcoins like Solana are likely to gain further traction. However, the pace of adoption will depend heavily on developments in regulatory frameworks and the broader economic environment, which continue to pose challenges and opportunities for investors in the space.

At press time, Solana traded at $144.07.