Strategy has just added to its Bitcoin buying spree with a multi-billion dollar purchase, its largest buy since November of last year.

Strategy Has Bought Another 21,021 Bitcoin

As announced by Strategy Chairman Michael Saylor in an X post, the company has completed a fresh Bitcoin acquisition. With this buy, Strategy has added 21,021 BTC to its holdings at an average price of $117,256 per token.

The $2.46 billion purchase was funded using proceeds from the firm’s initial public offering (IPO) of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC). This IPO, involving 28,011,111 shares, is the largest in the US in 2025 so far. Strategy said in the press release:

Once listed on Nasdaq, STRC will be the first U.S. exchange-listed perpetual preferred security issued by a Bitcoin Treasury Company to pay monthly dividends and, we believe, the first U.S. exchange-listed perpetual preferred security to incorporate a board determined monthly dividend rate policy.

Following the latest acquisition, the company’s BTC reserve has grown to 628,791 BTC, with an average cost basis of $73,277 per token or a total investment of $46.08 billion.

CryptoQuant community analyst Maartunn has shared a chart in an X post that puts the scale of the new buy into perspective against past ones.

As is visible in the above graph, the latest acquisition is Strategy’s largest since November 24th, around eight months ago. Back then, the firm made a massive purchase that was more than double the new one at $5.43 billion. Earlier in the same month, Michael Saylor’s company completed a purchase that was also notably larger than the current one, this time worth almost $4.59 billion.

At the current exchange rate, Strategy’s Bitcoin holdings are valued at about $74.04 billion, which reflects a profit of a whopping $27.96 billion or around 60.6%. Thus, the firm’s reserve is in a comfortable state at the moment.

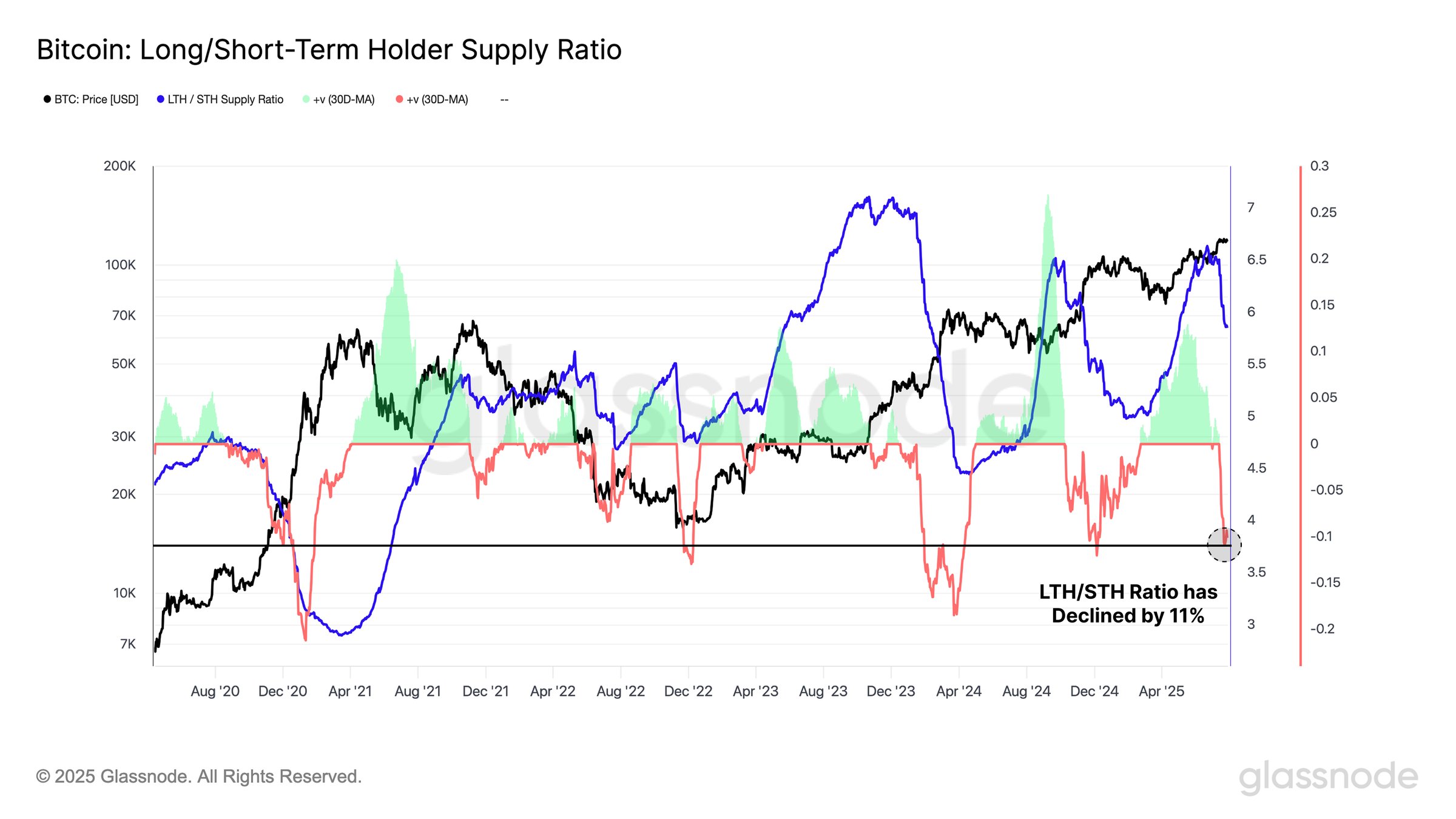

While Strategy continues to HODL, other strong hands appear to have taken to selling, as pointed out by on-chain analytics firm Glassnode in an X post.

The above chart shows the ratio between the supply held by the two main divisions of the Bitcoin market: short-term holders (STHs) and long-term holders (LTHs). Investors who purchased their coins within the past 155 days are placed in the STHs, while those who have held past this threshold belong to the LTHs.

From the graph, it’s visible that the ratio has witnessed a significant negative change of 11% over the past month, implying that a rotation of capital has occurred from the diamond hands to the STHs. “This pattern has preceded prior ATHs and highlights a structurally consistent shift in investor positioning,” noted Glassnode.

BTC Price

At the time of writing, Bitcoin is floating around $117,800, down 1% over the last 24 hours.