The post Solana’s TVL Climbs as SOL Price Holds Steady—Is a Breakout on the Horizon? appeared first on Coinpedia Fintech News

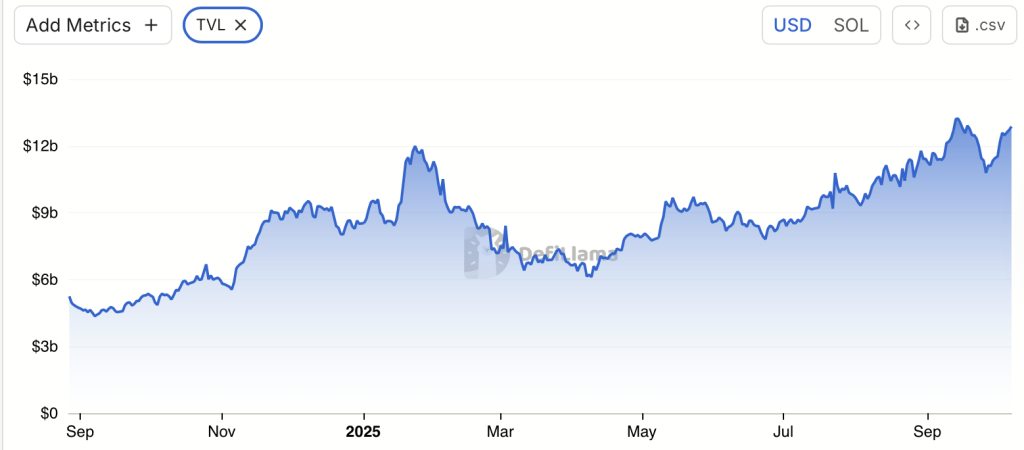

Solana’s on-chain metrics are painting an intriguing picture. While the network’s Total Value Locked (TVL) has surged steadily over recent weeks—signalling robust ecosystem activity—the SOL token itself remains largely range-bound, consolidating between key support and resistance levels. This divergence between network growth and the market price of Solana could be hinting at a deeper structural shift within Solana’s ecosystem.

Rising Network Activity Amid Price Stagnation

Solana’s DeFi ecosystem continues to expand, with platforms like Jupiter, MarginFi, Kamino, and Solend driving record inflows. The rising TVL reflects renewed investor confidence and increasing capital deployment into Solana’s decentralized economy. More users are interacting with dApps, staking assets, and utilising liquidity pools—strengthening the network’s real on-chain utility.

Yet, despite this visible growth, SOL’s price has struggled to break out decisively. Traders appear cautious, influenced by broader market uncertainty and Bitcoin’s dominance, which continues to steer capital flows across the altcoin market. This has created a temporary disconnect between Solana’s improving fundamentals and market speculation.

A Sign of Ecosystem Maturity, Not Weakness

This kind of divergence isn’t necessarily bearish—it often signals fundamental strength building beneath surface-level price action. With more than 65% of SOL staked, the circulating supply remains tight, while the liquidity that does exist is being efficiently recycled within Solana’s DeFi protocols. That means rising TVL doesn’t automatically translate into upward price movement—but it underscores a maturing, capital-efficient ecosystem.

In many cases, such phases represent accumulation zones, where smart money positions ahead of broader recognition. Historically, strong on-chain growth preceding a price lag has often led to powerful medium-term rallies once sentiment shifts.

Will SOL Price Rise Above $300?

After a strong push in the first few days of the month, the bulls appear to have been experiencing some upward pressure. Since the rebound in April, the SOL price has been forming consecutive higher highs and lows. However, the current chart patterns suggest the trend is slowly flipping in favour of the bears. If the bulls fail to reverse the persistent trend, the SOL price may face a 10% pullback.

The daily chart of Solana suggests the price continues to trade under bullish influence but could be subjected to a small pullback. The token appears to be repeating a previous pattern of forming a lower high within an ascending parallel channel. This has no doubt dragged the price levels lower to the support but has triggered a strong rebound towards the resistance as well. The RSI is also forming a similar pattern, indicating a drop to $210 is quite possible if the local support at $220 is not defended by the bulls. On the contrary, a healthy rebound could lead the rally beyond $260.

Looking Ahead

If Solana’s TVL continues to trend higher and ecosystem participation deepens, market sentiment may eventually catch up to the fundamentals. A sustained increase in network usage—paired with renewed liquidity inflows—could act as the catalyst for SOL’s next major price breakout.

For now, Solana stands as one of the few networks showing organic growth, even as its token consolidates—an encouraging sign for long-term believers eyeing strength beyond short-term price noise.

FAQs

Despite strong network growth, SOL’s price is consolidating due to broader market uncertainty and Bitcoin’s dominance steering capital away from altcoins currently.

Analysts see a potential rebound toward $260 if key support holds. However, a break below $220 could lead to a pullback toward the $210 level.

Solana’s strong fundamentals, including a rising Total Value Locked (TVL) and high user activity, suggest solid long-term potential despite short-term price stagnation.