Standard Chartered has sharply reduced its famously bullish Bitcoin roadmap, cutting its 2026 price target in half and acknowledging that its previous near-term projections were too aggressive, even as it keeps an ultra-optimistic long-term view intact.

Standard Chartered Downgrades Bitcoin Price Predictions

In a note shared on X by VanEck head of research Matthew Sigel, Standard Chartered argues that Bitcoin’s traditional halving cycle has been overtaken by ETF-driven flows. The bank writes: “With the advent of ETF buying, we think the BTC halving cycle is no longer a relevant price driver. The logic in previous cycles (when US ETFs did not exist) – i.e., prices would peak about 18 months after each halving and decline thereafter – is no longer valid, in our view.”

The report adds that it will “take a break of the current all-time high ($ 126,000 on 6 October 2025) to prove that; we expect this to happen in H1-2026.”

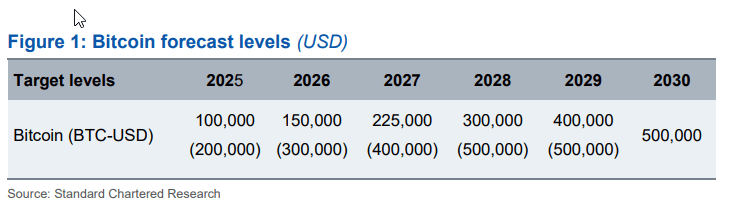

Alongside that shift in framework, the bank re-profiled its multi-year Bitcoin targets. According to the figures shared by Sigel, Standard Chartered has lowered its 2025 forecast from $200,000 to $100,000, its 2026 target from $300,000 to $150,000, its 2027 projection from $400,000 to $225,000, its 2028 estimate from $500,000 to $300,000, and its 2029 prediction from $500,000 to $400,000 while keeping a $500,000 target for 2030.

Geoff Kendrick, Standard Chartered’s head of digital assets research, characterises the recent drawdown as painful but not structural. He describes the current phase as “a cold breeze,” explicitly rejecting the notion of a new crypto winter and noting that the magnitude of the pullback remains consistent with corrections seen in past bull cycles.

At the same time, he points out that weaker valuations for listed Bitcoin treasury companies have curtailed their ability to act as major marginal buyers, leaving spot ETFs as the primary driver of near-term gains.

Wall Street Giant Bernstein Agrees

The downgrade also lands in the context of a broader rethink on Wall Street. One day earlier, on December 8, Sigel shared a separate note from Bernstein that reached a similar conclusion about Bitcoin’s market structure.

Bernstein wrote that “the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling.”

Despite an approximately 30% correction, the firm notes that “we have seen less than 5% outflows via ETFs.” On that basis, Bernstein now moves its 2026 Bitcoin price target to $150,000, sees the cycle “potentially peaking in 2027E at $200,000,” and keeps its long-term 2033 target at roughly $1,000,000 per BTC.

Both Standard Chartered and Bernstein are converging on the same structural message: the halving alone no longer explains Bitcoin’s trajectory. ETF flows, institutional positioning and balance-sheet dynamics are now the core variables, even if their precise price targets and timelines diverge.

At press time, Bitcoin traded at $92,686.