The post Solana Sell-Off Cools as SOL Price Defends Support—A Recovery Depends on This Level appeared first on Coinpedia Fintech News

Solana price is showing early signs of stabilization after weeks of persistent downside pressure, as both on-chain data and technical indicators point to cooling sell momentum. While the broader trend remains under pressure, traders are increasingly watching whether SOL can defend critical support levels and stage a recovery rally heading into year-end.

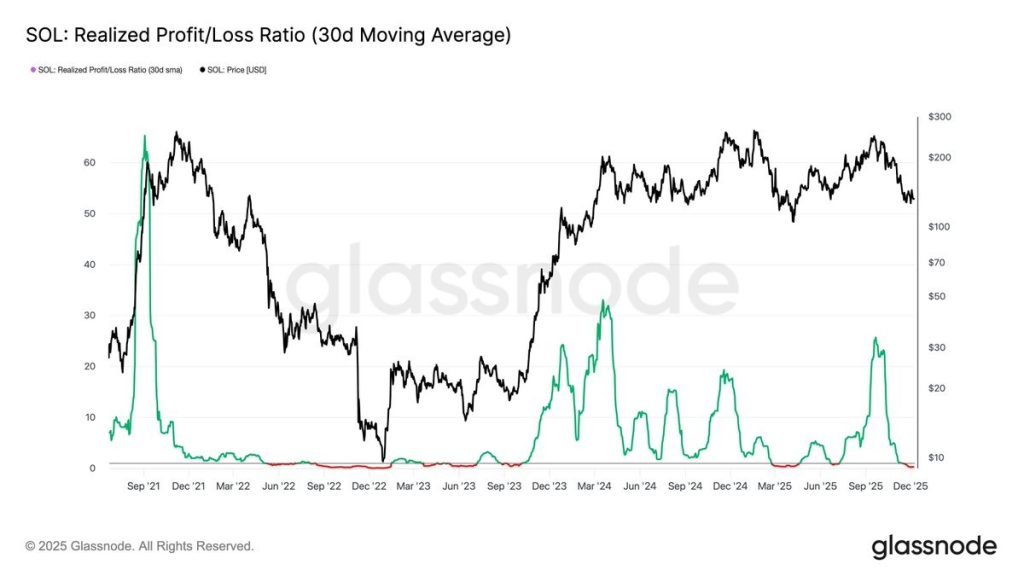

Solana On-Chain Data Signals Profit-Taking Is Cooling

On-chain metrics by Glassnode suggest that selling pressure may be easing. Solana’s Realized Profit/Loss Ratio, which tracks whether investors are selling tokens at a profit or a loss, has declined sharply after a recent spike. Historically, such cooling phases often mark the end of aggressive distribution periods rather than immediate trend reversals.

This shift indicates that many traders who bought lower have already locked in gains, reducing near-term sell pressure. While this does not guarantee higher prices, it creates conditions for consolidation, especially if spot demand begins to stabilize.

SOL Price Trades Inside a Descending Channel

From a technical perspective, SOL remains trapped inside a well-defined descending channel that has guided price action since late summer. However, recent price behavior suggests the downtrend is losing momentum.

At the time of writing, Solana is trading near the $139 level—an area that aligns with the Bollinger Bands and has served as a short-term equilibrium zone in recent weeks. Holding above immediate support at $135 is crucial to prevent a continuation toward the channel’s lower boundary.

RSI and Bollinger Bands Suggest Stabilization

Momentum indicators support the idea of a slowdown in selling. The Relative Strength Index (RSI) has rebounded from oversold conditions and currently sits near 48, signaling neutral momentum. This range often precedes directional breakouts, particularly after extended sell-offs.

Meanwhile, Bollinger Bands are beginning to compress, hinting at reduced volatility. Such compression phases often resolve with sharp moves once the price breaks out of its range.

Key Levels That Could Define SOL’s Next Move

For bulls, reclaiming the $145–$150 resistance zone is critical. This region coincides with the upper Bollinger Band and descending channel resistance. A daily close above this area would signal a structural shift and could open the door to a recovery rally toward $155 and potentially $170.

On the downside, failure to hold $135 would weaken the stabilization narrative and expose SOL to a deeper pullback toward the $125 support zone.

Solana Price Outlook: Year-End and Early 2026

Solana’s sell-off appears to be cooling, but the trend has not yet reversed. On-chain data supports reduced selling pressure, while technical indicators suggest the market is transitioning into a consolidation phase. Whether this leads to a recovery rally into early 2026 depends on SOL’s ability to break above key resistance levels in the days ahead.