Data shows there has been a large spike in interest around stablecoins recently, a sign that investors of Bitcoin and other assets may be looking to exit.

Stablecoins Have Observed A Sharp Rise In Social Volume Recently

According to data from the on-chain analytics firm Santiment, there has been a major uptick in the social volume of the stablecoins recently. The “social volume” refers to an indicator that measures the total number of social media text documents that are talking about a certain topic or term.

The social media text documents here have been collected by Santiment and include a variety of sources like Reddit, Twitter, Telegram, and other internet forums.

Something to note about the metric is that it only tells us about the unique number of such posts that are mentioning the given term at least once. This means that even if a thread includes several mentions of the topic, its contribution towards the social volume will still remain only one unit.

The social volume can provide insight into the degree of attention any particular coin is getting on social media platforms. Whenever this indicator’s value goes up, it means that the general interest in the asset among investors is rising currently.

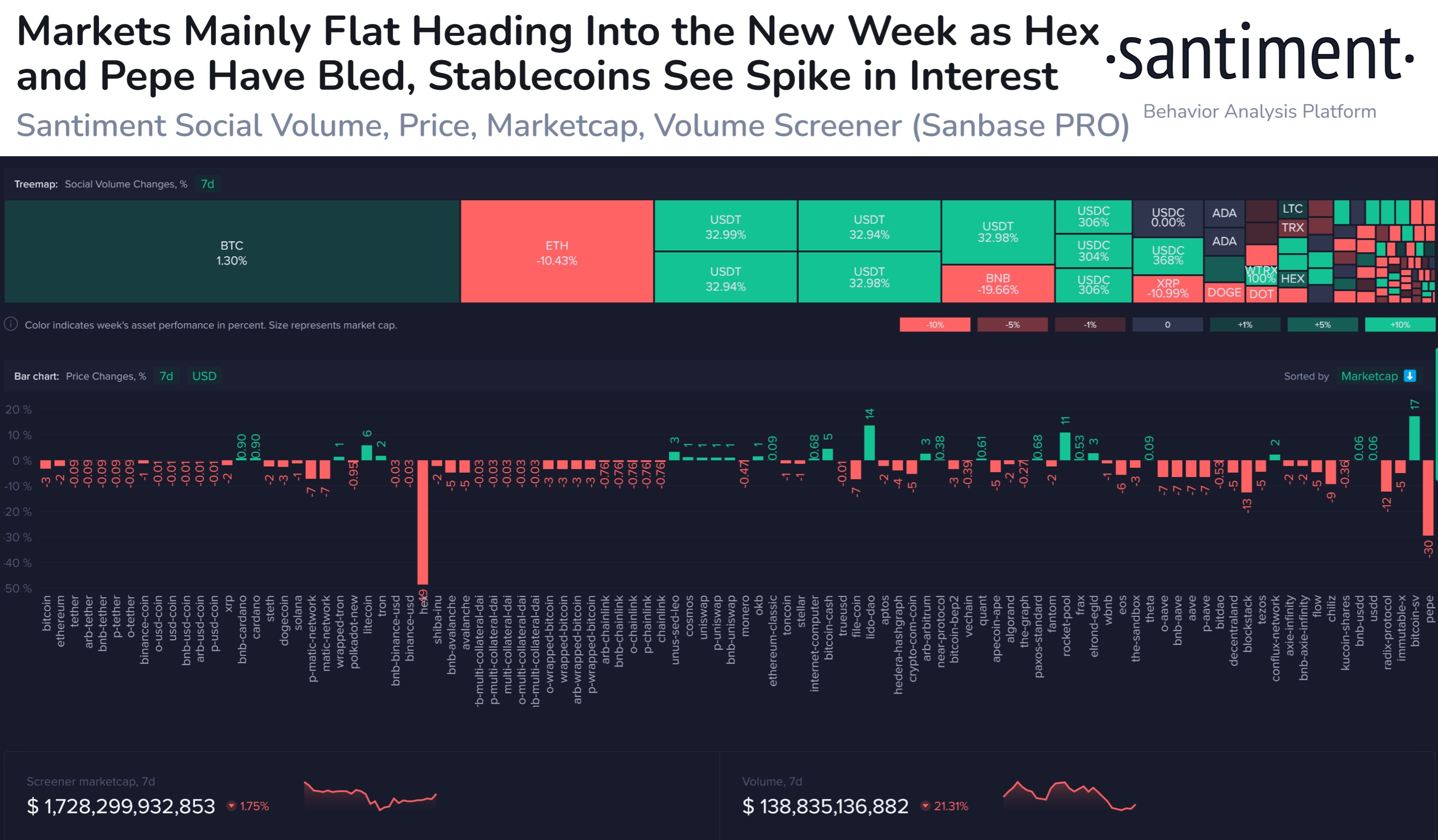

Now, here is a chart that shows the 7-day change in the social volume for the various assets in the cryptocurrency sector (including the stablecoins):

As displayed in the above graph, the social volume of a lot of the volatile assets has registered a negative 7-day change, implying that there is a lesser amount of discussion happening related to them right now as compared to a week ago.

Some of the assets like Bitcoin have seen a positive 7-day change in the metric, but the increase has only been minuscule for them, implying that their social volume is relatively unchanged.

Interestingly, while the volatile assets may have seen decreasing or sideways-moving social volumes, the stablecoins have seen a completely different trend with the metric; their social volumes have sharply surged in the past week.

USD Coin (USDC), which is the stablecoin second only to Tether (USDT) in terms of market cap, has seen an extraordinary rise of more than 300% in terms of this metric. This suggests that discussions around the coin have increased by more than 300% during the past week.

Tether itself has observed a positive 7-day change in the social volume of more than 30%, which, while much lesser than USDC’s, is still quite significant nonetheless.

Generally, investors use stables whenever they want to escape the volatility associated with the other coins in the sector. So, since the interest around these tokens has surged recently while the volatile cryptocurrencies have been seeing a red period, it would appear that holders may once again be seeking the safety of this stable form of digital assets.

BTC Price

At the time of writing, Bitcoin is trading around $27,300, down 2% in the last week.